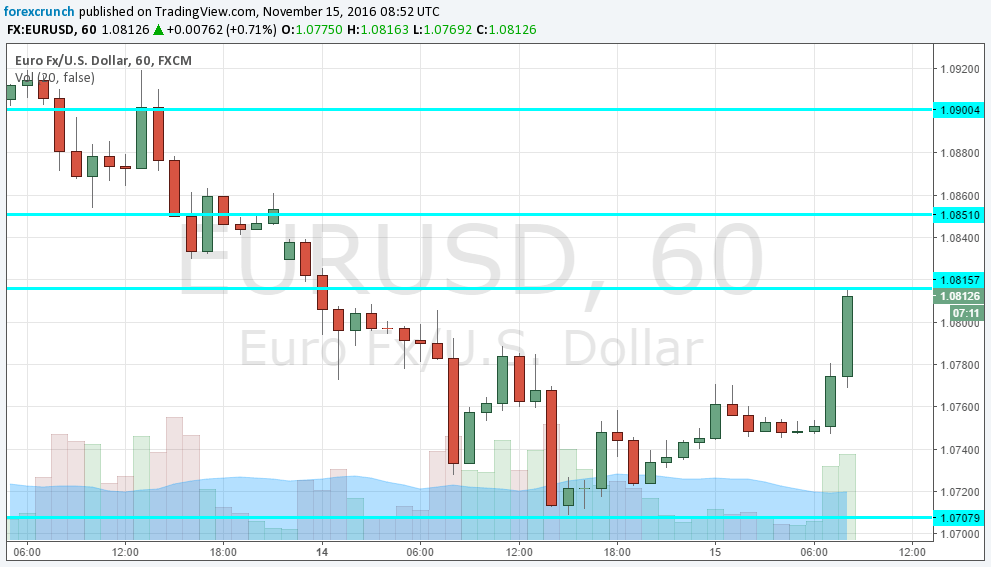

Yesterday, EUR/USD dropped to the lowest levels in 2016, testing support at those January lows. From there, the pair stabilized and eventually made a move to the upside. Once again, it is moving to familiar ground: the March lows now serve as resistance at 1.0820.

What is behind the bounce? This is mostly a counter-reaction to the big-league dollar rally inspired by hopes that President-elect Trump will spend, spend and spend. And now, this is a mix of a necessary correction as well as a reality check: Republicans are unlikely to go along with a huge plan.

The greenback is also losing ground against the yen, the pound and basically across the board. The drops are accompanied by drops in bond yields. In Europe, there aren’t many reasons to cheer: German GDP missed expectations. All in all, the move down and the current move to the upside are driven by the US dollar.

If euro/dollar breaks above this level, 1.0910 (post-Brexit low) and 1.10960 serve as resistance. However, some already begin talking about parity.

Here is how the recent moves look on the one-hour chart. Volatility is apparently good for the world’s most popular currency pair.