EUR/USD failed to hold onto higher ground in a mixed week. The ECB meeting is clearly the big event of the upcoming week, but not the only topics on the agenda. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

While the euro-zone economies are growing nicely, not everything is perfect. The Sentix Investor Confidence and retail sales both fell below expectations. ECB President Mario Draghi did not rock the boat in his speech. In the US, the significant progress on tax cuts sent the dollar higher even if the data were not always that great. The NFP report showed a healthy gain in jobs but also that wages are stuck. The Fed is unlikely to rock the boat and hike as it has well-telegraphed.

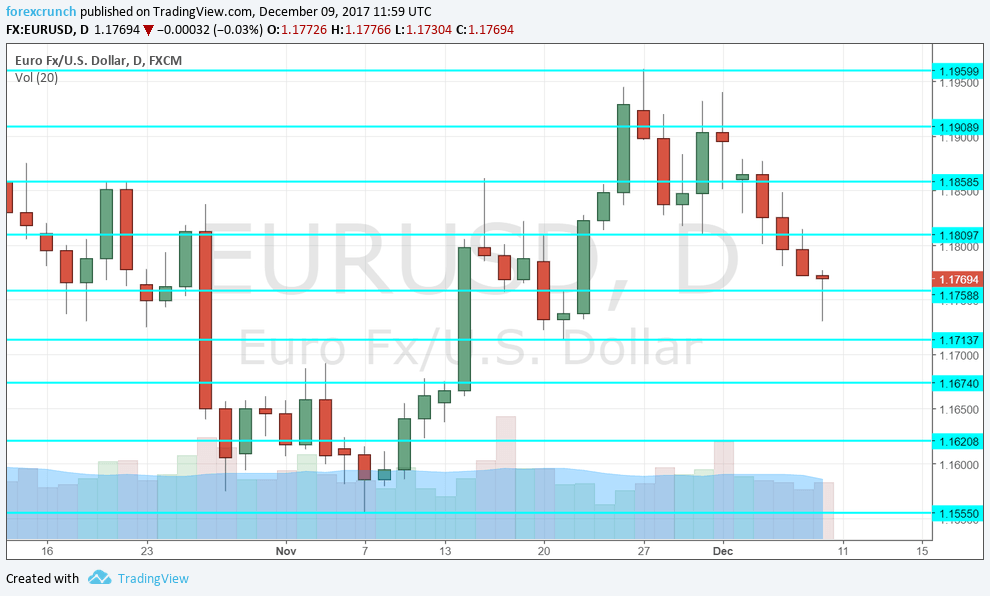

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German ZEW Economic Sentiment: Tuesday, 10:00. The ZEW institute leads by releasing its business survey quite early in the month. A score of 18.7 was reported for November, similar to the scores in recent months, and points to moderate optimism. A score of 17.9 points is on the cards now. The all euro-zone figures stood at 30.9 points and 30.2 is forecast now.

- Mario Draghi talks: Tuesday, 19:00. The president of the European Central Bank will speak at an event in Frankfurt less than 48 hours ahead of ECB meeting. He could drop a hint about the tone, but in such proximity to the event, it is more likely that Draghi will be more cautious.

- German CPI (final): Wednesday, 7:00. The initial read of German inflation in November came out slightly better than expected at 0.3%. This did not help the euro-zone core inflation to rise. The German figure will likely be confirmed now.

- German WPI: Wednesday, 7:00. The Wholesale Price Index provides a view of inflation in the pipeline, at the wholesale level, before it reaches the retail one. Back in October, prices remained flat.

- Employment Change: Wednesday, 10:00. Alongside upbeat economic growth, also employment is rising: it advanced by 0.4% in Q2 and another increase is likely now. We learned that the unemployment rate fell to 8.8%. Another gain of 0.4% is forecast now.

- Industrial Production: Wednesday, 10:00. Industrial output slipped by 0.6% in September and this was quite disappointing. This time, we can expect a rise given Germany’s positive figures that are already out. A drop of 0.2% is projected.

- French CPI (final): Thursday, 7:45. The second-largest economy saw a minor increase in prices: 0.1% m/m in November according to the flash release. This number will probably confirmed now. It all feeds into the all euro-zone number.

- Flash PMIs: Thursday morning: 8:00 for France, 8:30 for Germany and 9:00 for the whole euro-zone. Markit’s forward-looking surveys were quite upbeat for November. The French manufacturing sector saw a score of 57.7 points, well above the 50-point threshold that separates expansion from contraction. A score of 57.2 is predicted now. The services sector did even better with 60.2 points and 59.9 is on the cards at this point. In Germany, the manufacturing sector led with a sky-high level of 62.5 points and a small slide to 62.2 is expected. Germany’s services sector lagged behind with 54.4 and is now expected to advance to 54.7. For the whole euro-zone, the manufacturing PMI stood at 60.1 and 59.8 is on the cards now. The \services PMI scored 56.2 points and now carries expectations for 56.1.

- Rate decision: Thursday, 12:45, press conference at 13:30. The big news was out already at the October meeting. The ECB will halve the volume of its bond-buys in January to 30 billion euros per month and the program will run through September 2018. Draghi left the door open to what happens afterward, and that was a dovish sign that sent the euro down. Since then, weak inflation reads, especially with core CPI slipping to 0.9%, vindicated his dovishness. This time, no changes are expected, but the ECB will publish new staff forecasts for inflation and growth. A downgrade of inflation forecasts could serve to weaken the euro and Draghi could join in. However, it is hard to ignore the robust growth, especially in Germany (0.8% q/q). As usual, Draghi will continue his balancing act. If he talks about ending QE after September, the euro will jump, but this is unlikely. The ECB can wait until around June to make such future announcements.

- Trade Balance: Friday, 10:00. The euro-zone enjoys a very wide trade surplus, courtesy of German exports more than any other thing. A surprisingly strong surplus of 25 billion was recorded in September. The figure for October will likely be similar: 24.6 billion.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week by holding onto support at 1.1910 (mentioned last week). That did not hold for too long though.

Technical lines from top to bottom:

The cycle high of 1.2090 looms above. 1.20 is the obvious round level and also worked as resistance in September.

1.1950 was the high level seen in November and a stepping stone towards 1.20. 1.1860 capped the pair in August and in October while working as support in September.

1.1820 worked as a cushion to the pair in late November and works as weak support. 1.1760 served as a cushion in November and also played a role beforehand.

1.1710 was the high of August 2015 and also worked as support in November. 1.1670 was a swing low in October. and hasn’t worked too well.

The 2016 high of 1.1620 slowed down the pair also in October. 1.1555 was the low point in November and works as a cushion. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. The next level of support is only 1.1370.

I am neutral on EUR/USD

While inflation vindicates Draghi’s cautious approach, the drop in unemployment and upbeat growth are hard to ignore. A similar picture is seen in the US. The Fed is likely to strike a balance between optimism about the economy and perplexion about weak inflation. All in all, these balances could keep the pair balanced for now.

Our latest podcast is titled A December to remember for EUR/USD

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!