Activation of the Ethereum London hard fork was a shot in the arm for the entire crypto market. Prices have risen across the board, with all top coins swimming in a sea of green at time of writing (12 noon London time).

Ethereum is up 6% in the past 24 hours to $2,785, while bitcoin has advanced 7% to $40,734.

The biggest gainer is DeFi coin Uniswap, currently priced at $24.95, up 10.5%. Uniswap is an ERC20 token –which means it is built on top of the Ethereum blockchain – and could be spiking as a result of the burning mechanism that the EIP1559 upgrade introduced.

The positive sentiment on the successful upgrade seeming to reduce the risks associated with the ETH 2.0 proof-of-stake migration.

Get Free Crypto Signals – 82% Win Rate!

Ethereum on a roll: Burn baby burn

Depending on which burner you consult (Etherchain and ultasoundmoney are two popular ones), a cumulative burn of 4,400 ETH has already taken place, equivalent at current prices to $12 million.

The burn rate averages 3.09 ETH/min over the past 24 hours, but has reduced to around 1.89 ETH/min in the last hour.

The fee burn is detrimental to the income of miners but is driving the price of the No. 2 crypto higher because of its disinflationary impact on supply. Burning permanently removes ETH tokens from circulation.

As a point of detail, the burn is often referred to as being deflationary but this is not the case. Deflation refers to the economic phenomenon of a general fall in price, while disinflation refers to a fall in the rate of inflation, which is what we see as a result of the impact of EIP1559 on ETH supply.

ETH to become a deflationary asset?

However, if the burn rate were to outstrip the inflation rate, then its impact would be such as to transform ETH into a deflationary asset. However the current minting rate for ETH is 7.2, via the block reward (2 ETH) paid to miners. Unlike bitcoin, ethereum does not have a maximum token supply built into the protocol.

The EIP1559 upgrade introduces a base price for fees that is set algorithmically by the protocol and it also introduces dynamic block sizes so that the size can expand and contract in response to transaction load.

According to Ultrasound.money the largest burner is the non-fungible token (NFT) series CovidPunks, followed closely by the largest NFT marketplace OpenSea with Uniswap in third place. Read our Uniswap price prediction for 2021.

|

Burn leaderboard |

|

|

Asset |

ETH |

|

COVIDPunks |

527.52 |

|

OpenSea |

523.54 |

|

Uniswap V2 |

351.80 |

|

Axie Infinity |

265.15 |

|

Tether |

206.06 |

|

Uniswap V3 |

157.17 |

|

Metamask |

84.47 |

|

USD Coin |

76.32 |

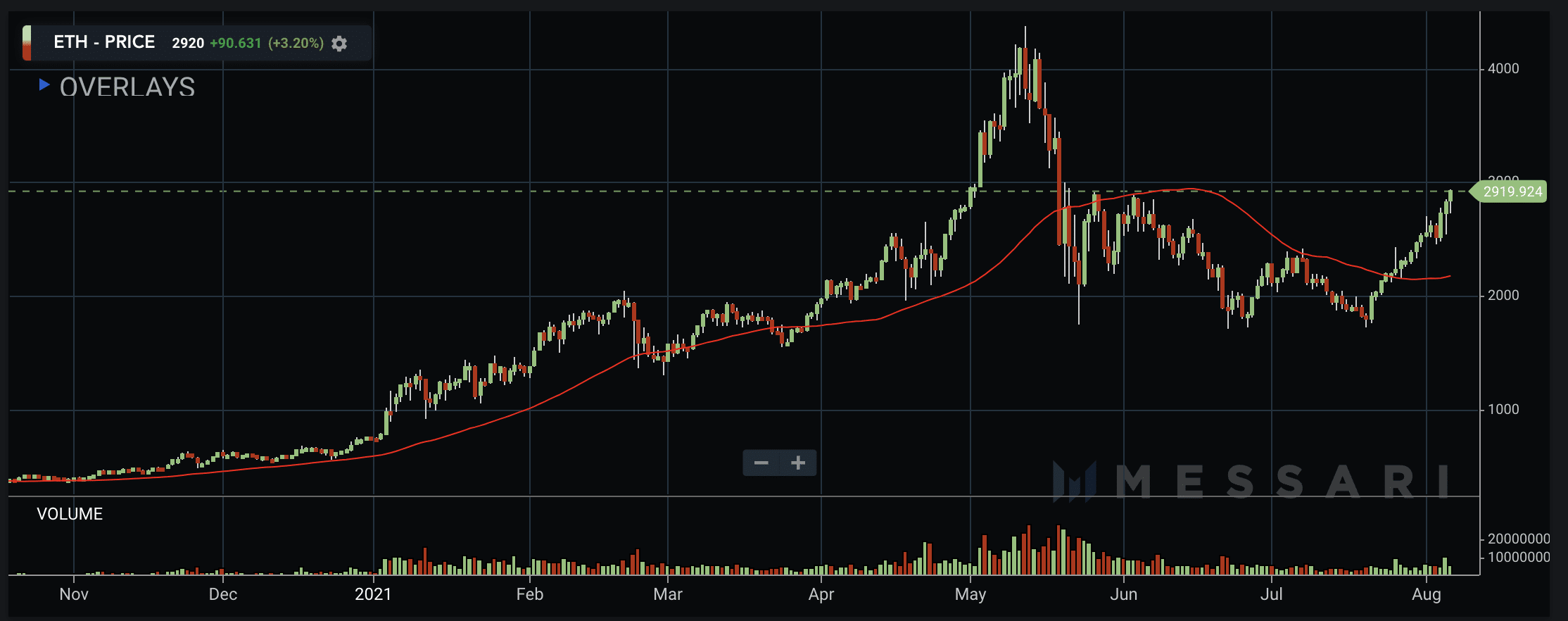

Ethereum to reach for new all-time highs north of $4,000

It is time to be super bullish with our ethereum price prediction. With ethereum knocking on the door of $3,000 it may not be long before ETH is trading in the $4,000s again.

Ethereum has broken through resistance at $2900 established in late May-early June and looks set fair for a monster rally going into the weekend.

Powering confidence in ETH 2.0: difficulty bomb up next

Speaking from Singapore in comments provided to Bloomberg co-inventor of Ethereum Vitalik Buterin said, “1559 is definitely the most important part of London”. But although it has garnered the most attention, it isn’t the only part of the upgrade package.

EIP3554 is the proposal that will set in train the forcing of proof-of-work miners to change their ways, with the introduction of the difficulty bomb, now brought forward to December this year. The changes will make it uneconomic to mine as the network prepares for the switch to PoS.

As Buterin outs it, the London upgrade is “proof that the Ethereum ecosystem is able to make significant changes”, and as the most important smart contract platform in the crypto space, that matters enormously, hence the prices rises of all assets today, including those platforms that are competitors, such as Polkadot, Polygon and Solana, to name a few.

The London hard fork “definitely makes me more confident about the merge,” Buterin confirmed to Bloomberg.

Ethereum’s move to ETH 2.0 will solve its scalability problem which makes it prone to congestion when the network becomes busier, and for transaction fees to make usage and development prohibitively expensive.

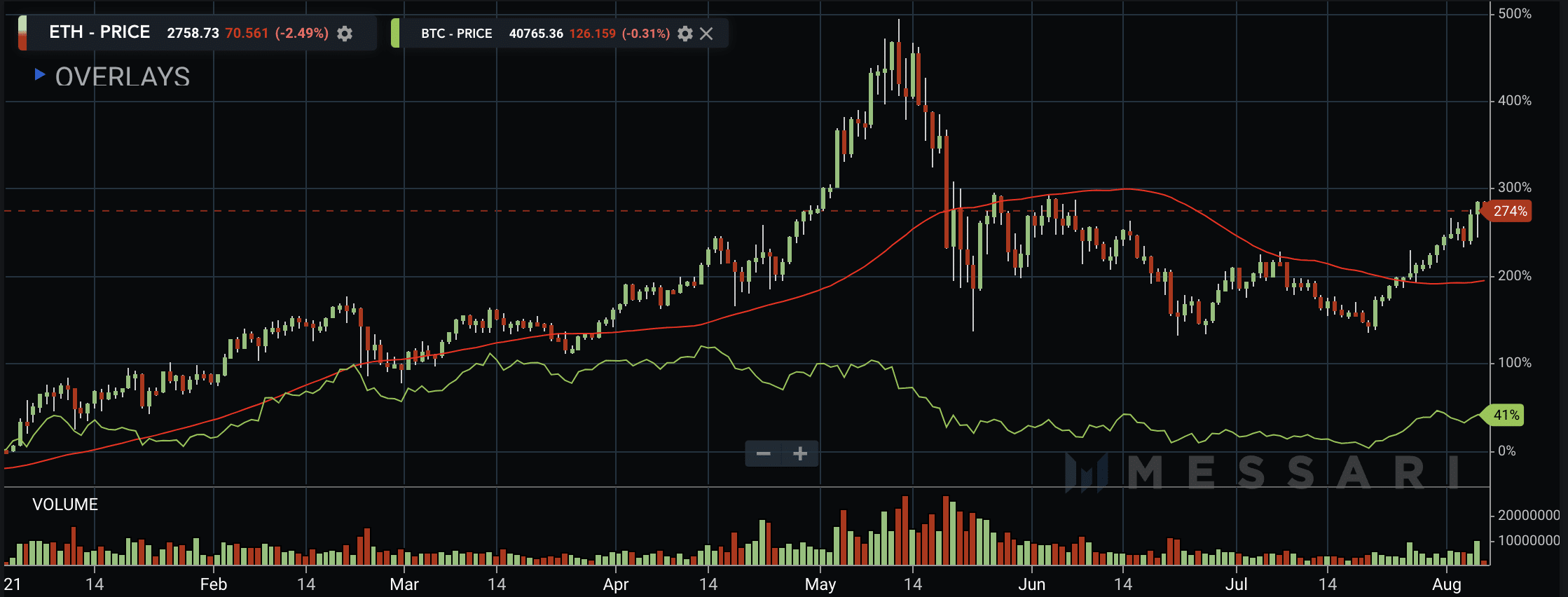

Progress along the ETH 2.0 roadmap has been the key driver of the bitcoin price this year. Compared with bitcoin, year to date it has risen 274% to bitcoin’s 41%.

It may be time to go big and long on ethereum.

Looking to buy or trade Ethereum now? Invest at eToro!

Capital at risk