EUR/USD made its way to much higher ground but turned down from the highs. The upcoming week features key German data including the GDP data as well as other events. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Euro-zone PMIs did not rock the boat too much with as expected figures. Also Draghi did not add much to monetary policy prospects but the ongoing clash with the German government seems problematic. In the US, figures were quite mixed but the dollar did manage to stage a comeback from the lows, with EUR/USD trading in clear technical levels and falling a lot from the highs.

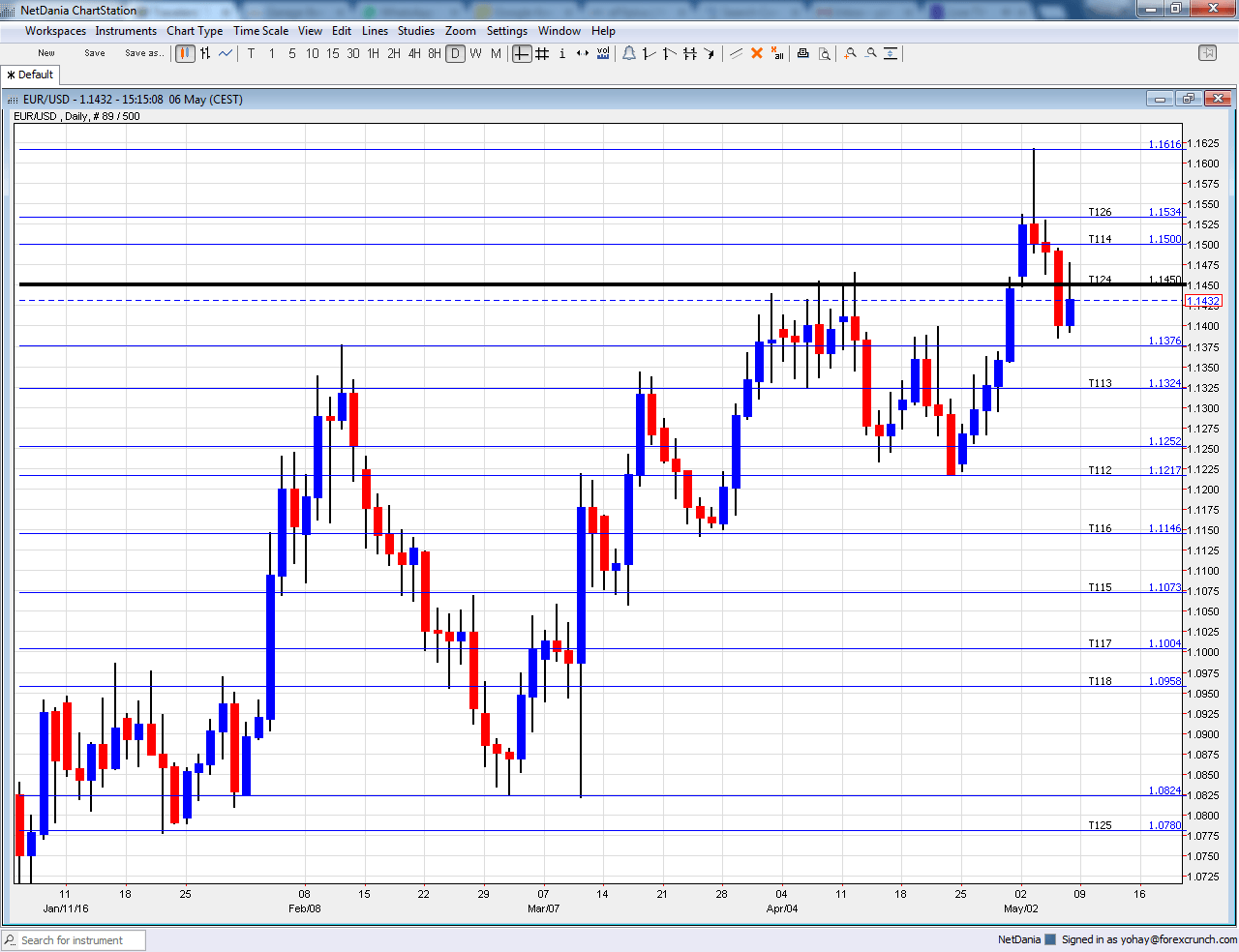

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Eurogroup meetings: Monday. The finance ministers of the euro-zone convene as the deadlock around the Greek bailout continues. The IMF wants debt relief and more austerity while the EU refuses any relief for the debt-stricken country. The story remains on the back-burner but is gradually moving to the forefront. Watch this space.

- German Factory Orders: Monday, 6:00. Orders from factories dropped 1.2% in February, below expectations. While it seems worrying, this indicator is quite volatile. A rise of 0.7% is on the cards.

- Sentix Investor Confidence: Monday, 8:30. This 2800 strong survey disappointed by staying on low ground at 5.7 points, also reflecting the dearth of investment. A small rise to 6.1 points is on the cards.

- German Industrial Production: Tuesday, Industrial output at the continent’s powerhouse fell by 0.5% in February, but this was actually a small beat. For those trading the euro as the heir to the Deutschemark, this is a key release. A drop of 0.2% is on the cards.

- German Trade Balance: Tuesday, 6:00. Germany’s surplus is behind the wider euro-zone trade surplus, thanks to the exports coming out of the country. A surplus of 19.8 billion was recorded in February. A similar figure is on the cards. A surplus of 20.4 billion is expected.

- French Industrial Production: Tuesday, 6:45. A drop of 1% was seen in February, erasing a previous rise of the same scale. Will the see-saw continue? A gain of 0.6% is expected.

- French Final CPI: Thursday, 6:45. The initial estimate for April showed a rise of 0.1% m/m in prices. This will likely be confirmed now.

- Industrial Production: Thursday, 9:00. While published after the German and French figures, the publication has an impact. After a drop of 0.8% in February, we could see a rise this time: +0.1% is predicted.

- German GDP: Friday, 6:00. This time, the German figure is published separately from some of the other publications. An advance of 0.3% was seen in Q4 2015 and we could see a stronger one now.: +0.6%, in line with the preliminary euro-zone release.

- German final CPI: Friday, 6:00. A drop of 0.2% was published in the initial report, which carried some confusion. This is expected to be confirmed now, but a surprise cannot be ruled out after that initial confusion.

- French Non-Farm Payrolls:Friday, 6:45. This quarterly report by the second largest economy showed a much needed rise of 0.2% in the fourth quarter of 2015. The same figure is on the cards now.

- Italian GDP: Friday, 8:00. The third largest economy saw its GDP growing by 0.1% in Q4 2015. This feeds into the euro-zone read. +0.2% is estimated.

- GDP: Friday, 9:00. An early GDP figure was already published in the previous week, and this showed a strong rise of 0.6%. This may be modified now, depending mostly on the German figure but the expectations stand at 0.6%.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar made its way up but was once again unable to break above the 1.1460 level (mentioned last week) and eventually closed lower.

Technical lines from top to bottom:

1.1712 was the high point in August 2015 and remains high in the sky. The May 2016 high of 1.616 is certainly worth watching.

1.1535 is a stepping stone as seen in May 2016 and also beforehand. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1375 worked as resistance in February and as support in May 2016.

1.1325 served as support in late March and early April. It is followed by the swing low of 1.1220 in September which is minor resistance now.

1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which worked in the past as resistance, provided a cushion for the pair in February. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

I am bearish on EUR/USD

Even if the ECB is not about to add new stimulus and the Fed is not predicted to raise rates in June, the euro lost its safe haven status and may have completed its big recovery. The tables have turned in favor of the greenback as well, as we’ve seen in Turnaround Tuesday.

In our latest podcast we examine: Markets vs. Trump vs. Clinton