EUR/USD had a mixed week, sticking to known ranges. The upcoming week features fresh inflation figures, GDP updates, and some PMIs. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Troubles in German coalition talks sent the euro briefly lower, but it recovered quite quickly. Hopes for a grand coalition and upbeat PMIs already sent EUR/USD to challenging the double top. The meeting minutes by the ECB did not tell us something we did not know. In the US, the meeting minutes actually revealed a growing concern about low inflation. Three hikes in 2018 does not seem so likely.

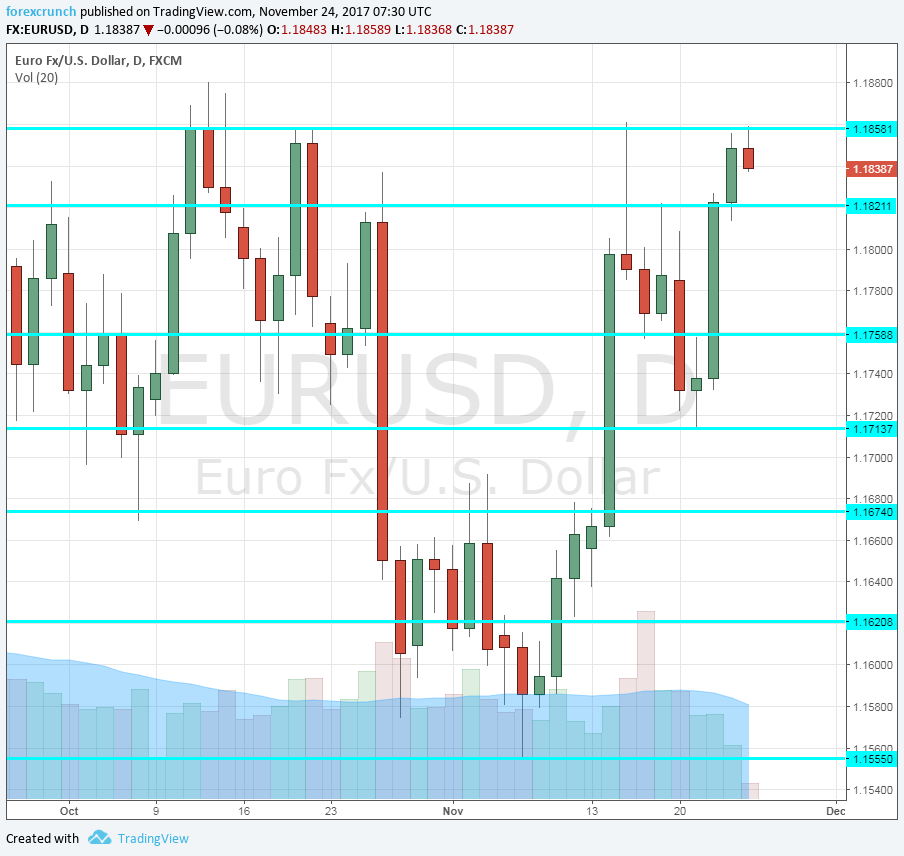

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Import Prices: Tuesday, 7:00. Prices of imported goods such as oil impact consumer prices. After a few months of drop and/or missing expectations, a rebound was recorded in September: 0.9%. We will now get the somewhat belated figures for October. An increase of 0.4% is expected.

- Monetary data: Tuesday, 9:00. M3 Money Supply, which reflects money in circulation, grew at an annual pace of 5.1% in September, similar to previous levels. A repeat of 5.1% is predicted now. Growth in private loans stood at 2.7% y/y. An acceleration to 2.8% is projected now. These are healthy gains, partly a result of the ECB’s monetary stimulus.

- French Consumer Spending: Wednesday, 7:45. French consumers were active in September, increasing their spending by 0.9%, better than had been expected. No change in spending is forecast now.

- French GDP: Wednesday, 7:45. Wednesday, 7:45. France reported a healthy growth rate of 0.5% q/q in the Flash version of GDP. This will likely be confirmed in this second release for Q3

- Spanish Flash CPI: Wednesday, 8:00. The fourth-largest economy in the euro-zone saw a rise of 1.6% y/y in October. This was weaker than expected but not far from the levels seen beforehand. A rise to 1.7% is estimated.

- German CPI (preliminary): Wednesday: the German states publish the data during the morning and the all-German number is out at 13:00. In October, Germany reported no change in prices, weaker than +0.1% that had been expected. This dragged down the euro-zone figure. Now, a gain of 0.3% m/m is predicted.

- German Retail Sales: Thursday, 7:00. German consumers expanded their buying by 0.5% in September after a slide in August. The German economy leans more towards exports, but consumption is also looking good. Another increase of 0.5% is projected.

- French CPI (preliminary): Thursday, 7:45. The second-largest economy in the euro-zone publishes an early assessment of price development in November. Back in October, it reported a price rise of 0.1%, exactly as expected.

- German Unemployment Change: Thursday, 8:55. The German job market is booming and for quite a while. The high level of employment puts the focus on low wages. In any case, 11K people came out of unemployment in September. The data for October will likely be similar: a drop of 10K in the number of those out of work.

- CPI (flash): Thursday, 10:00. After the major countries have already released their own figures, we get the flash figures for the whole euro area. October was quite disappointing with 1.4% in headline inflation and only 0.9% in core CPI, quite a setback after this figure had already advanced. A bounce back is forecast now: 1.6% in the headline figure and 1% in the core CPI.

- Unemployment Rate: Thursday, 10:00. The unemployment rate in the euro-zone continues falling gradually and it has dipped under 9% in September, hitting 8.9%, the lowest since April 2009. The same level of 8.9% is predicted, but we have seen surprises in the past.

- Manufacturing PMIs: Friday morning: 8:15 for Spain, 8:45 for Italy, final French figures at 8:50, final German data at 8:55 and the final euro-zone figure at 9:00. The Spanish manufacturing sector has been expanding more rapidly in October according to Markit, with 55.8 points, significantly above the 50-point threshold that separates expansion and contraction. A score of 56.6 is expected now. Italy, the third-largest economy, saw 57.8 points, even better. Also here, expectations point to a rise to 58.4 points. The initial read for France for November stood at 57.5. For Germany, the level of a whopping 62.5 and the euro-zone had 60 points. These three initial reads will likely be confirmed in the final update.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week around the 1.1780 level (mentioned last week). It then made a move to the upside.

Technical lines from top to bottom:

The cycle high of 1.2090 looms above. 1.20 is the obvious round level and also worked as resistance in September.

1.1910 held the pair down back in August. 1.1860 capped the pair in August and in October while working as support in September.

1.1760 served as a cushion in November and also played a role beforehand. 1.1710 was the high of August 2015 and also worked as support in November.

1.1670 was a swing low in October. and hasn’t worked too well. The 2016 high of 1.1620 slowed down the pair also in October.

1.1555 was the low point in November and works as a cushion. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. The next level of support is only 1.1370.

I remain bullish on EUR/USD

Euro-zone data is looking great and Germany’s political issues will eventually be resolved. The worries about inflation in the US alongside another political battle about tax cuts could weigh on the dollar.

Our latest podcast is titled German gyrations + nature and natural gas

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!