- The ECB is set to get more aggressive amid inflation worries.

- Inflation in the Eurozone is becoming entrenched and moving beyond energy prices.

- US job growth is expected to slow down in September.

Today’s EUR/USD outlook is slightly bullish. According to ECB meeting accounts, policymakers were increasingly concerned that high inflation might persist and necessitate aggressive policy tightening, even at the expense of slower development.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

The ECB increased rates by 75 basis points during the meeting, which was more than anticipated, and signaled further increases. Rapid inflation, previously limited to skyrocketing energy prices, is now affecting everything from services to durable goods.

The records released on Thursday show that while some policymakers argued for a lower 50 basis point rate hike, a “very high” number supported a larger increase. Ultimately, all 25 rate-setters agreed on the decision.

“Inflation had started to become self-reinforcing, to the point that even a projected marked weakening in growth was not sufficient to bring inflation back to target,” the accounts said. “Inflation was far too high and likely to stay above the Governing Council’s target for an extended period.”

The Federal Reserve, on the other hand, has enough justification for continuing its aggressive monetary policy tightening campaign for a while, even though it is likely that US job growth slowed in September. Due to rapidly rising interest rates, businesses are becoming more cautious about the economy’s outlook.

EUR/USD key events today

All focus will be on the US jobs report coming out later today. This report will show how the labor market is holding up to higher interest rates.

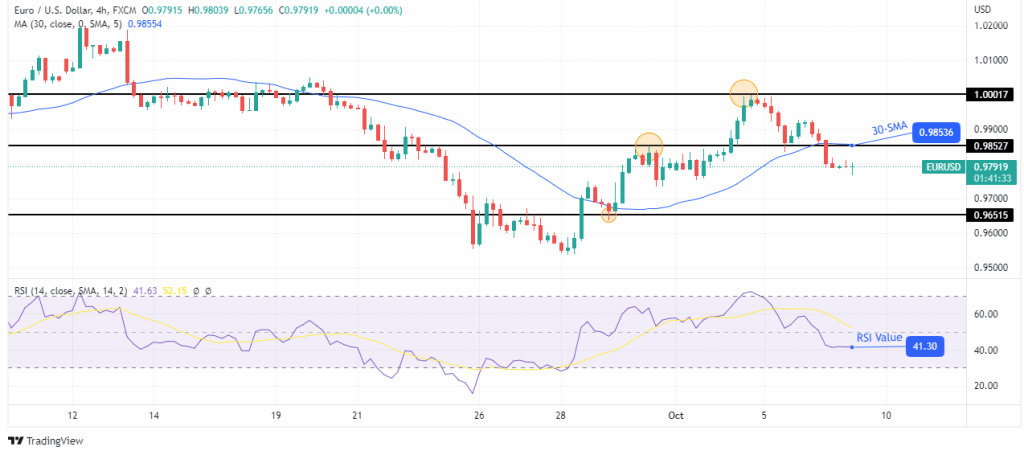

EUR/USD technical outlook: Bearish momentum back after failed attempt to break above parity

Looking at the 4-hour chart, we see the price trading below the 30-SMA and the RSI below 50. This is a sign that the bears are back. The price had been in a short uptrend, reaching the 1.0001 key level. At this point, bulls failed to go above the key level, allowing bears to come in and push the price below the 0.9852 support level.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

With the price now trading below the 30-SMA, bears are eyeing the next support level at 0.9651. The downtrend will be confirmed when the price starts respecting 30-SMA as resistance. If it does not respect it, this might just be a consolidation around parity before bulls gather enough momentum to push beyond 1.0001.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.