EUR/USD was looking for a new direction and certainly found it: an upside shot on the back of a weak US dollar. Will we see more range trading? Draghi will have another opportunity to move the euro in the upcoming week. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Mario Draghi made his best efforts not to rock the boat with minimal changes to forecasts (as inflation remained as expected) and a general “wait and see” mode as the last measures announced in March are awaiting implementation now. The lack of enthusiasm was reflected in EUR/USD. And then came the Non-Farm Payrolls: a disastrous gain of only 38K jobs hit the dollar very hard and erased several weeks of slides for the pair.

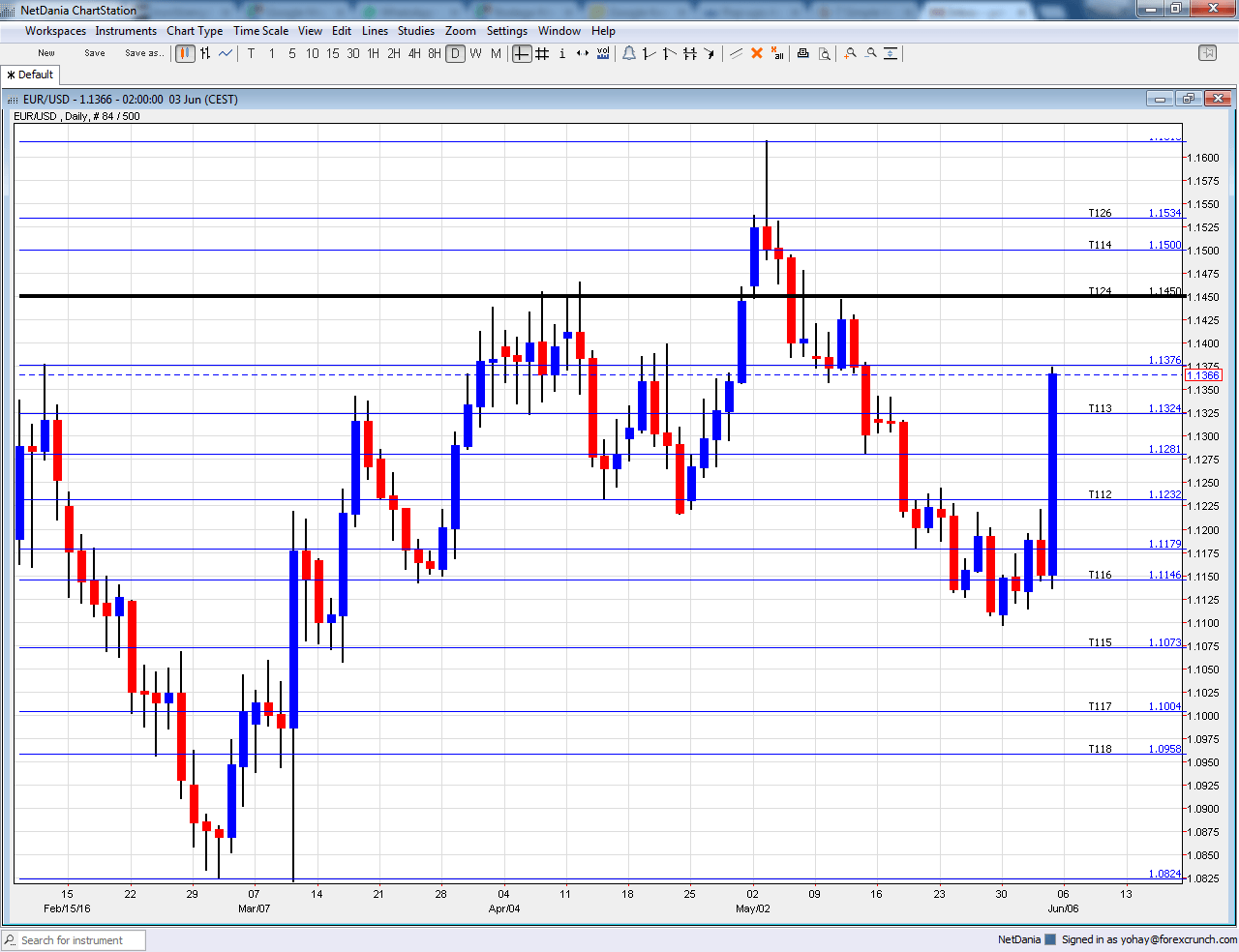

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Factory Orders: Monday, 6:00. Europe’s economic powerhouse has enjoyed a strong rise of 1.9% in factory orders back in March. This is a volatile indicator, yet quite influential. A drop of 0.4% is on the cards now.

- Retail PMI: Monday, 8:10. The purchasing managers’ indicator for the retail sector showed contraction at 47.9 points, which is somewhat worrying. It has flirted with the 50 point level separating growth and contraction for quite some time.

- Sentix Investor Confidence: Monday, 8:30. This survey of around 2800 analysts and investors enjoyed a second consecutive month of rises, standing at 6.2 points in May. This is still much lower than the levels seen in 2015. A rise to 7.1 is expected now.

- German Industrial Production: Tuesday, 6:00. Industrial output dropped for a second month in a row in March, contrary to factory orders. After the slide of 1.3%, will we see a bounce? A rise of 0.8% is expected.

- French Trade Balance: Tuesday, 6:45. Contrary to Germany’s high trade surplus, France suffers a deficit. A negative 4.4 billion was recorded last time, and a similar figure is on the cards now: -4.2 billion.

- GDP: Tuesday, 9:00. This is a revised GDP read for Q1 2016. The initial assessment showed a robust growth rate of 0.5% and a confirmation is likely now. Note that the second quarter is expected to be much weaker.

- French Non-Farm Payrolls: Thursday, 5:30. The initial NFP read from France showed a gain of 0.2% in the number of payrolls. The number will likely be confirmed.

- German Trade Balance: Thursday, 6:00. Germany’s trade surplus got even wider in March with 23.6 billion, but this was driven by lower imports. A wide surplus is on the cards now as well but it is expected to be narrower with 21.4 billion.

- Mario Draghi talks: Thursday, 7:00. The president of the ECB has another opportunity to move the euro. Speaking at the Brussels Economic Forum, Draghi could repeat his call for governments to do more, and perhaps show his determination to act if necessary.

- German inflation data: Friday, 6:00. The final read of inflation is expected to confirm a rise of 0.3% in prices in May, but revisions sometimes happen. The Wholesale Price Index is expected to rise 0.2% after 0.3% beforehand.

- French Industrial Output: Friday, 6:45. The second largest economy in the continent suffered a drop of 0.3% in its output back in March, the second straight drop. A bounce with +0.5% is predicted now.

- Jens Weidmann talks: Friday, 7:00. Probably Draghi’s strongest opposition comes from the powerful and hawkish German central bank. The president of the Bundesbank will speak in his home turf.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar had a relatively balanced week, trading mostly at the 1.11 handle, similar to last week. But then, on Friday, it shot higher, hitting a high of 1.1373 before settling a bit lower.

Technical lines from top to bottom:

1.1712 was the high point in August 2015 and remains high in the sky. The May 2016 high of 1.616 is certainly worth watching.

1.1535 is a stepping stone as seen in May 2016 and also beforehand. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1375 worked as resistance in February and as support in May 2016.

1.1335 worked as the lower bound of a higher range and then capped recovery attempts in May. 1.1230 capped the pair after the fall in May and works as resistance.

1.1175 was the low point in the mid-May fall. 1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which worked in the past as resistance, provided a cushion for the pair in February. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

I am neutral on EUR/USD

The extremely poor jobs report in the US was certainly a shocker. When the dust sets, the USD could re-emerge as the cleanest shirt in the dirty pile as the situation in Europe doesn’t look too good and a US July hike cannot be discarded, at least not now. However, at the moment we might see the pair get comfortable on much higher ground.

Our latest podcast is titled Payroll Problem and Rate Readiness