EUR/USD made an attempt to move higher but never went too far. The highlight of the upcoming week is the ECB decision. Will Draghi upgrade the assessment? Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

ECB President Mario Draghi kept things balanced when expressed optimism about growth but worries about inflation. Inflation indeed fell back, with core CPI retreating from the highest levels since 2013 at 1.2% to 0.9%. That was primed by reports from Germany, France, and Spain. Subsequent reports about the ECB were already more upbeat: the sources said that Draghi and his colleagues will likely upgrade their assessment of risk. In the US, the Fed is likely heading to a June hike, but it could be a dovish one.

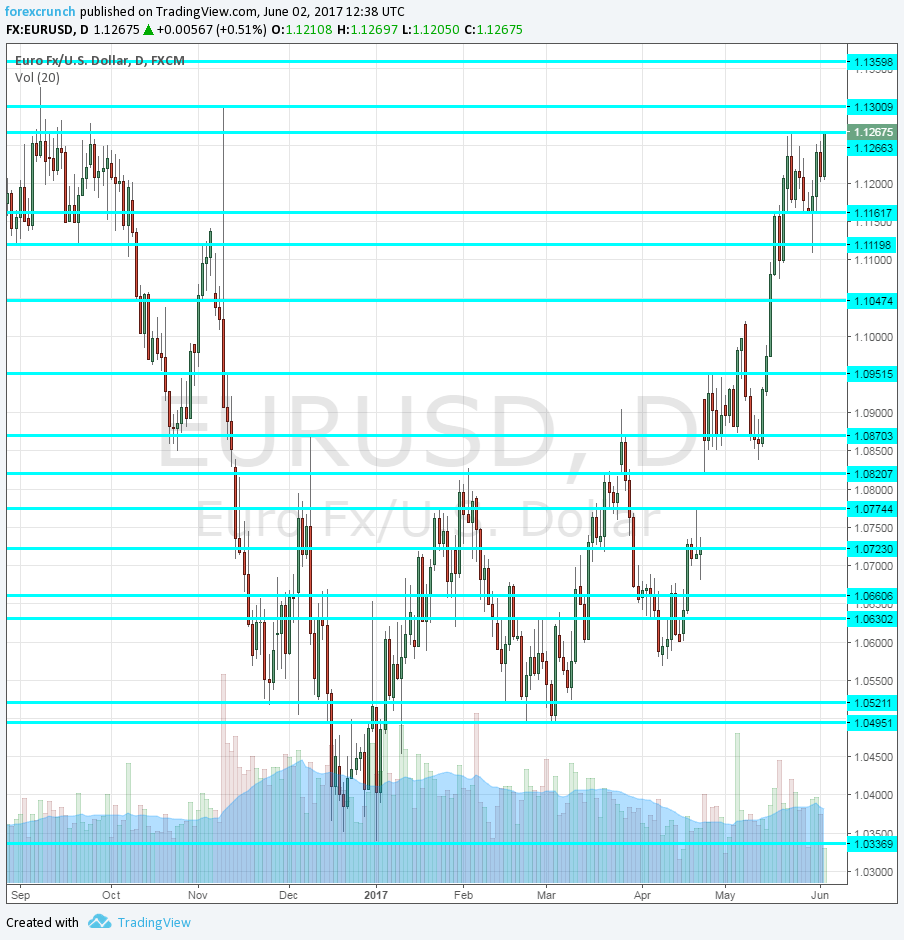

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Services PMIs: Tuesday: 7:!5 for Spain, 7:45 for Italy, final French figure at 7:50, final German release at 7:55 and the final euro-zone number is published at 8:00. In April, Spain’s services sector enjoyed robust growth according to Markit, with a score of 57.8 and 57.5 is on the cards now. Italy, the third-largest economy, had 56.2 points and 55.4 is predicted for May. According to the flash estimate for France, the score was a robust 58 points. Germany had it lower with 55.2 and the whole euro-zone saw 57 points. The last three numbers will probably be confirmed now.

- Retail PMI: Tuesday, 8:10. This often overlooked measure of the retail sector was flirting with the 50 point level, the threshold separating expansion and contraction. However, it recently advanced. The score for April was 52.7. Will we see another improvement?

- Sentix Investor Confidence: Tuesday, 8:30. This 2800-strong survey beat expectations in recent months and was on the march to the upside. After hitting a score of 27.4 in May, the figure for June could be a bit higher: 27.6 points.

- Retail Sales: Tuesday, 9:00. Despite being released after the parallel readings from the major countries, the indicator is still eyed. The volume of sales advanced by 0.3% in March. We now get the April data which is projected to show a rise of 0.2%.

- German Factory Orders: Wednesday, 6:00. Germany is considered the “locomotive” of the euro-zone thanks to its industry. Factory orders rose by 1% in June. Volatility is not uncommon in this measure.A drop of 0.2% is forecast.

- GDP: Wednesday, 9:00. According to the previous estimates, the euro-zone economy grew by 0.5% in Q1 2017. Since that read, we had an upgrade of GDP from France. Will the euro-zone GDP be upgraded as well? A confirmation of 0.5% is expected.

- German Industrial Production: Thursday, 6:00. Contrary to factory orders, this measure of the German industry was negative in March, with a drop of 0.4%. A bounce could be seen for April, worth 0.6%.

- French Trade Balance: Thursday, 6:45. France’s trade deficit had already narrowed last year, but it had widened once again, reaching 5.4 billion in March. A deficit of 5.9 billion is estimated.

- ECB rate decision: Thursday, the decision is at 11:45, Draghi’s press conference at 12:30. Will the ECB stop seeing risks as tilted to the downside? Will they hint at the beginning of the end of QE? After reducing the amount of monthly buys of bonds from 80 to 60 billion euros, the ECB is still on course to continue with the money-printing scheme through 2017. The big question is what’s next. Given the recent improvement in the economy and expectations for higher inflation, the ECB might provide an upgraded outlook, setting the scene for an announcement about tapering QE in September. Note that this is an important ECB meeting, where they also release new forecasts for growth and inflation. In many past events, Draghi dragged down the euro. Will it be different this time? According to some reports, the ECB is set to ignore the most recent drop in inflation and upgrade its assessment.

- German CPI (final): Friday, 6:00. The initial estimate for Germany’s inflation showed a drop of 0.2% in May, lower than expected. The figure will likely be confirmed.

- German Trade Balance: Friday, 6:00. Contrary to France, Germany enjoys a wide trade surplus that shapes the euro zone’s surplus. This surplus reached 19.6 billion euros in March. 20.3 billion is expected now.

- French Industrial Production: Friday, 6:45. The second-largest economy in the euro-zone saw its industry ramp up production in March with a jump of 2%. A drop could be seen now. An increase of 0.3% is on the cards.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar initially dipped, finding support at 1.1120 (mentioned last week). However, it recovered and recaptured the 1.12 handle.

Technical lines from top to bottom:

1.1420 was a high back in the summer of 2016. 1.1360 capped the pair in September.

1.13 is the top line seen in November before the collapse. 1.1266 is a peak seen in the month of May.

1.1160 was a low point in May, where the pair retreated to after hitting new highs. 1.1120 was a support line beforehand.

The round number of 1.10 is a key psychological level. 1.0950 is close by, and the most recent 2017 high.

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0820 was the post-French elections low.

1.0775 capped the pair in January and remains of importance. 1.0720 was also high in January.

The pair was unable to crack 1.0660 in February and it remains the high end of the range.

I remain bullish on EUR/USD

Even if Draghi makes an attempt to keep the euro in check, the trend remains to the upside. And he will probably refrain from giving a fight, as the economy has genuinely improved. Will he unleash new highs?

Our latest podcast is titled US labor market and UK’s Labour comeback

Follow us on Sticher or iTunes

Safe trading!