EUR/USD was pressured and slipped lower, but did not go far. Will it stay in range?. The upcoming week features Pthe PMIs, key German surveys and Draghi’s highly anticipated speech in Jackson Hole. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

German GDP slightly missed expectations but this did not affect the euro-zone growth rate which remained at 0.6% in Q2. The ECB minutes expressed concern over the strong euro. EUR/USD dipped, but it was only temporary The terror attack on Barcelona did not seem to affect the common currency. The US dollar made another attempt to recover early in the week, but the trouble in the White House and the somewhat dovish meeting minutes weighed on the greenback. Economic data has been mixed, with weak housing data but a robust retail sales report.

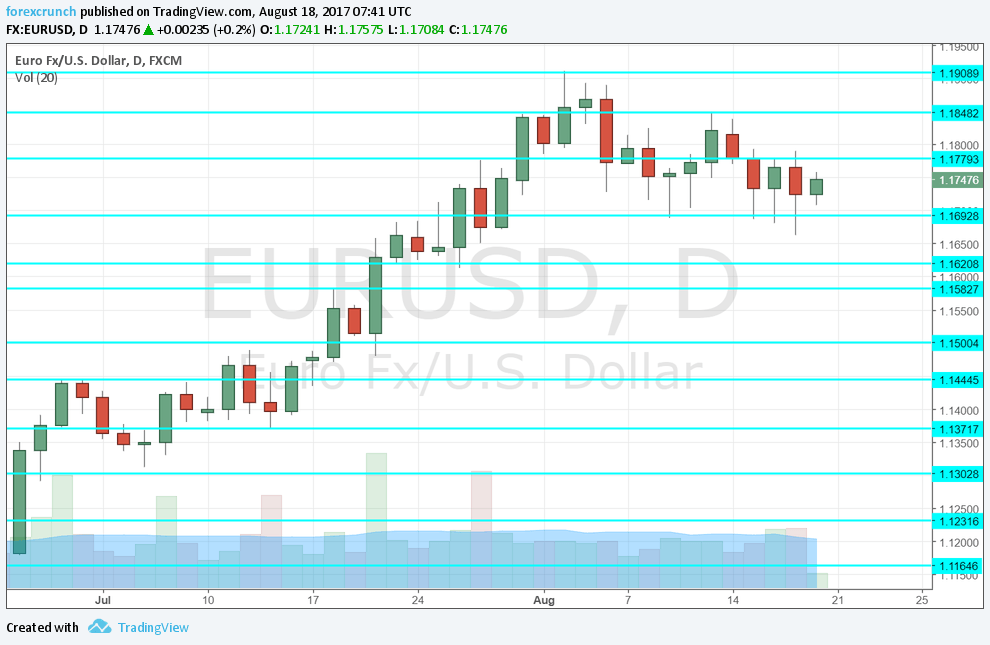

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German ZEW Economic Sentiment: Tuesday, 9:00. This 275-strong survey has dropped from the highs of 20.6 recorded in May and drifted down to 17.5 points in July. A small drop to 15.3 is predicted now. The all-European measure stood at 35.6 in July and 34.2 is on the cards now.

- Draghi speaks in Germany: Wednesday, 7:00. Prior to departing for the US, the president of the ECB will be speaking in Germany. He will likely keep his powder dry ahead of the Jackson Hole speech, but he can also surprise by providing early hints.

- Flash PMIs: Wednesday, 7:00 for France, 7:30 for Germany and 8:00 for the euro-zone. Markit’s final manufacturing PMI for France stood at 54.9 points, above the 50-point threshold that separates expansion from contraction. A small drop to 54.6 is expected. The services sector had a higher score of 56 points and 55.8 is on the cards for August. Germany, the largest economy in the euro-zone, had an upbeat manufacturing PMI of 58.1 points and a slide to 57.8 is predicted. Services were behind with 53.1 and here, a rise is on the cards:53.3 points. The euro-zone as a whole saw a manufacturing PMI of 56.6 and a services PMI of 55.4. Manufacturing is expected to slip to 56.3 while services carry expectations of remaining unchanged.

- Consumer Confidence: Wednesday, 14:00. This official survey of around 2300 consumers disappointed in July by falling back to -2 points. The negative number reflects pessimism, albeit weaker than in the past. A repeat of -2 is forecast.

- Belgian NBB Business Climate: Thursday, 13:00. Belgium’s wide survey serves as a gauge for the whole continent. The score is close to being balanced between improving and worsening conditions at 0 points but remains behind. The score was -1.5 in July. -1.6 is estimated for August.

- German Final GDP: Friday, 6:00. The German economy enjoyed robust growth and served as a locomotive. The final read will likely confirm the previous one.

- German Ifo Business Climate: Friday, 8:00. Germany’s leading Think-tank has published upbeat reports in recent months. The 7000-strong survey advanced to 116 points in July, the highest since the pre-crisis days. A similar score of 115.7 is predicted.

- Draghi speaks at Jackson Hole: Friday 19:00. The announcement of Draghi’s speech in Jackson Hole already triggered high expectations. The president of the ECB used his 2014 speech in Wyoming to provide significant hints about the central bank’s QE announcement that followed in January 2015. This time, he is expected to hint about the beginning of the end of QE: an announcement of QE tapering to come in the Autumn and to begin in 2018. In the recent rate decision, Draghi stressed that there has been no discussion about tapering but his dovishness did not convince markets. Some expect him to play down expectations also now, in order to halt the rise of the euro. However, the recent strength of the common currency reflects the strength of the economy, and it will be hard for Draghi to change the course, even temporarily.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started off the week with a slide under the 1.1870 level mentioned last week. It hit a low of 1.1660, but this was just temporary.

Technical lines from top to bottom:

1.2565 capped the pair back in late 2014. It is followed by 1.2240, another line from that time and 1.2170, quite close by.

1.2040 was the low point in 2012 and close to the round number of 1.20. It is followed by 1.1876, the trough in 2010, also seen in early August 2017.

1.17 is a round number that served as a cushion for the pair during the month of August. It replaces the 2015 high of 1.1712. 1.1620 was a swing high in May 2016.

1.1580 was a stepping stone for the pair on the way up in July 2017. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. 1.1390 is the post-breakout low and works as support.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

I am bullish on EUR/USD

The euro has the backing of a strong economy, making the rise of the euro justified. Will Draghi try to fight it? Can he do that? The speeches at Jackson Hole will likely stress the advantage Europe currently has over the US and could boost the pair.

Follow us on Sticher or iTunes

Safe trading!