EUR/USD had a turbulent week that it eventually ended slightly lower and it is still looking for a new direction. The upcoming week features a speech by Draghi, final inflation figures, and more. What’s next for EUR/USD? Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

While Germany will finally have a government, Italy’s elections ended with an inconclusive outcome that initially weighed on the euro. The ECB decided to remove its open door to increasing the size of its QE programming, initially sending the euro higher, but Draghi then downplayed the change by saying there was no change to the outlook and that the change only confirms the previous assessments. Falls in industrial output, that joined weaker PMIs caused speculation that the euro-zone economic growth has peaked. The US gained 313K jobs but wages slowed down to 2.6%, below expectations and pushing the greenback lower. The breakthrough in talks with North Korea weakened the dollar and the yen while Trump’s tariffs initially hurt the greenback but when they were watered down, they allowed for a recovery. All in all, a very busy week with many moving parts.

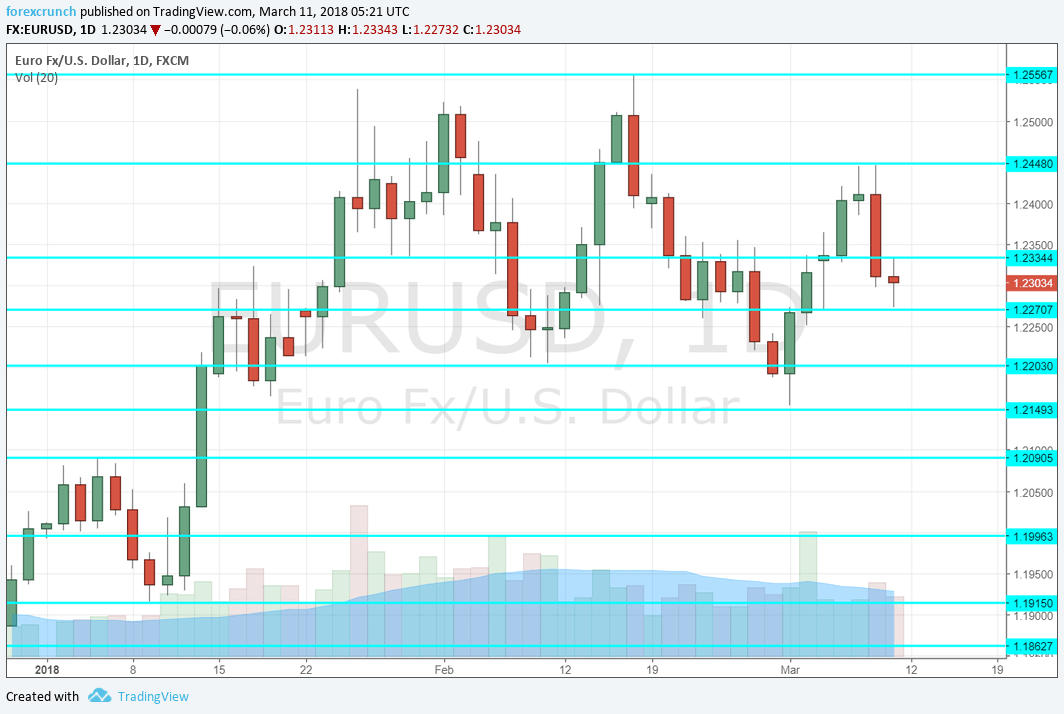

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Eurogroup Meetings: Monday, during the day. Finance ministers of the euro-zone convene to discuss various matters for the first time after Germany has a government. Further euro-zone integration, as pledged by France, is on the cards. Greece is nearing the end of the bailout program and further steps will probably be discussed. Any comments about the recent economic growth and future prospects may move the euro.

- French Final Private Payrolls: Tuesday, 6:30. France is finally seeing significant employment growth. The second-largest economy initially reported a rise of 0.3% in employment during Q4 and this number will probably be confirmed now.

- German Final CPI: Wednesday, 7:00. Germany reported a rise of 0.5% in monthly prices in February in the preliminary read and this number will probably be confirmed now. This feeds into the final CPI read for the euro-zone.

- Mario Draghi talks Wednesday, 8:00. The President of the ECB managed to push down the euro with his dovish downplay of the small hawkish shift the ECB made to its statement. He will have another chance to move markets when speaking in Frankfurt. He will speak at the Institute for Monetary and Financial Stability, so he may refer to monetary policy.

- Employment Change: Wednesday, 10:00. The overall change in employment is a lagging figure but still provides an overview. After an increase of 0.4% in Q3 2017, a slightly more moderate rise of 0.3% is on the cards for Q4.

- Industrial Production: Wednesday, 10:00. The reports coming out from the continent’s main countries fell short of expectations and also the overall number will probably be negative. After a growth rate of 0.4% in December, euro-zone industrial output is projected to fall by 0.4% in January. A deeper fall may increase concerns that the economic growth has peaked in the old continent.

- French Final CPI: Thursday, 7:45. France reported a monthly drop of 0.1% in its CPI for February and the final figure will likely confirm it. This also feeds into the all-European CPI.

- German WPI: Friday, 7:00. Prices at the wholesale level eventually reach consumers. The WPI rose by 0.9% back in January and a more modest increase of 0.2% is now on the cards.

- Final CPI: Friday, 10:00. The flash estimate for euro-zone inflation showed headline inflation slowing down to 1.2% y/y, extending the gradual fall and sending price development further away from the ECB’s “2% or a bit below” target. Core inflation stood at 1%, above the low of 0.9% that the indicator was stuck at for some time. The final read is expected to confirm the initial read.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started off the week with a drop towards the 1.2260 level mentioned last week. It then recovered nicely hitting a high of 1.2447 before falling back to the middle of the range.

Technical lines from top to bottom:

1.2650 is where the long-term downwards resistance level dating from 2008 meets this month’s levels. Further below, the recent swing high of 1.2555 may serve as resistance.

1.2450 was a swing high in March 2018. 1.2360 provided support to the pair in early February and now switches to resistance.

1.2260 was a support line in mid-February. 1.22 is a round number and also a level of comfort in February. 1.2155 was the low point in early March.

The 2017 peak of 1.2090 remains essential. 1.20 is the obvious round level and also worked as resistance in September.

1.1950 was the high level seen in November and a stepping stone towards 1.20. 1.1860 capped the pair in August and in October while working as support in September.

I turn from bullish to neutral on EUR/USD

While the ECB is nearing the exits, a new worry emerges: euro-zone growth may have reached a peak and this takes the sting out of the common currency. In the US, the setback in wages balances things out. All in all, this is beginning to turn into an “ugly contest”.

Our latest podcast is titled The Powell Power Play.

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!