EUR/USD was on the back foot once again, but never went too far. The ECB stands out in a very busy week. Will the pair accelerate its falls or recover? Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The Eurogroup meetings ended with a providing Greece with the latest bailout tranche but also with a deferral of the debt debate – another can kicking exercise. German surveys showed contradicting data, with ZEW pointing down and IFO pointing up. Initial PMIs were mixed. In the US, things were also complicated with good housing data against mediocre durable goods orders and a minor upgrade to GDP. Fed Chair Yellen kept the door open to rate hikes and this kept the dollar bid. The beginning of a new month looks very promising.

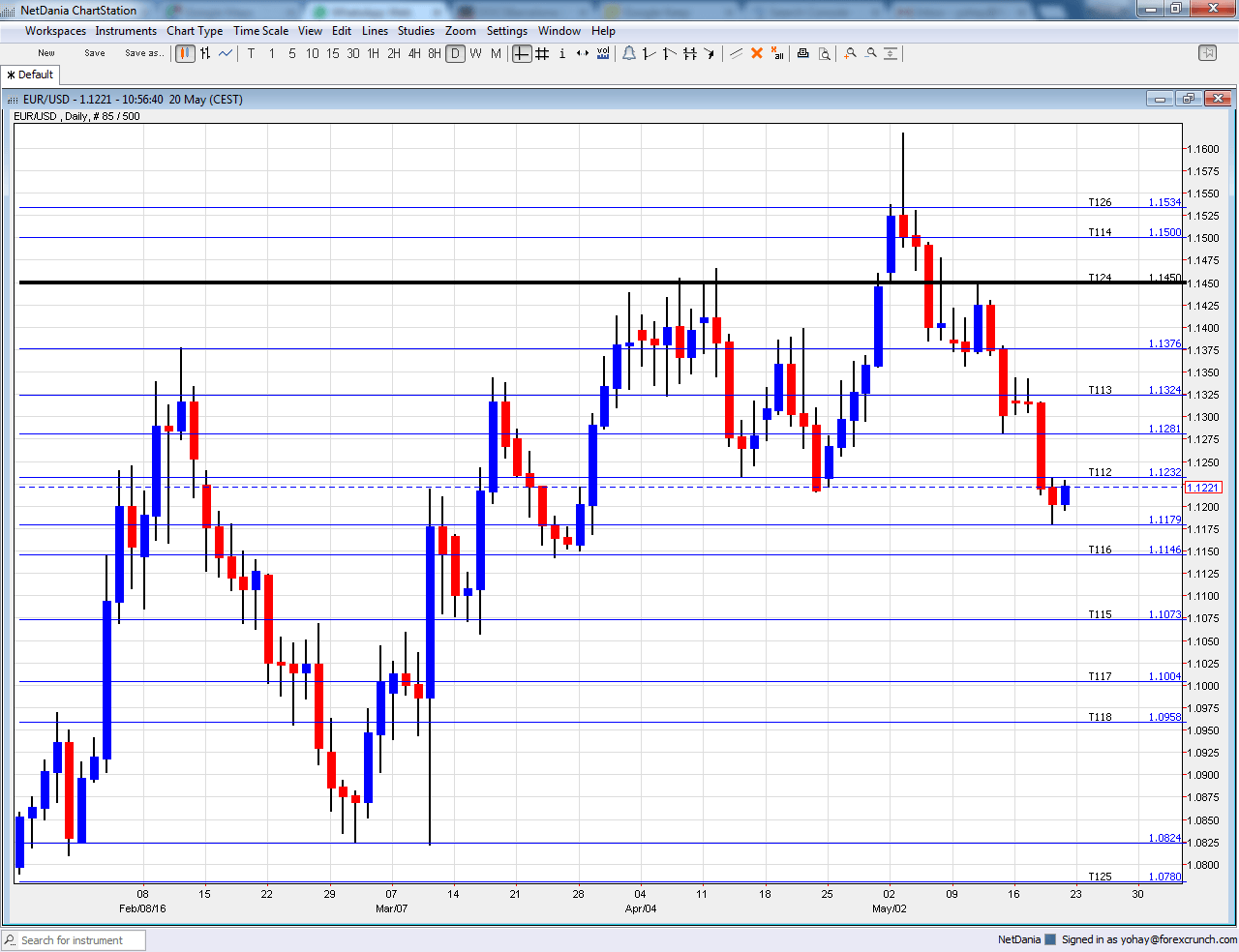

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German Import Prices:Monday, 6:00. Prices of imported goods feed into final inflation figures. After many long months of falls, prices turned to the upside, with a rise of 0.7% last time. Another advance of 0.4% is on the cards.

- German CPI: Monday morning: the various German states release their numbers during the day with the all-German number at 12:00. A worse than expected drop of 0.4% m/m was seen in April. The preliminary number for May is expected to show a rise of 0.3%. Year over year, things remain dire.

- French Consumer Spending: Monday, 6:45. The continent’s second largest economy saw its consumers increase their volume of spending by 0.2% last time. Another rise, this time of 0.1% is on the cards.

- Spanish CPI: Monday, 7:00. The fourth largest economy is suffering from both high unemployment and also deep deflation. After a drop of 1.1% in prices y/y, a slight improvement to -1% is predicted now.

- German Retail Sales: Tuesday, 6:00. Sales in the continent’s largest economy dropped by 1.1% in March and a rebound is estimated for April: a rise of 1.1%.

- French CPI: Tuesday, 6:45. Prices in France have risen by 0.1% m/m in April and the preliminary number for May, as with other countries, carries expectations for a bigger bump: 0.3%.

- German Unemployment Change: Tuesday, 7:55. Germany continues enjoying a drop in unemployment. The number of those out of a job fell by 16K last time, and a more modest drop of 4K is on the cards now.

- Monetary Data: Tuesday, 8:00. The ECB’s loose monetary policy contributed to increasing the amount of money in circulation, the M3 Money Supply, and the rate is 5% year over year. The same level is expected. Low interest rates encouraged banks to lend out money, and from an annual fall things turned positive: a rise of 1.6% last time and 1.5% is expected now. Despite the positive figure, the low level of loan growth is worrying.

- CPI: Tuesday, 9:00. The figures for April were quite disappointing, with a fall of 0.2% y/y in headline CPI and a rise of only 0.8% in core CPI despite the ECB’s best efforts. A small improvement is predicted now: -0.1% in CPI and +0.8% in core CPI. These preliminary numbers for May feed into the ECB decision.

- Unemployment Rate: Tuesday, 9:00. The unemployment rate in the euro-zone is falling, and this is good news, albeit the still high level. No change is expected from 10.2% reported last time.

- Manufacturing PMIs: Wednesday: 7:15 for Spain, 7:45 for Italy, final French number at 7:50, final German number at 7:55 and final all-European number for May at 8:00. Spain saw modest growth in April in its manufacturing sector according to Markit: 53.5, above the 50 point threshold separating growth and contraction. A slide to 52.6 is expected now. Italy, the third largest economy, will likely see a slide from 53.9 to 53.5 points. According to the preliminary release, the French manufacturing sector has been on the slide in May, with only 48.3 points. A confirmation is expected now. Germany saw 52.4 and an upwards revision to 52.5 is predicted. The all-European number carries expectations for a confirmation of the 51.5 points in the initial read.

- Spanish Unemployment Change: Thursday, 7:00. Spain is still suffering from a very high unemployment rate but as we near the summer, tourism helps reduce the number of unemployed. After a drop of 83.6K in April, a bigger fall of 110K is predicted now.

- PPI: Thursday, 9:00. On the morning of the ECB decision, we’ll get yet another inflation read. Producer prices advanced by 0.3% and are now expected to rise by 0.1%.

- ECB Decision: Decision at 11:45 and President Mario Draghi’s press conference is at 12:30. In the last meeting in April, the ECB left its policy unchanged: the main lending rate at 0%, the deposit rate at -0.4% and the QE program at 80 billion. Part of the measures announced back in March will be implemented in June: buying corporate bonds and the new lending programs: the TLTROs. So, no change is expected now. Draghi and other officials are worried about weak inflation but the message is that they have done a lot. While leaving the door open to perhaps do more in the future, they have raised the rhetoric regarding the need for governments to contribute as well. This time, the ECB releases new forecasts for growth and inflation. Lower forecasts could imply further action. Draghi would like a lower exchange rate for the euro, but he will probably not do anything soon. Another topic is helicopter money, something that was rejected by Draghi last time. Implying that this radical idea was discussed could weigh on the euro.

- Manufacturing PMIs: Friday: 7:15 for Spain, 7:45 for Italy, final French number at 7:50, final German number at 7:55 and final all-European number for May at 8:00. According to Markit, Spain’s services sector was doing well, with 55.1 points in April. A rise to 55.6 is on the cards for May. Italy is also expecting a move up, from 52.1 to 52.3 points. The preliminary release for France for May showed 51.8 points, for Germany it was 55.2 and for the whole euro-zone it stood on 53.1 points. All numbers are awaiting confirmation. In general, the services sector is doing better than manufacturing.

- Retail Sales: Friday, 9:00. Despite being released after German and French numbers, this all-European nubmer tends to surprise. After a drop of 0.5%, a rise of 0.4% is on the cards now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar held its head under 1.1335 (mentioned last week) before dropping to much lower ground under 1.12.

Technical lines from top to bottom:

1.1712 was the high point in August 2015 and remains high in the sky. The May 2016 high of 1.616 is certainly worth watching.

1.1535 is a stepping stone as seen in May 2016 and also beforehand. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1375 worked as resistance in February and as support in May 2016.

1.1335 worked as the lower bound of a higher range and then capped recovery attempts in May. 1.1230 capped the pair after the fall in May and works as resistance.

1.1175 was the low point in the mid-May fall. 1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which worked in the past as resistance, provided a cushion for the pair in February. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

I remain bearish on EUR/USD

Inflation figures are likely to imply looser monetary policy for longer, and Draghi could certainly hit the euro when it’s down. In the US, a June rate hike isn’t really likely, but one in July is certainly an option. The monetary policy divergence play could continue this week.

In our latest podcast we talk stocks, oil and preview the big week.