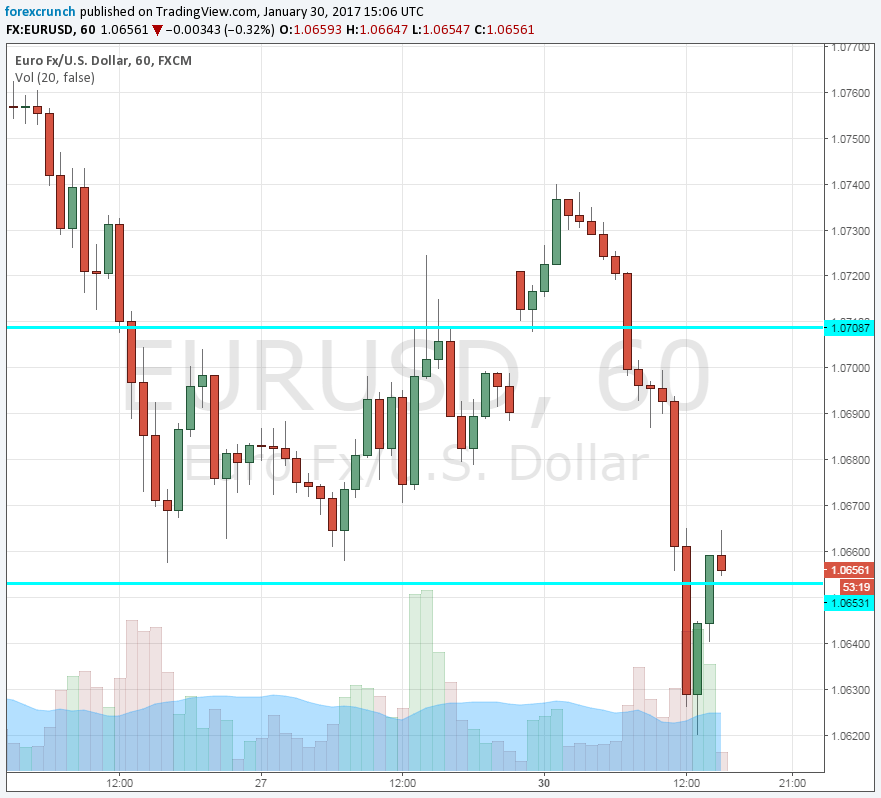

EUR/USD opened the week with a weekend gap to the upside, but this episode is already behind us. The reason for the rise was Trump’s Muslim ban. The executive order from the new president about banning entries from 7 Muslim countries caused chaos in US airports and resulted in a global crisis.

However, as time passed by, the US issues moved away and in came some bearish data from Europe. Germany reported a drop of 0.6% in prices in January, lowered than 0.5% expected. Also on the year over year figures, the data points were a miss: 1.7% according to the HICP and 1.9% in the national CPI.

Germans were worried about the jump in inflation last month, albeit the blame was pointed at German holiday packages at the time. Those suspicions proved correct. Draghi had already dismissed the temporary rise in inflation as energy-related and today he is vindicated, at least according to the German data. Tomorrow we will get the full euro-zone data.

Risk off

In addition, the Trump troubles have another effect. The bad news triggers a “risk-off” sentiment. This aids the safe-haven Japanese yen first and foremost, but the greenback is also a beneficiary. This can also help explain the slide in EUR/USD.

The low so far has been 1.0620, under support at 1.0650. Yet following this move, the pair bounced back. At the moment this seems to be a false break. Further below, we find 1.0520 and 1.0460. On the topside, 1.0710 and 1.0780 await the pair.

More: EUR/USD: To Rally Towards 1.10 Short-Term; Sell Into This Rally Long-Term – SEB

US data has been OK, with the Core PCE price index hitting 1.7% exactly as expected. Personal income is up 0.3% and spending is up 0.5%. Pending home sales came out at 1.6%, better than projected.