- Ethereum price is exchanging hands at $138 following a 0.21% increase in value on the day.

- ETH/USD bulls risk losing control of the sideways trend.

Ethereum bulls have managed to curb the declines that began when the crypto failed to sustain movement above $146 during the weekend trading. The largest altcoin has ushered in sideways trading supported at $138. Buyers are pushing for gains above this level but the upside remains capped by the 50 SMA 1-hour as well as the 61.8% Fib retracement level 1-hour.

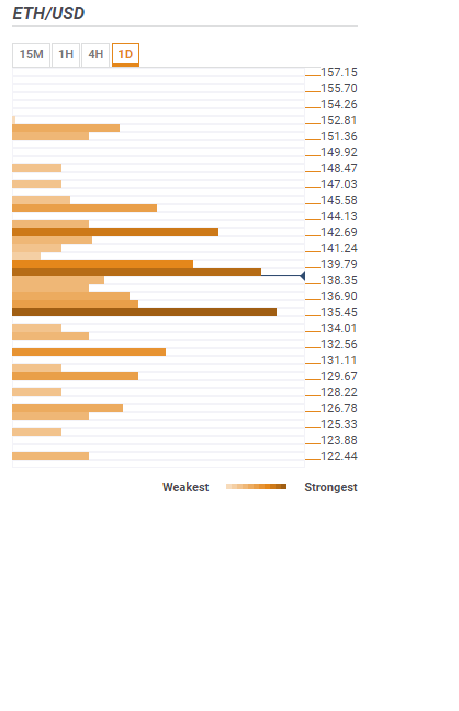

ETH/USD technical levels – confluence detector

Ethereum price is exchanging hands at $138 following a 0.21% increase in value on the day. The asset is among the few coins that are in the green on Tuesday. The confluence detector shows that initial resistance starts at $138.35 – $139.79. The region is host to the following confluence of indicators: The 23.6% Fib retracement level daily range, 5 SMA 4-hour, 100 SMA 15′, 5 SMA 1-hour, 10 SMA 1-hour, previous week high, Bollinger Band 1-hour Middle, 50 SMA 15′, previous high 4-hour, 10 SMA 15-minutes, previous low 1-hour, previous low 15′ and Bollinger Band 4-hour Middle.

It is clear that Ethereum’s movement to the upside will not an easy one. The correction above the above resistance range will encounter more hurdles at $142.69 – $145.58. The region is highlighted by a confluence of indicators including the pivot point 1-day R1, the 38.2% Fib level 1-minute, the Bollinger Band 1-day Upper, previous high 1-day, Bollinger Band 4-hour upper, 161.8% Fibo weekly and the pivot point 1-weekly R2.

It is essential that Ethereum resumes the uptrend above $140 and focuses on $150 and other higher levels. However, the bulls risk losing control of the sideways trend. Initial support is seen at $135.45 with various indicators including the 100 SMA 4-hour, Bollinger Band 1-day Middle, the pivot point 1-day S1 and the 61.8% Fib level weekly. If this support is cleared, ETH/USD will slide to the next support zones at $132.56 and $129.67.