- ETH/USD failed to pass $158.00 barrier.

- Critical support is created by 61.8% Fibo retracement.

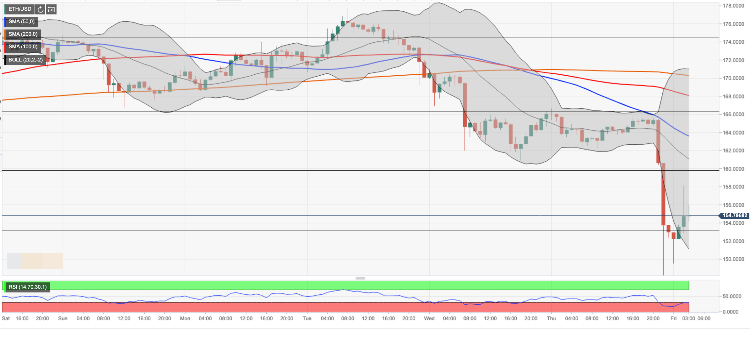

Ethereum (ETH) has recovered from Thursday’s low registered at $148.23 to trade at $155.00 handle at the time of writing. However, despite some positive momentum and a bullish trend on the intraday charts, the coin is 5% lower from this time on Thursday. While the sell-off was triggered by Tether cover-up allegations, the further momentum into the end of the week will depend on whether the coin manages to regain ground above $160.00 handle.

Ethereum’s technical picture

ETH/USD is now trading at $155.47, above 61.8% Fibo retracement ($153.30). However, the recovery momentum seems to have petered out as the price stumbled into a selling interest located on approach to $158.00. The bulls have to push the price above psychological $160.00 strengthened by 50% Fibo retracement, $161.00 (midline of 1-hour Bollinger Band) to get a chance for an extended recovery with the ultimate aim at the congestion zone $166.30-50 that encompasses 38.2% Fibo retracement and the upper boundary of the previous consolidation channel.

On the downside, a sustainable move under $153.30 will expose the recent low of $148.23.

ETH/USD, the hourly chart