EUR/USD had a relatively balanced week, dipping to the downside but never going too far. The upcoming week is packed with PMI data, inflation figures and more. Will the pair move decidedly to one direction or another? Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Euro-zone data was mostly positive, with flash PMIs all coming out above expectations. Also Germany’s IFO figures beat early estimations. Hope also came for markets from French political news, where centrist candidate Macron received a boost from a centrist rival. In the US, data was positive as well, and also the FOMC’s minutes were relatively upbeat. However, Trump’s administration does not seem to prioritize big economic changes.

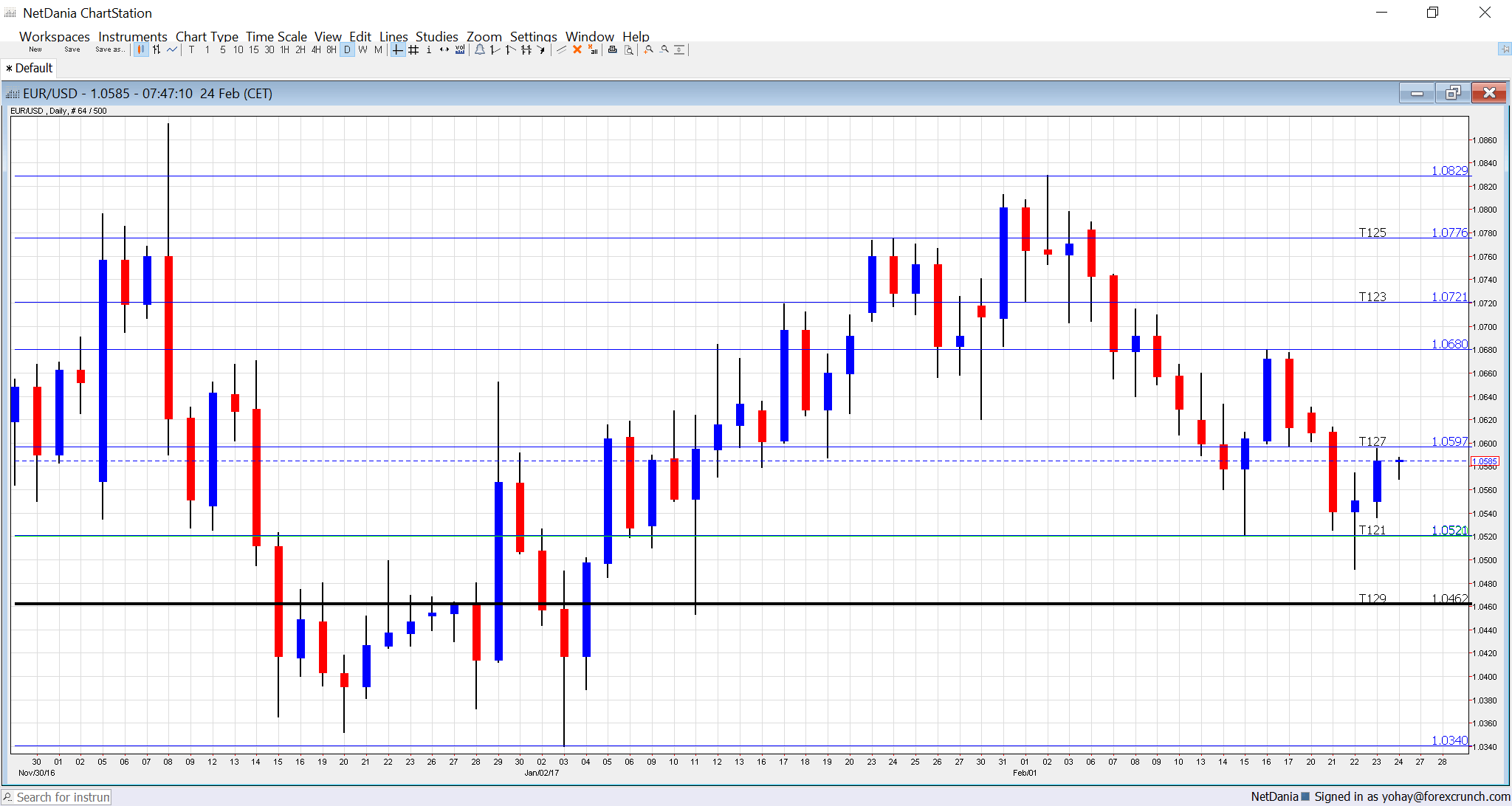

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Spanish Flash CPI: Monday, 8:00. The fourth-largest country in the euro-zone has seen its inflation rate leap in January, reaching 3%. This is a big change from the once deflation-struck country. We now get the initial estimate for February which is expected to stand at 3.3%.

- Monetary data: Monday, 9:00. The European Central Bank is probably satisfied to see the amount of money in circulation (M3 Money Supply) move up to 5% y/y and the growth of private loans tick up to 2% y/y. This is an indicator of economic growth. Similar numbers are expected: 4.9% and 2.1% for M3 Money Supply and Private Loans respectively.

- French CPI: Tuesday, 7:45. Prices in France dropped by 0.2% in January, beating expectations for a bigger monthly drop. We now receive the figures for February, that feed into the all-European CPI. A rise of 0.4% is on the cards.

- French GDP: Tuesday, 7:45. This is a revision for Q4 data. The initial read showed an accelerated growth level of 0.4%, in line with the European average. A confirmation is on the cards now. Note that in addition to the CPI and GDP releases, France also releases consumer spending at the same time and this is projected to rise by 0.6%.

- Manufacturing PMIs: Wednesday morning: 8:15 for Spain, 8:45 for Italy, the final French number at 8:50, final German figure at 8:55 and the final euro-zone score at 9:00. Markit’s purchasing managers’ indicator showed Spain at a solid growth rate in January, 55.6 points. A score of 55.9 is predicted now. Italy lagged behind with 53 points, albeit above the 50 point threshold that separates growth from contraction. 53.6 is estimated now. The initial read for February for France showed 52.3 points. Germany had a strong figure of 57, reflecting robust growth and the euro-zone had 55.5. The flash reads are forecast to being confirmed.

- German unemployment change: Wednesday, 8:55. The No. 1 economy in the euro-zone enjoys a strong jobs markets. The number of unemployed dropped by no less than 26K in December. Another improvement is on the cards for January: a drop of 10K.

- German CPI: Wednesday morning from the various states, with the all-German figure coming out at 13:00. Contrary to some of its peers, German inflation data fell short of expectations in January, with prices falling 0.6% m/m. A rebound with +0.6% is forecast now.

- Spanish Unemployment Change: Thursday, 8:00. Spain still suffers a very high unemployment rate, above 18%, but things are getting better. The unemployment change report provides a fresh view into quick changes, even though it is prone to seasonal changes. In January, the figure jumped by 57.3K. A rise of 5.2K is expected.

- CPI (flash): Thursday, 10:00. Headline inflation is rising in the euro-zone, putting German pressure on Draghi to begin scaling down the QE program. CPI reached 1.8% y/y in January, mostly due to rising oil prices in comparison to the previous year. However, core inflation is still stuck at 0.9%. A repeat of the exact same numbers is expected: 1.8% and 0.9%.

- Unemployment rate: Thursday, 10:00. Similar to Spain, the unemployment rate for the euro-zone is improving, but remains high, standing at 9.6% in December. This was better than expected. The unemployment rate is forecast to remain unchanged at 9.6%.

- PPI: Thursday, 10:00. Producer prices eventually feed into consumer prices, providing a look into the beginning of the price pipeline. PPI rose by 0.7% last time. A more moderate rise of 0.5% is on the cards.

- German Retail Sales: Friday, 7:00. Consumers came short of expectations in December as the volume of sales dropped by 0.9%. We now get the initial figures for January, the first read for 2017, and a small rise of 0.2% is expected.

- Services PMIs: Friday morning: 8:15 for Spain, 8:45 for Italy, the final French number at 8:50, final German figure at 8:55 and the final euro-zone score at 9:00. Markit showed that Spain’s services sector was advancing nicely, with a score of 54.2 in January. A rise to 55.1 is expected. Italy’s stood at 52.7 points and 53.1 is predicted. For February, the preliminary read for France was robust at 56.7, Germany’s at 54.4 and the euro-zone 55.6. These numbers will probably be confirmed.

- Retail Sales: Friday, 10:00. While the figure is released after the German and French ones, it still has an impact. A drop of 0.3% was previously recorded and a bounce could be seen now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week with a dip, halting initially at the 1.0520 level (mentioned last week) before dipping lower and bouncing back up.

Technical lines from top to bottom:

1.10 is the ultimate high level in current trading ranges. It is followed by 1.0950. More importantly, the swing high of 1.0870 is fierce resistance.

1.0775 is the high line seen in late January. 1.0720 was a temporary peak seen in January 2017.

1.0660 capped the pair during February 2017 and also in the past. The round level of 1.06 served as resistance in February as well.

Further below, the early 2016 low of 1.0520 and the 2015 low of 1.0460 are seen. 1.0460 seems to carry more weight.

Even lower, there are two significant barriers on the way to parity. The 1.0340 level was the low of 2003 before the pair advanced to higher ground.

The 101.50 level was a peak seen in 2002, on the first attempt of the pair to break above parity. And then, there is EUR/USD parity.

I turn from neutral to bullish on EUR/USD

Economic indicators are likely to continue supporting the euro. In addition, markets are currently focused on politics: in Europe, the French elections could lean towards Macron and in the US, the Trump train is derailing.

Our latest podcast is titled Fed refocus as monetary matters once again

Follow us on Sticher or iTunes

Safe trading!