- Traders are focused on when the Federal Reserve might start reducing rates.

- Futures indicate a 30% chance that the Fed could start rate cuts as early as next March.

- The euro reached its highest point in over two months.

As we embark on the new week, the dollar extended its downward journey, painting an optimistic picture for the EUR/USD forecast. In response to the weakened dollar, the euro climbed to a level exceeding $1.0924. Consequently, it hit its highest point in over two months.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Traders solidified their belief that US rates have peaked and shifted attention to when the Fed might start reducing rates. Notably, the dollar index hit 103.64, marking its weakest point since September 1. This extends its almost 2% drop from last week, the steepest weekly decline since July.

Weaker-than-expected US economic indicators, particularly a below-estimate inflation reading, led markets to rule out the possibility of further rate hikes from the Fed.

Now, the focus is on the timing of the first rate cuts. Moreover, futures indicate a 30% chance that the Fed could initiate rate reductions as early as next March, according to the CME FedWatch tool.

“The market will likely maintain relatively stable pricing for FOMC policy this week. Therefore, there will be limited catalysts for significant movements in the dollar,” stated Carol Kong, a strategist at the Commonwealth Bank of Australia. Furthermore, she said, “In the event of an improvement in risk appetite, the dollar has the potential to weaken further.”

Meanwhile, investors are awaiting the minutes of the latest Fed meeting later this week. These will provide insight into Fed policy.

EUR/USD key events today

Investors do not expect any key economic reports from the US or the Eurozone. Therefore, the pair will likely consolidate.

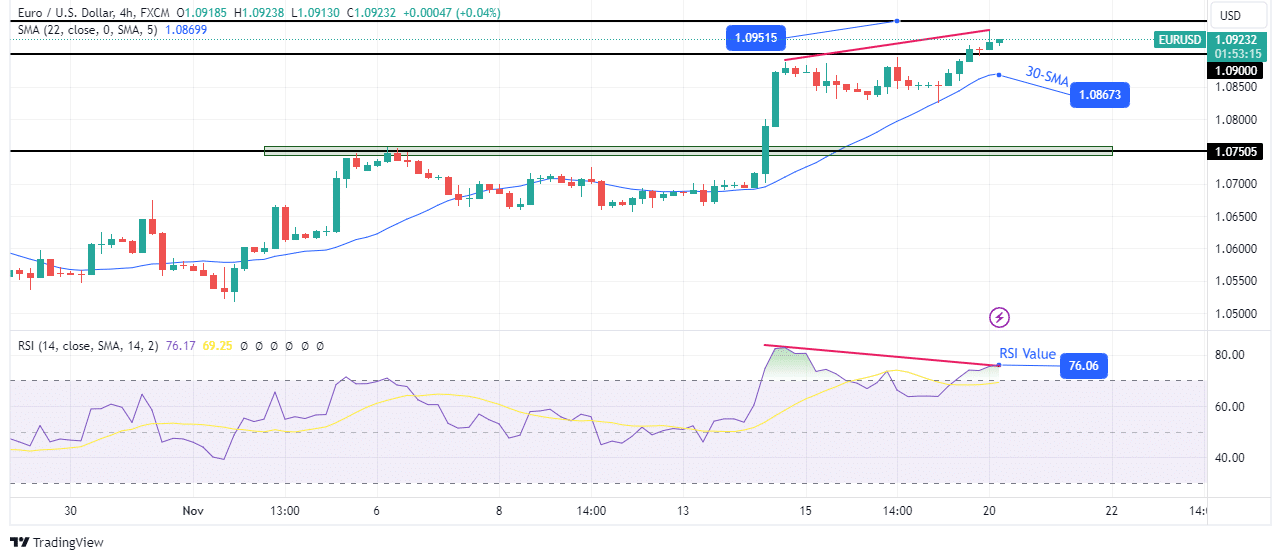

EUR/USD technical forecast: Bullish momentum wanes above 1.0900.

The bias for EUR/USD on the 4-hour chart is bullish, and the price has made a new high. EUR/USD currently trades above the 1.0900 key level. However, bulls are not making as strong candles as they did when the price broke above the 1.0750 key level.

–Are you interested to learn more about crypto signals? Check our detailed guide-

Moreover, the RSI is showing a bearish divergence with the price. It indicates weaker momentum in the bullish move. Consequently, bears might come in for a deep pullback or reversal. If that is the case, the price will likely break below the 30-SMA to retest the 1.0750 key level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.