EUR/USD had an excellent week, breaking to much higher ground. The upcoming week features a mix of PMIs, GDP, and inflation figures. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

ECB President Mario Draghi did his best to sound balanced and even dovish, but markets didn’t buy it. He did say that they will discuss the next steps in the Autumn, and that was enough for markets to see tapering. The final inflation figures confirmed the original ones. In the US, the failure to pass a health bill triggered a fresh wave of dollar selling. The revelation that Special Counsel Mueller is expanding his investigation into Trump’s business dealings exacerbated the sell-off.

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Flash PMIs: Monday morning: 7:00 for France, 7:30 for Germany and 8:00 for the euro-zone. In June, French manufacturing PMI stood at 54.8 according to the final figure. Any score above 50 reflects expansion. A score of 54.6 is on the cards now. The services sector had a better score of 56.9 points and a slide to 56.6 is predicted. In Germany, manufacturing reached very high levels, at 59.6. It is forecast to slip to 59.1. Services lagged behind with 54 points and a tick up to 54.4 is estimated. For the whole euro-zone, a score of 57.4 was reported for manufacturing and 55.4 for services. Scores of 57.3 and 55.5 points are expected for manufacturing and services respectively.

- German Bundesbank Report: Monday, 10:00. The German central bank, also known as the Bundesbank or Buba, publishes a monthly assessment of the economy. Growth has been satisfactory in Germany and unemployment is low. Optimism from the team led by Jens Weidmann could imply an upbeat growth rate.

- German Import Prices: Tuesday, 6:00. Prices of imported goods, such as energy in Germany’s case, eventually reach consumer prices, but tend to be quite volatile. A drop of 1% was seen in May. A slide of 0.6% is projected.

- German Ifo Business Climate: Tuesday, 8:00. Germany’s No. 1 Think Tank has been reporting improvements in business confidence. In June, the score reached 115.1 points. A minor slide to 114.9 is predicted.

- Belgian NBB Business Climate: Tuesday, 13:00. This wide survey got very close to 0 from the bottom but failed to top it last month. The score disappointed with -2 points for June, reflecting a deteriorating situation. A very similar score of 1.9 is on the cards.

- Spanish Unemployment Rate: Thursday, 7:00. The fourth-largest economy in the euro-zone still suffers from a high level of unemployment, despite the recovery. It bounced back up to 18.8% in Q1, and an improvement is likely for Q2 2017. A slide to 17.9% is on the cards.

- German GfK Consumer Climate: Thursday, 7:00. Similar to business confidence, also consumer confidence is on the rise, reaching 10.6 points in June. Will it continue rising? While the German exports machine continues humming along, consumers are not spending very heavily. A repeat of the 10.6 score is projected.

- Monetary data: Thursday, 8:00. M3 Money Supply, or the money in circulation, has been at a robust 5% in May. Private loans accelerated to a level of 2.6% and could now continue rising. More money and loans mean more economic activity and a potential for higher inflation. Money Supply is expected to rise by 5% y/y again while the levels of loans are expected to accelerate to 2.7%.

- French GDP: Friday, 5:30. The second-largest economy in the euro-zone enjoyed a solid growth rate of 0.5% according to the final read for Q1 2017. We now get the first estimate for Q2 2017. The same growth rate of 0.5% is on the cards.

- French CPI: Friday, 6:45. In June, month over month prices remained flat in France, as widely expected. The figure feeds into the all-European measure. Note that France releases its consumer spending measure at the same time, but inflation has a more significant impact. This time, a slide of 0.4% m/m is on the cards.

- Spanish CPI: Friday, 7:00. Spain saw inflation rising from the deep deflationary levels to 3% but it fell quickly back to 1.5% y/y in June. We now get the preliminary rate for July. A repeat of 1.5% is expected.

- Spanish GDP: Friday, 7:00. Among the continent’s large economies, Spain enjoys persistently high growth. Quarterly growth of no less than 0.8% was seen in Q1 and an even better figure could be seen for Q2: 0.9%.

- German CPI: Friday, the states release the numbers throughout the morning and the all-German figure is published at 12:00. Consumer prices rose by 0.2% m/m in Germany in June, beating expectations and eventually pushing the all-European inflation higher. Another monthly rise of 0.2% is expected.

* All times are GMT

EUR/USD Technical Analysis

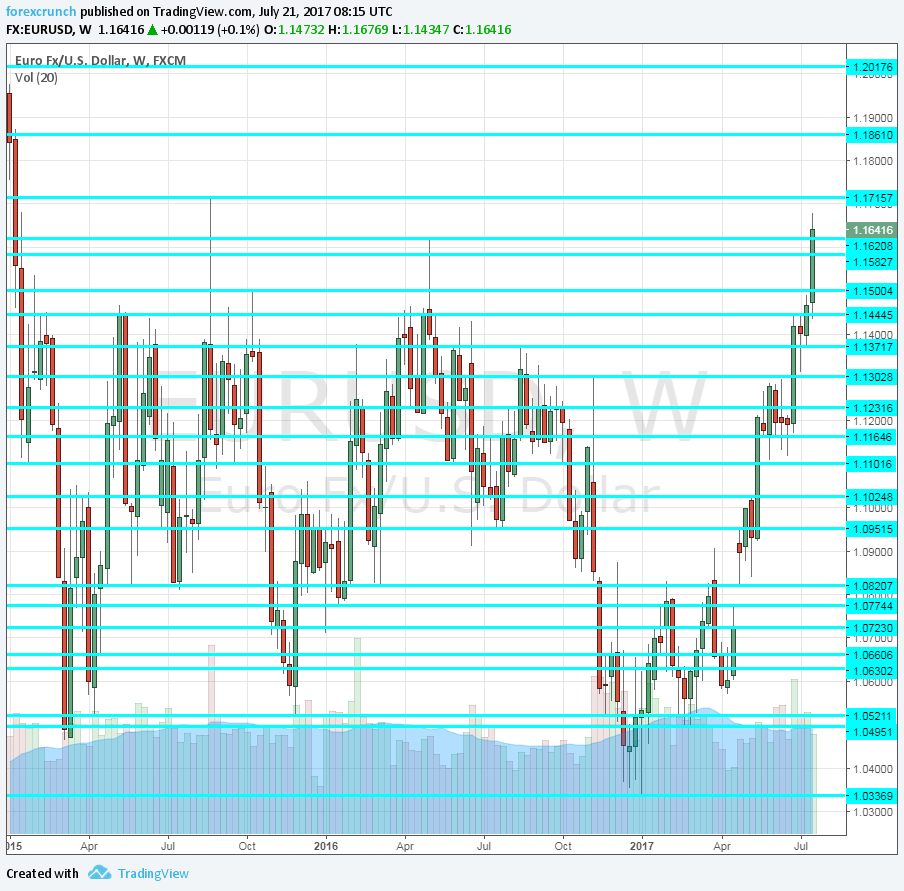

Euro/dollar was initially capped at the 1.1445 level (mentioned last week). This did not last too long before a decisive rise sent it much higher.

Technical lines from top to bottom:

We start from higher ground this time. 1.2040 was the low point in 2012 and close to the round number of 1.20. It is followed by 1.1876, the trough in 2010.

1.1712 was the swing high in August 2015, the highest point after the ECB announced QE. 1.1620 was a swing high in May 2016.

1.1580 was a stepping stone for the pair on the way up in July 2017. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. 1.1390 is the post-breakout low and works as support.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

1.1160 was a low point in May, where the pair retreated to after hitting new highs. The round number of 1.11 was a swing low in late May.

I turn from bullish to neutral on EUR/USD

The pair had a good run, and for good reasons: the euro-zone leads in growth and in politics. The monetary advantage that the US has is eroding. However, the pair had a strong run. Apart from the natural correction, the ECB could try to dampen the euro’s rise.

Our latest podcast is titled Draghi Dud and the Petrol Pendulum

Follow us on Sticher or iTunes

Safe trading!