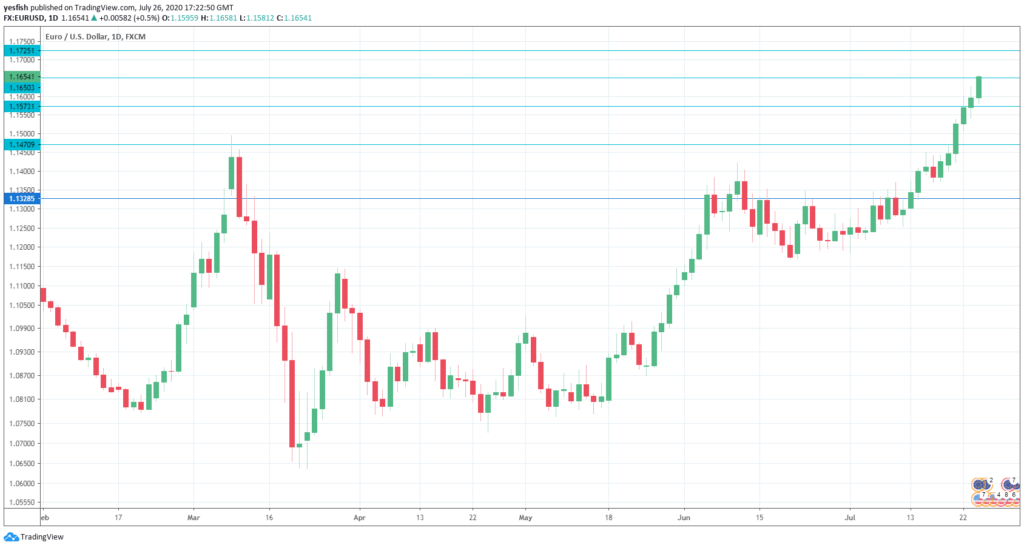

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Monetary Data: Monday, 8:00. M3 Money Supply climbed to an annual growth rate of 8.9% in May, up from 8.3% a month earlier. Private Loans remained at 3.0% in May y/y. We will now receive data for June. Money Supply is projected to rise to 9.5% while Private Loans are expected to grow by 3.2 percent.

- Spanish Unemployment Rate: Tuesday, 7:00. The unemployment rate rose to 14.4% in Q1, up from13.8% beforehand. Analysts are braced for a weaker reading in Q2, with a forecast of 16.7%.

- German Preliminary CPI: Thursday, All Day. Inflation rebounded nicely in June, with a gain of 0.6%. The previous reading was -0.1%. The estimate for July stands at -0.2%.

- German Preliminary GDP: Thursday, 8:00. The eurozone’s largest economy contracted by 2.2% in Q1, and investors are bracing for an abysmal release in Q2, with an estimate of -9.0%. A sharp decline could send the euro lower.

- French Flash GDP: Friday, 5:30. France’s economy slipped by 5.8% in Q1 and is projected to plunge by 15.2% in Q2, as Corvid-19 has caused massive disruption to the eurozone economy.

- German Retail Sales: Friday, 6:00. Retail sales rebounded with a gain of 13.9%, after back-to-back declines. However, another decline is expected in the upcoming release, with a forecast of -3.0%.

- Eurozone Inflation: Friday, 9:00. Eurozone CPI posted a gain of 0.3% in June and no change is expected in the initial July reading. The core reading is expected to remain pegged at 0.8%.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1850. 1.1725 is next.

1.1650 has switched to support. It is a weak line.

1.1573 (mentioned last week) is the next support line.

1.1470 has held since mid-March.

1.1328 is the final support line for now.

.

I remain bullish on EUR/USD

The euro is surging, with a gain of 3.7% in July. With the US struggling to control Covid-19, investors have soured towards the US dollar and the euro rally could continue.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!