American consumers are more confident. Will they go on a shopping spree? In any case, this is good news that sends the US dollar slightly higher.

CB Consumer Confidence came out at 122.9 points, better than expected and higher than 120 points in July, according to the revision.

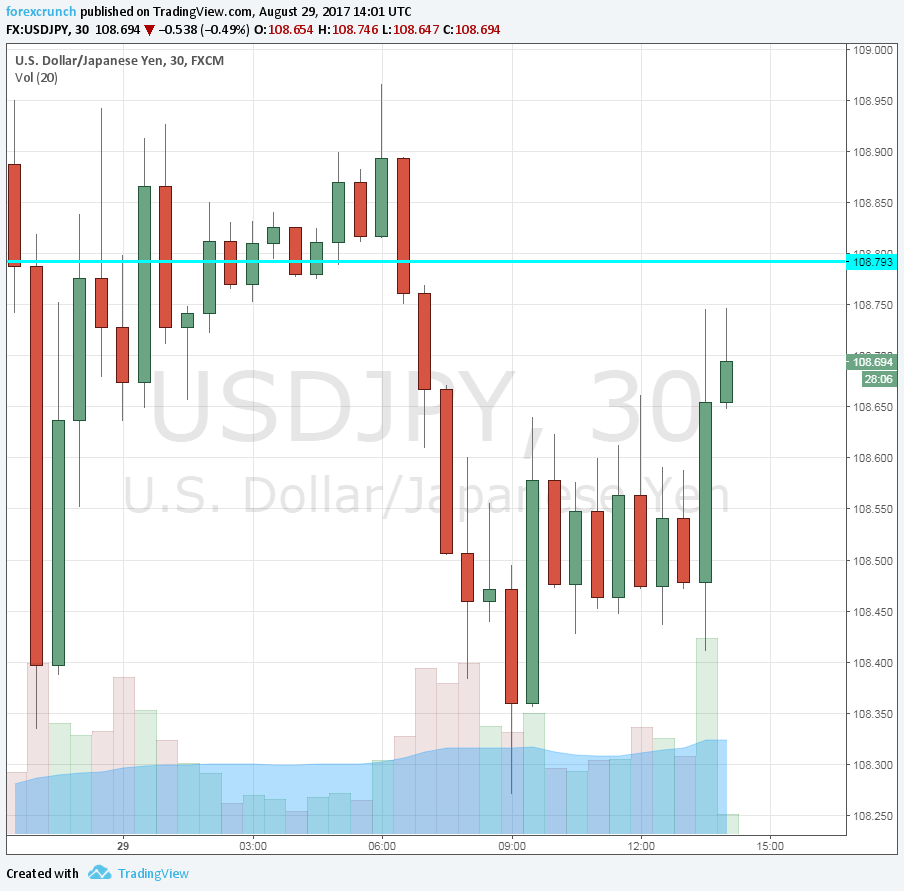

Here is the reaction as seen on the dollar/yen chart. Other currencies are seeing similar moves.

The Conference Board’s consumer confidence measure was expected to tick down from 121.1 points in July to 120.3 in August. Earlier, the S&P Case Shiller 20-city HPI rose by 5.65% y/y, as expected.

The US dollar was on the back foot, with EUR/USD breaking above 1.20, USD/JPY edging closer to the lows, GBP/USD sneaking its way towards 1.30 and commodity currencies also showing some strength.

The US news is dominated by two themes:

- Storms: The Harvey Hurricane which turned into a storm is flooding Texas, wrecking havoc and also shutting down refineries. The economic damage is hard to assess but seems huge. Louisiana is next to feel the brunt of the rains.

- North Korea: The rogue nation fired a missile above Japan’s northern island. President Trump said that “all the options are on the table”. The UN’s Security Council is set to convene.

We still have the Non-Farm Payrolls coming up later this week. Why this NFP could be very volatile – 5 reasons