EUR/USD has been moving down on political risk from Europe as well as a strengthening US dollar following Yellen as well as the upbeat retail sales and CPI. What’s next?

Here is their view, courtesy of eFXnews:

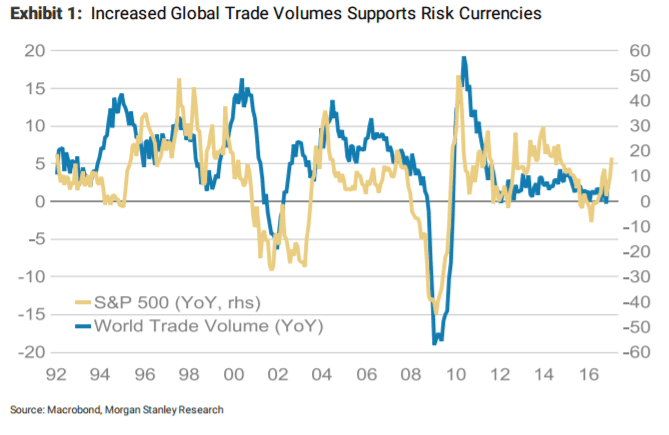

As the VIX is approaching the lows again,and with iron ore prices bursting 10% higher over recent days, we continue to see risk currencies performing well, particularly vs the EUR.

China is tightening monetary conditions. New CNY loans grew in January (CNY2.03trn) but were lower than market expectations after the Jan 24 10bp rise in the Medium-term Lending Facility (MLF). The gap between M1 and M2growth has also narrowed for a seventh consecutive month to 3.2% last month from 10.1% in December. The result appeared in property sales data which slowed in January after tightening measures and potentially the Chinese New Year holiday. Data from local housing developers shows that average weekly property sales by area in Tier 1 cities in January fell more than 30%Y and more than 10% week over week. Shanghai and Shenzhen fell even more,according to the China Index Academy.

Cash readyto buy risk. The global impact of China’s tightening of monetary standards may not be seen in FX markets straight away as it is masked by still expanding balance sheets at the ECB and BoJ, rising commodity prices helping growth and now a newly developing point, cash ready to be deployed into assets. The FT is reporting on Swiss banks seeing increasing questions from private wealth on where they can invest cash in a rising inflation environment. Surveys among affluent US investors show they held 28% of their portfolios in cash in 2015,up from 25% the year before. Cash holdings in Europe and Asia are much higher at 40% and 37% respectively. The EUR may weaken in this environment as political risks may increase caution in investment into this region.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.