- EUR/USD started an upside correction from July lows.

- Dollar dynamics are still favorable amid Fed’s tightening policy.

- ECB is still accommodative and maintains a dovish tone.

- EUR/USD can find bearish dominance next week with the first target of 1.1800.

The European currency is recovering uncertainly in the EUR/USD forecast, investors have become more restrained in their attitude to risk due to concerns about the global economic recovery. Moreover, fears are amplified by data

The dollar’s dynamics are influenced by market expectations that the Fed will announce a planned reduction in asset purchases in August or September. At the same time, the first reduction in the bond purchase program is projected at the end of 2021 or at the beginning of the next year.

The document showed that policymakers are still waiting for “significant further progress” to achieve their inflation and employment targets before changing their monetary policy. However, officials are still talking about the cuts and have surprised investors with their dovish tone. Fed officials acknowledged the economic progress, but at the same time, promised financial support.

– If you are interested to learn more about day trading, then look out for our detailed guide on it-

In the meantime, the European Central Bank held a special meeting to discuss pursuing an unconventional monetary policy. As a result, the ECB decided to let the inflation rate exceed its target of 2% to avoid the risk of premature tightening. President Christine Lagarde called the new policy ‘symmetrical inflation’ very similar to the Fed’s last year. Overall, European policymakers seem more concerned about the risk of the pandemic and its impact on the economy. In addition, the ECB released the minutes of its last meeting, which showed that members were discussing a cut in bond purchases but generally agreed that maintaining a favorable economic environment during the pandemic remains important.

EUR/USD forecast: Key events to watch next week

Three key events can potentially bring volatility in the EUR/USD pair.

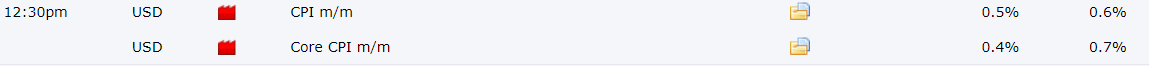

US core inflation

US core inflation figures are due on Tuesday. Although the inflation figures may weigh on the Greenback apparently it seems like the market has already discounted the effect of higher inflation.

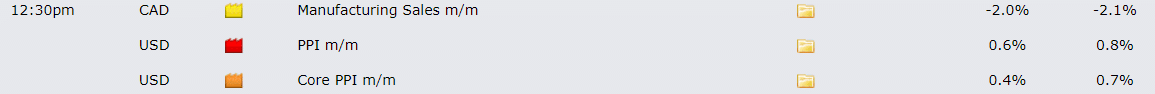

US PPI

US PPI

US PPI data is due on Wednesday, and it can impart a significant change in the pricing of the EUR/USD. We expect a positive release of figures.

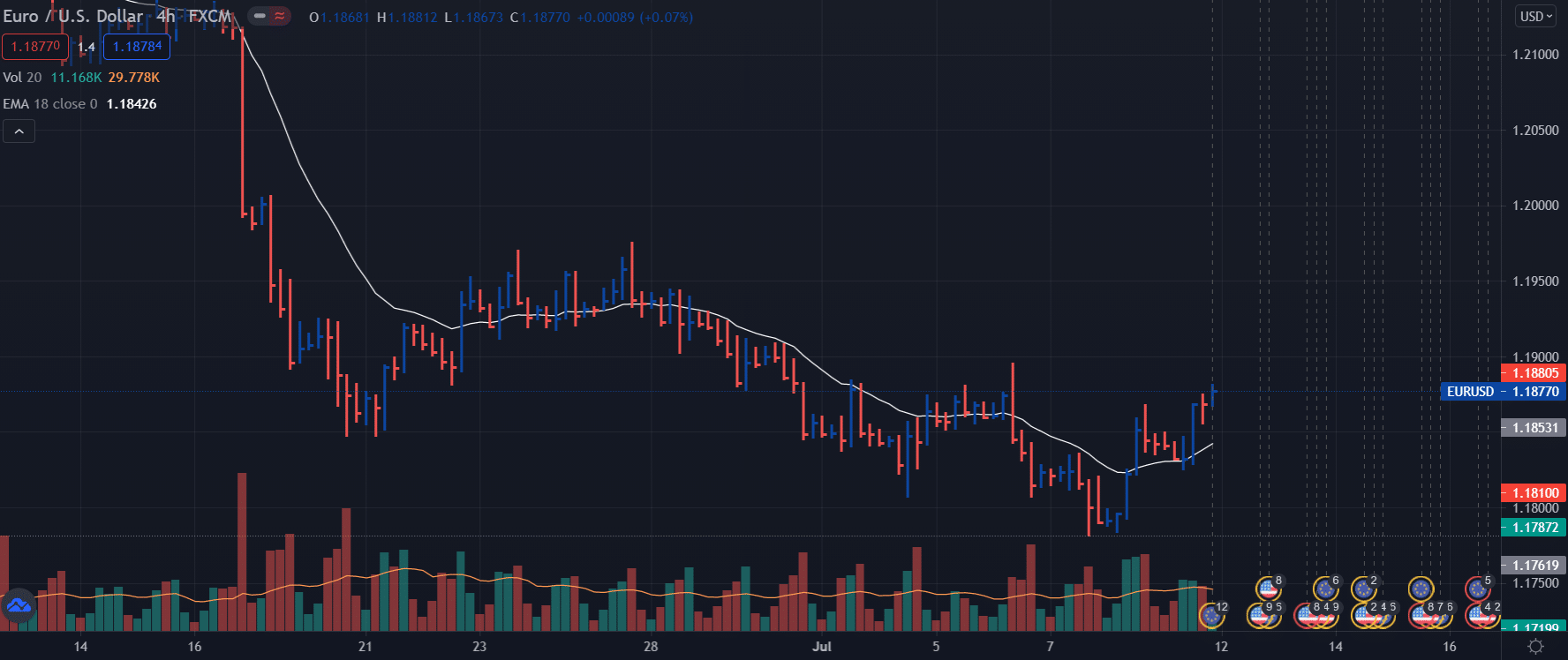

US retail sales

US retail sales figures are due on Friday. We expect a rise in US retail sales.

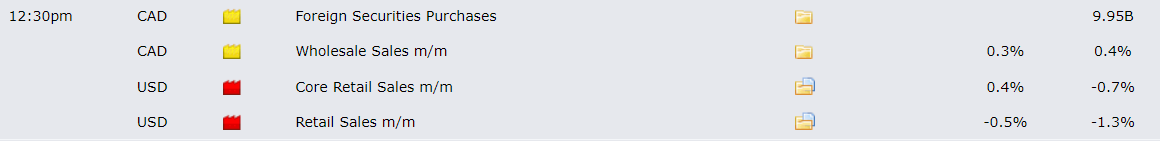

EUR/USD technical forecast for the week of July 12-16, 2021

EUR/USD is correcting for the second trading session in a row from the lows of July. The volume does not support the recent upside correction. However, further growth is limited by the short-term downtrend line, which signals favor of the renewed decline in the European currency. As part of the EUR/USD forecast for the week of July 12-16, 2021, a downward trend is expected to develop with renewed lows, the first target for the bears is at 1.1800. Weekly forex signals for the EUR/USD forecast shows a selling bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

US PPI

US PPI