- The ECB will raise rates as high as it needs to control core inflation.

- Inflation is getting entrenched in the eurozone, as seen in the 4.8% core inflation rate.

- Lagarde hinted at a possible pause in economic stimulus.

Today’s EUR/USD price analysis is bullish as the pair soars on hawkish comments from ECB policymakers. According to ECB policymaker Francois Villeroy de Galhau, the bank will raise interest rates as much as necessary to reduce core inflation. However, the rate of increase may slow after the year’s end.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

Villeroy, also the governor of the French central bank, claimed that the euro zone’s core inflation rate of 4.8%, which excludes food and energy costs outside the central bank’s authority, was too high and too broad.

Villeroy stated that it was critical for the ECB’s upcoming actions to continue to be “orderly” after the ECB increased its main interest rate by 50 basis points in July and 75 in September. This, he explained, meant not upsetting the markets or abruptly tightening financial conditions for households and businesses.

ECB President Christine Lagarde added that the central bank must, at a “minimum,” stop stimulating the economy with its monetary policy when speaking later in Cyprus.

EUR/USD key events today

Investors are awaiting the ADP Nonfarm Employment Change report from the United States. The publication, which comes out two days before official government data, is a reliable indicator of the non-farm payroll report. There will also be the ISM Non-manufacturing PMI that will show the level of economic activity in the non-manufacturing sector.

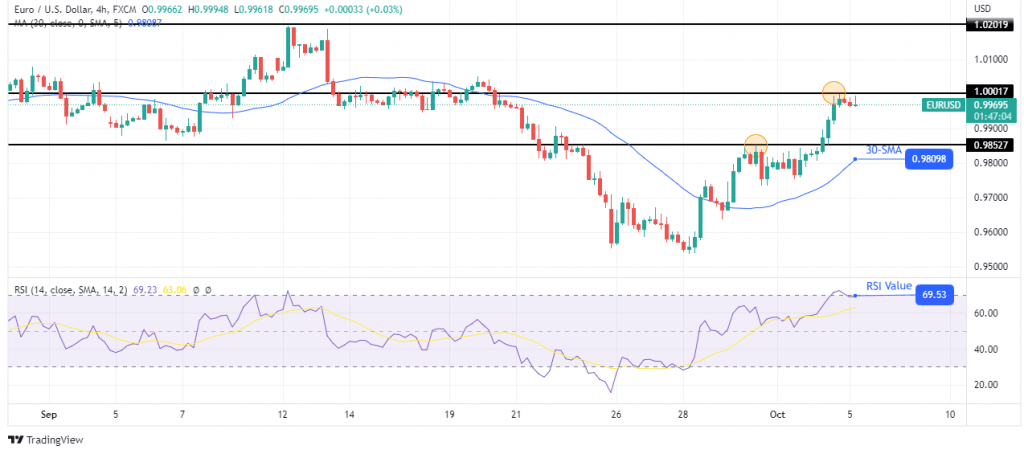

EUR/USD technical price analysis: Bulls facing solid resistance at parity

Looking at the 4-hour chart, we see the price trading well above 30-SMA and the RSI above 50. Bulls have taken over and pushed the price back to parity. The price is now making higher highs and higher lows, confirming the new bullish trend. However, the bullish trend might not continue if bulls cannot break above the 1.0001 key psychological level.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

This level has been known to hold the price in a range for some time before it breaks or bounces off. Therefore, if bulls cannot gather enough momentum to push above parity, the price might consolidate for some time before either bears or bulls win. If the bulls win, the price will likely retest 1.0201.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.