- Ethereum price pauses at $3,200 as the bullish bias following the launch of the London hardfork fails to push it higher.

- On-chain metrics show reduced network activity as ETH hovers around $3,110.

- Players have Mixed Opinions on Ethereum’s deflationary future.

Ethereum investor enthusiasm increased after the London hardfork went live. However, Ethereum price prediction is bearish as the decrease in network activity suggests.

Ethereum Price Rally to $4,000 Takes Breather

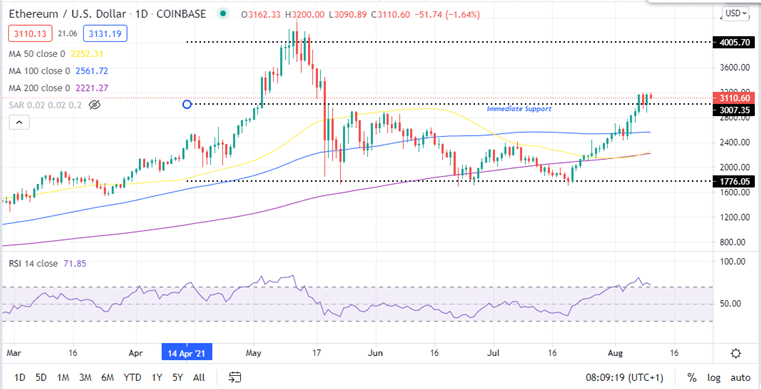

The launch of the much-awaited London hardfork has placed ETH/USD in the limelight. Ethereum’s price reached a high of around $3190 on Sunday. This coincided with the occurrence of a golden cross, a crypto signal that happened when the 50-day Simple Moving Average (SMA) crossed above the 200-day SMA accentuating the bullish bias as shown on the daily chart.

This has bolstered the bulls who are determined to push the price beyond $3,500 towards the $4,000 psychological level.

However, the recent massive ETH price rally has pushed the RSI (Relative Strength Index) into the overbought territory. This is an indication that the rally is reaching an end and a trend reversal or a consolidation could happen in the near term.

This bearish narrative will eb validated if Ethereum breaks and closes the day below the $3,000 mark. This could result in a decline to $2,500 where it coincides with the 10-day SMA.

ETH/USD Daily Chart

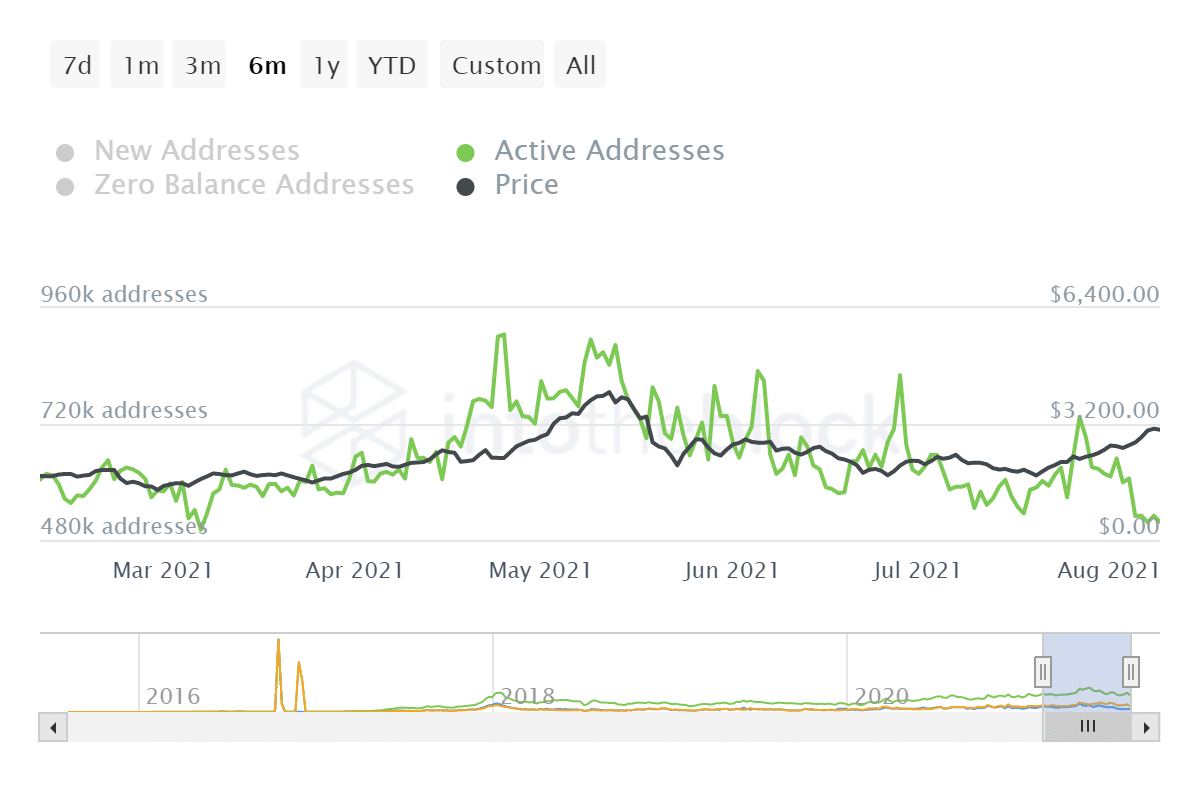

Unlike ETH price, Ethereum’s network activity snubbed the network upgrade. There was a drop in the number of Daily Active Addresses (DAAs) sending or receiving ETH on the network. IntoTheBlock’s data shows that DAAs on the Ethereum network dropped by over 14% from 607,290 addresses on August 4 to 517,350 addresses on August 09. Ethereum’s network activity contrasts the bullish narrative that led to a mass rally to $3190.

Ethereum Daily Active Addresses

Network activity is usually a strong indicator of the demand of the asset on crypto exchanges. The drop in the number of DAAs on the Ethereum network can be translated as a drop in demand and a possible bearish divergence in price.

Therefore, ETH price rise to $4,000 is likely to take a breather in the short term since the investors holding the token are not trading as would be expected.

Mixed Opinions on Ethereum’s deflationary future

Shark Tank’s Kevin O’Leary claims that Ethereum fated to become “ultrasound money” once its chain merge occurs. In a video posted on Cameo, the website that allows users to buy personalised videos from celebs, O’Leary claims promoted the benefits that Ethereum London hardfork upgrade would bring. Particularly, the EIP-1559 which introduces a base fee attached to every transaction happening on the Ethereum blockchain making it less inflationary.

“It introduced a very important change to the monetary policy of Ethereum. Currently the fees that users pay to send transactions go to the miner, but after this improvement, the fees will be burned, ” said O’Leary.

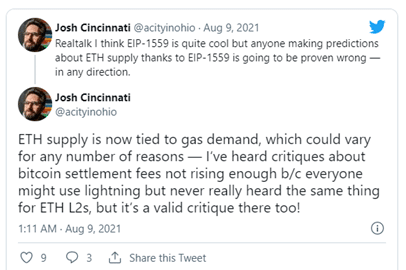

Not all analysist agree with O’Leary’s bullish outlook for Ethereum. Bearish sentiments from experts like Josh Cincinnati, developer advocate BlockCypher, hold that Ethereum may not be deflationary as kits supply is depended on gas demand. Cincinnati tweeted:

Looking to buy or trade Ethereum now? Invest at eToro!

Capital at risk