- Inflation in the eurozone was only slightly higher than initially anticipated in January.

- Consumer spending in the US increased by 1.8% in January.

- The US PCE price index increased by 0.6% last month.

The EUR/USD weekly forecast is bearish as the Fed will likely raise and keep rates high for longer due to the US economy’s resilience.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Ups and downs of EUR/USD

According to Eurostat’s Thursday report, Eurozone inflation was only slightly higher than initially anticipated in January. This confirms that price growth has long since passed its peak.

Data from the Commerce Department revealed that consumer spending, which makes up two-thirds of US economic activity, increased by 1.8% in January, beating analyst expectations and representing the highest growth in nearly two years.

The Fed’s favored inflation indicator, the personal consumption expenditures (PCE) price index, also increased by 0.6% last month, the most in the previous six months. These reports followed the hawkish FOMC minutes and the jobless claims report that surprisingly fell. They all point to a resilient economy despite rising rates.

The dollar index rose 0.65% to a seven-week high, strengthening against other major currencies and pushing EUR/USD lower.

Next week’s key events for EUR/USD

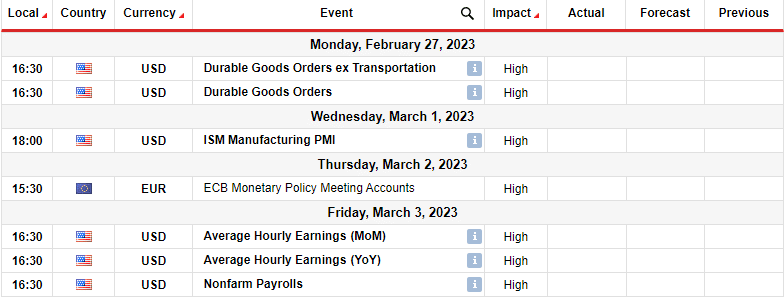

Investors anticipate the US and the Eurozone to release economic data next week, but all eyes will be on the ECB minutes and the US nonfarm payrolls. Many have been astonished by the US labor market’s resilience, which may continue. A figure greater than anticipated could cause a decline in EUR/USD.

EUR/USD weekly technical forecast: Bears face strong support at the 1.0526 level

The daily chart shows the EUR/USD declining after breaking below the 22-SMA and the RSI below 50. This comes after the price found resistance at the 1.1004 key level. Bears took over and pushed the price lower to the 1.0526 support level.

–Are you interested to learn more about making money in forex? Check our detailed guide-

At this point, bears might pause before the price breaks below the support and the downtrend continues. However, the pause might allow bulls to come in and retest the 22-SMA as resistance.

Bears will remain in control if the price stays below the SMA and might make a new low at the 1.0253 support. On the other hand, if bulls get stronger and the price breaks above the SMA, we might get a retest of the 1.1004 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.