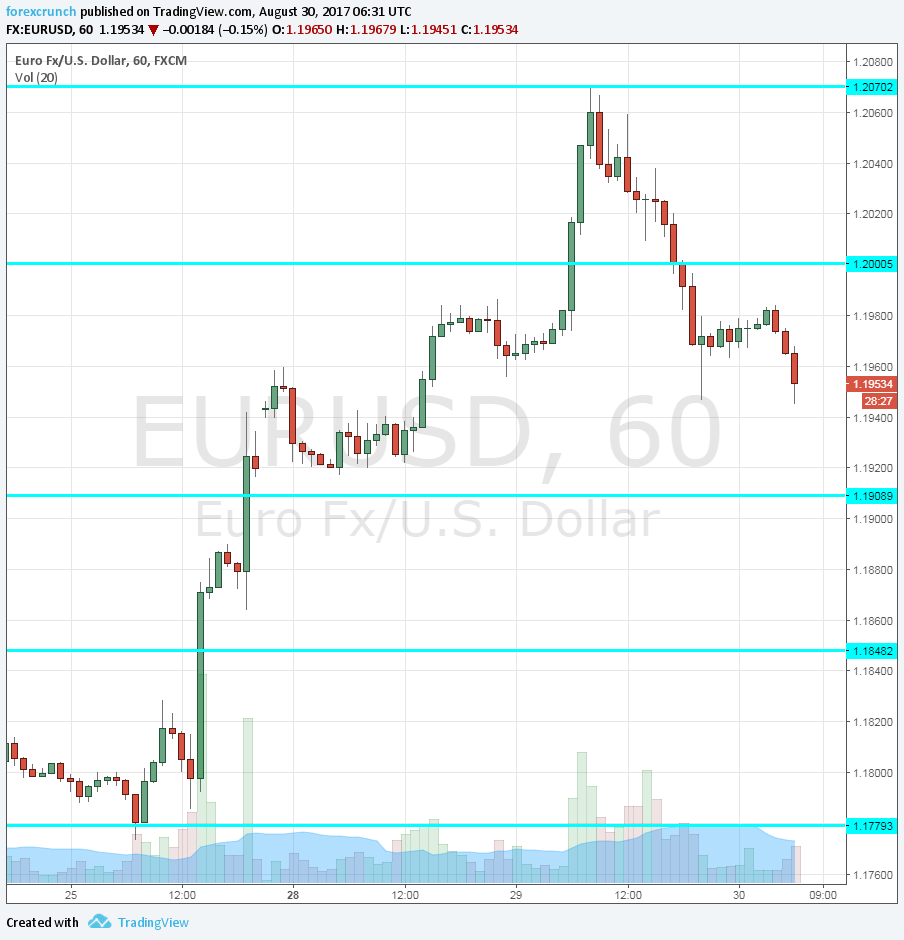

Yesterday, EUR/USD finally made a break above 1.20 and made it big-time. The pair even broke above the “whatever it takes” level of 1.2040 and hit a new high of 1.2070. However, this didn’t last.

In the US session, the dollar gained some ground, also thanks to a high level of consumer confidence. The greenback gradually reasserted itself and EUR/USD climbed down from the highs, eventually slipping under 1.20.

This climb down accelerates with a further drop: the pair is trading around 1.1950. Support awaits at 1.1870.

Some of this drop is related to fear that a strong euro would push Draghi to announce a softer version of QE tapering. Yet some is just a US dollar correction ahead of key US figures.

Later today, we will get a snapshot of the US economy via an updated version of GDP. This will be accompanied by the ADP Non-Farm Payrolls. The biggest event of the week is the official NFP on Friday.