- Signals from technical indicators are positive, although ETH/USD is range bound.

- A break above the range is essential but defending the support at $195 keeps the bears at bay.

The market is still sinking in the sea of red while the bulls’ attempts to correct higher are thwarted by selling pressure. The drop from $208 billion to $202 billion has left the buyers barely gasping for air. Ethereum, the 2nd largest cryptocurrency in the market in the world broke the levels above $200 to trade lows around $195. Moreover, the $20 billion crypto has recorded a decline in the daily trading volume from $1.5 billion to the current $1.3 billion in the last couple of days.

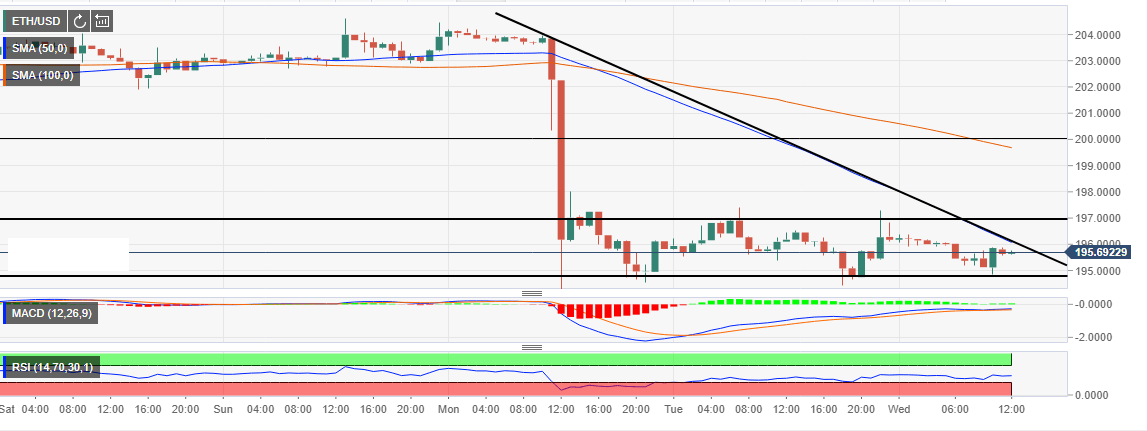

In the interim, Ethereum is trading at $195.7, although it is confined in a range with the upper resistance limit $197. The declines a couple of days ago saw byers seek refuge around $195 preventing a slide the former support at $195. Ethereum has been unable to correct above the range resistance, besides, both the 50 SMA (15′ chart) and the descending trendline are capping gains immediately to the upside.

The signals from technical indicators are positive but at this moment, buyers require a catalyst in order to break free from the resistance. If buyers can sustain growth above $197 ETH/USD will be primed for gains above $200. However, the ranging RSI means that the stability will continue in the near-term.

The MACD, on the other hand, has sustained growth towards the mean line. Crossing over into the positive region will affirm the bulls presence in the market. For the buyers a break above the range is essential but defending the support at $195 keeps the bears at bay. Meanwhile, the support at $190 will come in handy; there is another support at $170 (primary support).

ETH/USD 15-minutes chart