- The trading volume surged on June 25 reaching approximately $4 billion.

- The majority of Ethereum trading took place on CoinBene exchange.

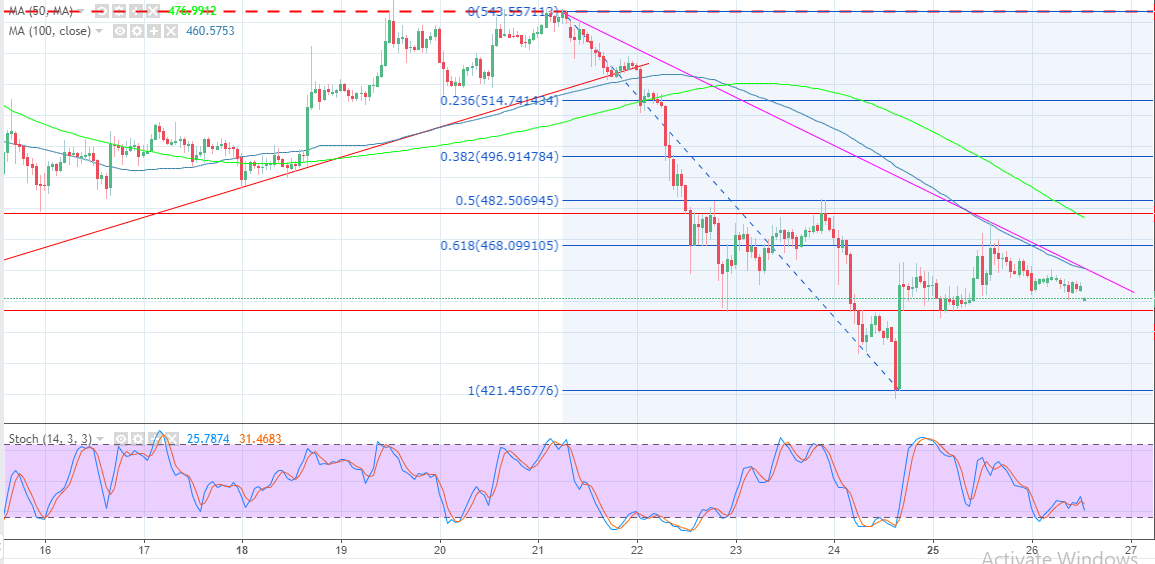

- The key resistance is the 61.8% Fibo, but intraday upside capped below $460.

Ethereum is a sitting duck on Tuesday, besides the retracement is limited below $460, while the support is held at $450. Ethereum is also correcting slightly lower by 1.85%, similarly after opening the trading session at $458.74 it is currently exchanging hands at $454.

Ethereum is the second largest cryptocurrency by market capitalization after Bitcoin. Although the price is experienced high selling pressure, Ethereum trading volumes are skyrocketing. The digital asset recorded $2.4 billion in trading volume on June 24. The trading volume surged on June 25 reaching approximately $4 billion. At the time of writing, CoinMarketCap shows $4.5 billion in trading volume in the last 24 hours. The majority of Ethereum trading took place on CoinBene exchange in ETH/USDT trading pair with 36.52% of the trading volume while Bit-Z comes second with 30.65% in ETH/BTC trading pair.

Ethereum price has maintained a downward trend for at least 5 days. It is still trading below the bearish trendline on the 1-hour chart. The crypto even traded lows of around $421 in the recent declines, however, a bullish trend kicked in bringing the price above $450. The 61.8% Fib retracement level with the previous swing high of $543 and a low of $421.4 offered resistance slightly below $470. The upside has been limited below $460 in the intraday trading on Tuesday. Ethereum must keep the support at $450 to ensure that a break down towards the demand zone below $430 that does not occur.

ETH/USD 1-hour chart