EUR/USD made a move to higher ground but was rejected on high resistance. Will this be followed by another move up? It now faces final inflation figures among other events. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

German factory orders are on the back foot and PMIs were also mostly negative. The ECB meeting minutes revealed a discussion about a deeper cut in rates and that the central bank has not reached its lower bound. This helped keep the pair in check. In the US, the indicators look OK but the Fed is not going anywhere fast according to the minutes. The dollar rocked and rolled across the board.

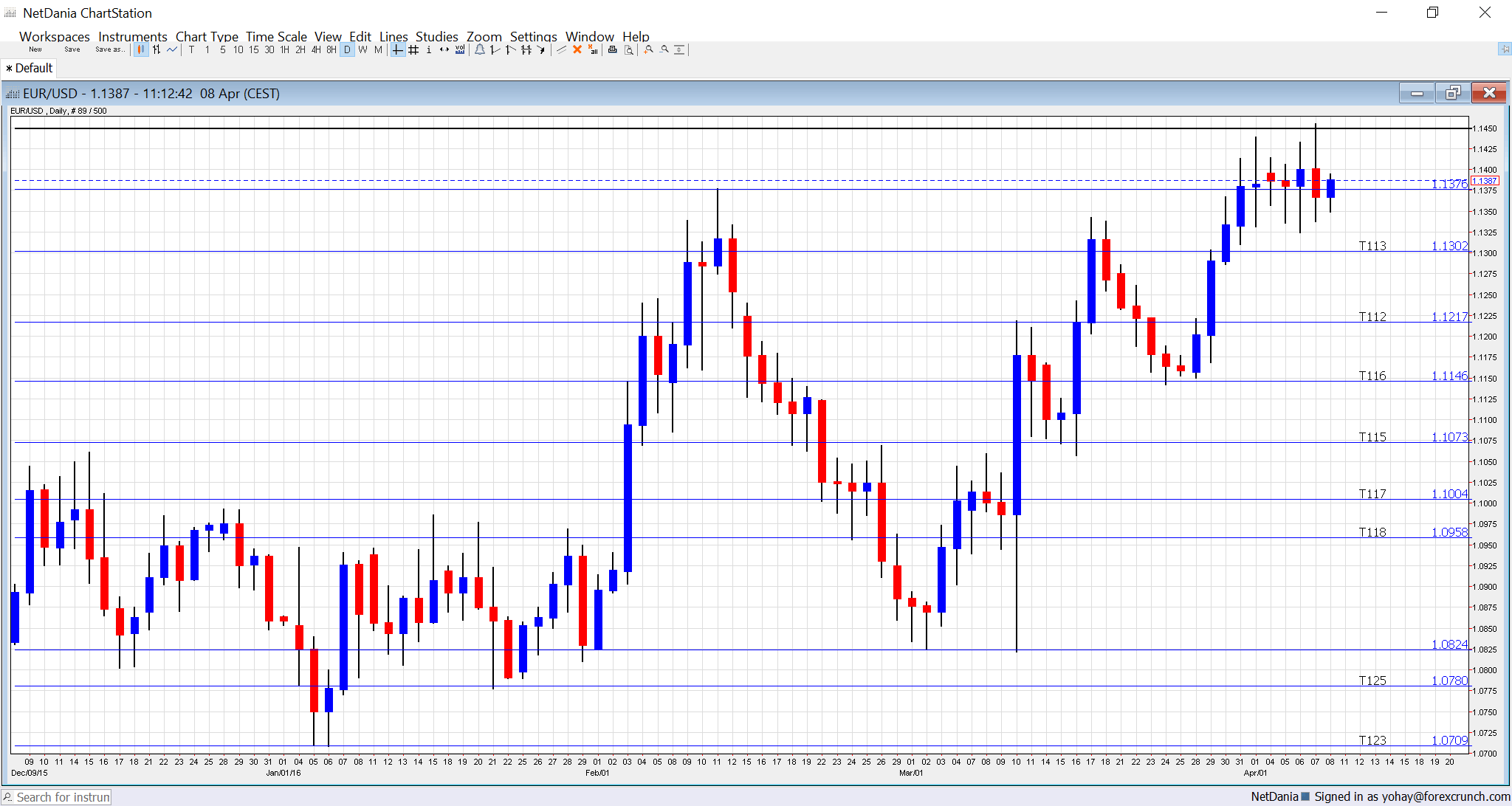

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German CPI (final): Tuesday, 6:00. According to the initial release, prices advanced 0.8% in March, slightly better than expected. This will likely be confirmed now. Year over year, things are far from being positive.

- German WPI: Tuesday, 6:00. The Wholesale Price Index can be a leading indicator to consumer inflation. Prices disappointed with a fall of 0.5% in February and they have basically disappointed for long months. A rise of 0.3% is expected now.

- French CPI (final): Wednesday, 6:45. The continent’s second largest economy saw prices bounce by 0.7% in March in the initial read. Also here, a confirmation is on the cards.

- Euro-zone industrial output: Wednesday, 9:00. This figure leaped by 2.1% last month on the positive German one and is now expected to slide by 0.6% when Germany’s slide. This euro-area number is released after the German and French ones, making it somewhat less important.

- Euro-zone CPI (final): Thursday, 9:00. The euro area is still in deflation, with prices falling by 0.1% y/y according ot the initial read for March. At least this is better than the number seen in February. Core inflation is also somewhat encouraging at 1%. A confirmation is expected here but contrary to the French and German figures, revisions are quite common.

- Trade balance: Friday, 9:00. The euro-zone rides on German exports for its surplus, but this has been off the highs. A positive 21.2 billion number was seen in January. We now get the February number which is expected to rise to 21.9 billion euros.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar found support at 1.1365 (mentioned last week) but eventually slipped below this line. Another move to the upside already challenged the 1.1460 level but the pair slipped back.

Technical lines from top to bottom:

1.1712 was the high point in August 2015 and remains high in the sky. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1365 separated ranges late in March 2016 and replaces the 1.1375 level.

1.13 worked as support back in October and is the high line at the moment. It is followed by the swing low of 1.1220 in September which is minor resistance now.

1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which worked in the past as resistance, provided a cushion for the pair in February. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

I am bearish on EUR/USD

It seems that ECB will indeed not give up, and with lower prospects for inflation and growth, the euro looks like a “dirtier shirt” in the laundry pile and the dollar suffering a bit less.

In our latest podcast we explain why the doves do NOT cry.