EUR/USD is reversing its early gains and already trading below Friday’s close, currently under 1.1350.

This happens while stock markets from Athens to anywhere in the continent are soaring on the optimism from Greece. So why has EUR/USD begun reversing? Is the pair already “selling the fact”? It’s probably more related to the USD side.

Over the weekend, news emerged that Greece and its creditors were genuinely getting closer to hammering a deal. Concession made by Greece and perhaps acceptance of some form of debt structuring from the EU resulted in optimistic reports, even if the details remain unclear.

It’s a busy day ahead:

- 8:30 GMT: ECB decision on more ELA

- 9:00 Greek PM Alexis Tsipras meets IMF MD Christine Lagarde, ECB President Mario Draghi, EU president Jean-Claude Junker and Eurogroup president Jeroen Dijsselbloem to discuss the new Greek ideas.

- 10:30 Eurogroup meeting begins.

- 17:00 Meeting of heads of state

The markets may be cautious: hopes existed during many months and too often they resulted in a breakup of talks. We don’t have anything definitive so far.

Another reason could be an early sell-off of “the fact” – the market is already moving forward.

However, looking across the board shows a similar surge of the USD against both the GBP and the JPY. The moves are less marked against the commodity currencies.

More: EUR/USD: Fade Rally On Any Greek Resolution – BNPP

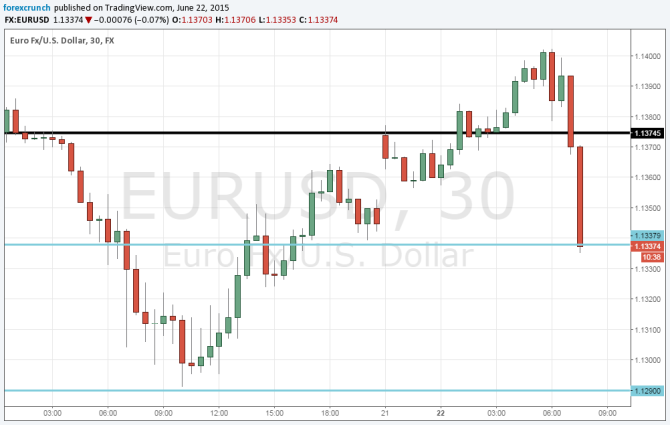

Here is how it looks on the chart, with a small Sunday gap followed by a sharp reversal: