EUR/USD traded in a wider range and eventually closed towards the higher end of the range. Will it remain in the range or make a break? The big event of the week is undoubtedly the ECB decision, which also consists of new forecasts. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Inflation data in the euro-zone, which reached 2%, continued putting pressure on Draghi, especially from his German peers. Developments in the French elections helped the euro. In the US, Donald Trump’s priorities do not provide the necessary fuel for the dollar, but upbeat expectations for Fed action keep it bid. Hawkish comments from Dudley and then from Brainard, two known doves, sent the greenback soaring.

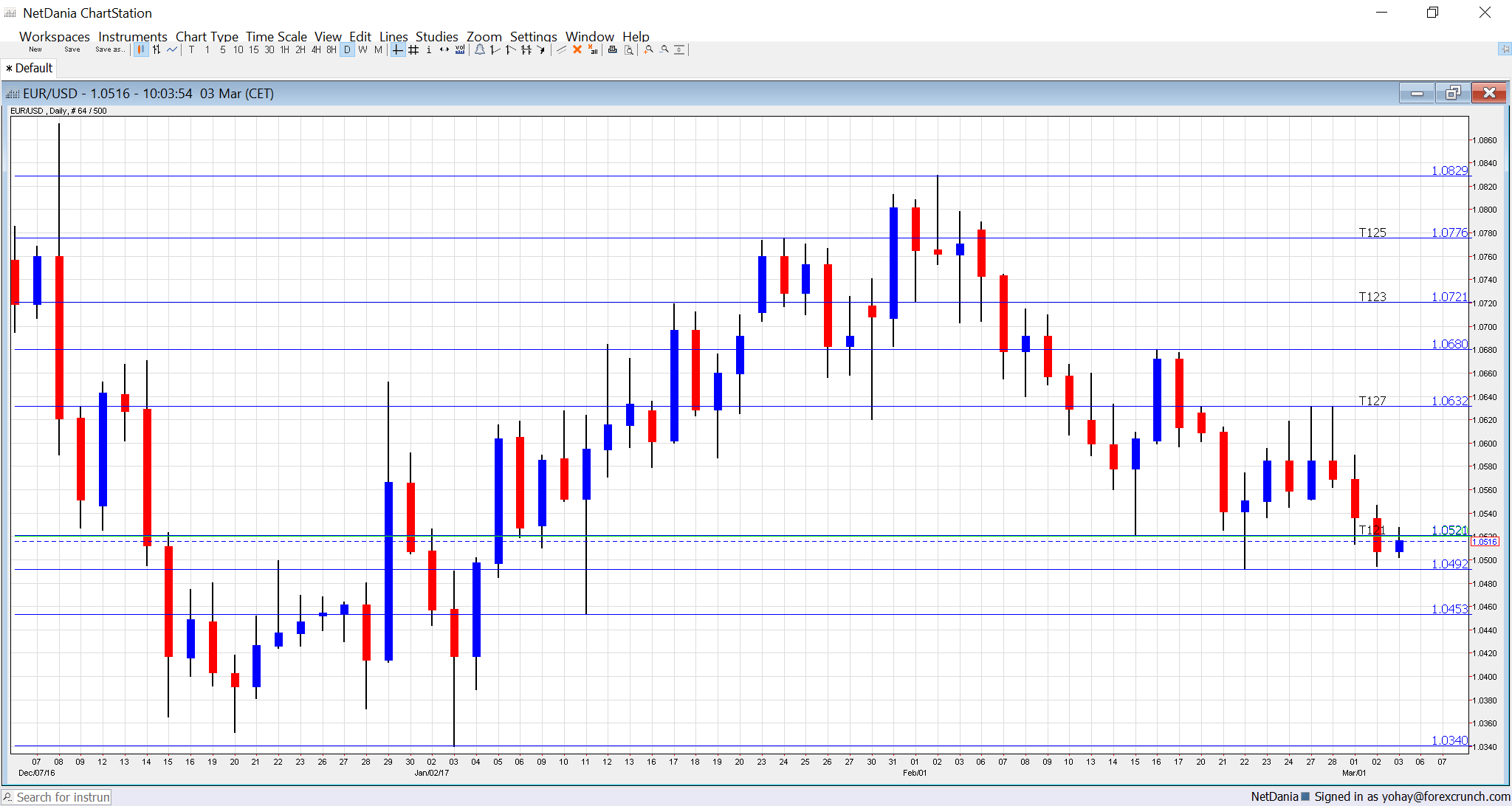

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Retail PMI: Monday, 9:10. Markit’s measure for the retail sector was almost perfectly balanced at 50.1 points, at growth territory, but only just. A similar score is likely this time.

- Sentix Investor Confidence: Monday, 9:30. The 2800-strong survey beat expectations in January by reaching 17.4 points, extending the advance. A score of 18.8 is on the cards now.

- German Factory Orders: Tuesday, 7:00. The volume of factory orders leaped by 5.2% in December, but this came after a fall of 3.6% beforehand. The volatile indicator is not likely to repeat the big bounce. I fact, a slide of 2.5% is predicted.

- GDP (revised): Tuesday, 10:00. Initial GDP reports were positive, putting the growth rate at 0.5%, but German output was not up to speed and the last release for Q4 2016 stood at 0.4%. This will likely be confirmed now.

- German Industrial Production: Wednesday, 7:00. Contrary to factory orders, this measure of the industry dropped by 3% in December. A bounce could be seen now.

- French Trade Balance: Wednesday, 7:45. France traditionally suffers from a trade deficit, contrary to Germany. A deficit of 3.4 billion euros was reported in December, and will likely print a similar figure now: -3.7 billion.

- Rate decision: Thursday: decision at 12:45, press conference at 13:30. The European Central Bank not only makes its decision (where no change is expected) but also releases new staff forecasts for growth and inflation. Since the beginning of the year, inflation has bounced quite sharply. This is due to energy prices and the diminishing base effect. Oil prices were at their trough in early 2016, and this is the reason for elevated yearly prices rises now. The ECB and especially President Mario Draghi had anticipated the rise, but the more hawkish members of the Governing Council want the ECB to tackle headline inflation, which is getting closer to the ECB’s target of 2% or a bit below. Draghi is likely to focus on Core CPI, which is not going anywhere fast. On the other hand, other measures such as growth, employment, and business confidence have been rising. The keys to the euro reaction depend on two factors: if forecasts are revised to the upside and Draghi’s tone regarding inflation. Back in December, inflation forecasts were hardly changed, implying further stimulus. Will they change their mind now? Draghi would prefer to keep the euro low and not to talk about tapering or ending QE. The ECB currently buys 80 billion euros per month, but the amount will be reduced to 60 billion from April and set to run until the end of the year. See the full ECB preview: acknowledging reality or playing it down?

- German Trade Balance: Friday, 7:00. Germany enjoys a high trade surplus that keeps the euro-zone’s balance of trade positive. A surplus of 18.4 billion was seen in December and a similar 19.2 billion is likely now.

- French Industrial Production: Friday, 7:45. French industrial output slipped by 0.9% back in December. A bounce is likely now: +0.6%.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar had a steady start to the week, trading below the 1.0660 level (mentioned last week). It then dropped reaching new lows under 1.05.

Technical lines from top to bottom:

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0830 is the 2017 high and follows closely.

1.0775 capped the pair in January and remains of importance. 1.0720 was also a high in January.

The pair was unable to crack 1.0660 in February and it remains the high end of the range. 1.0630 is the next level, holding back the pair in February and March.

1.0520 is a relic of the past but still serves as a cap. The more recent low of 1.0490 follows very closely.

Further below, we find the multi-year low of 1.0340. Only 1.0150 separates the pair from parity at this point.

I am bearish on EUR/USD

Draghi is likely to do his best to weigh on the euro. It seems that he got his magic back after a few failed attempts and he could certainly hit the common currency as core inflation remains subdued. In the US, while Trump could certainly disappoint once again, the hawkishness of the Federal Reserve is certainly dominant.

Our latest podcast is titled March hike, Macron, and Mario Draghi

Follow us on Sticher or iTunes

Safe trading!