EUR/USD had an excellent week, riding on USD weakness to rally but was contained by tough resistance. Will it bounce or break? . Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

GDP growth beat expectations with 0.6% q/q in the euro-area. Also the unemployment rate is falling, with 10.2%. However, the ECB’s mandate is seeming less achievable in the short term at least. Inflation fell back to negative territory with -0.2%, below expectations. Also core inflation missed with +0.8%. Nevertheless, the dollar’s poor performance is what drove the pair higher: the Fed is not really into hiking rates soon and the greenback collapsed.

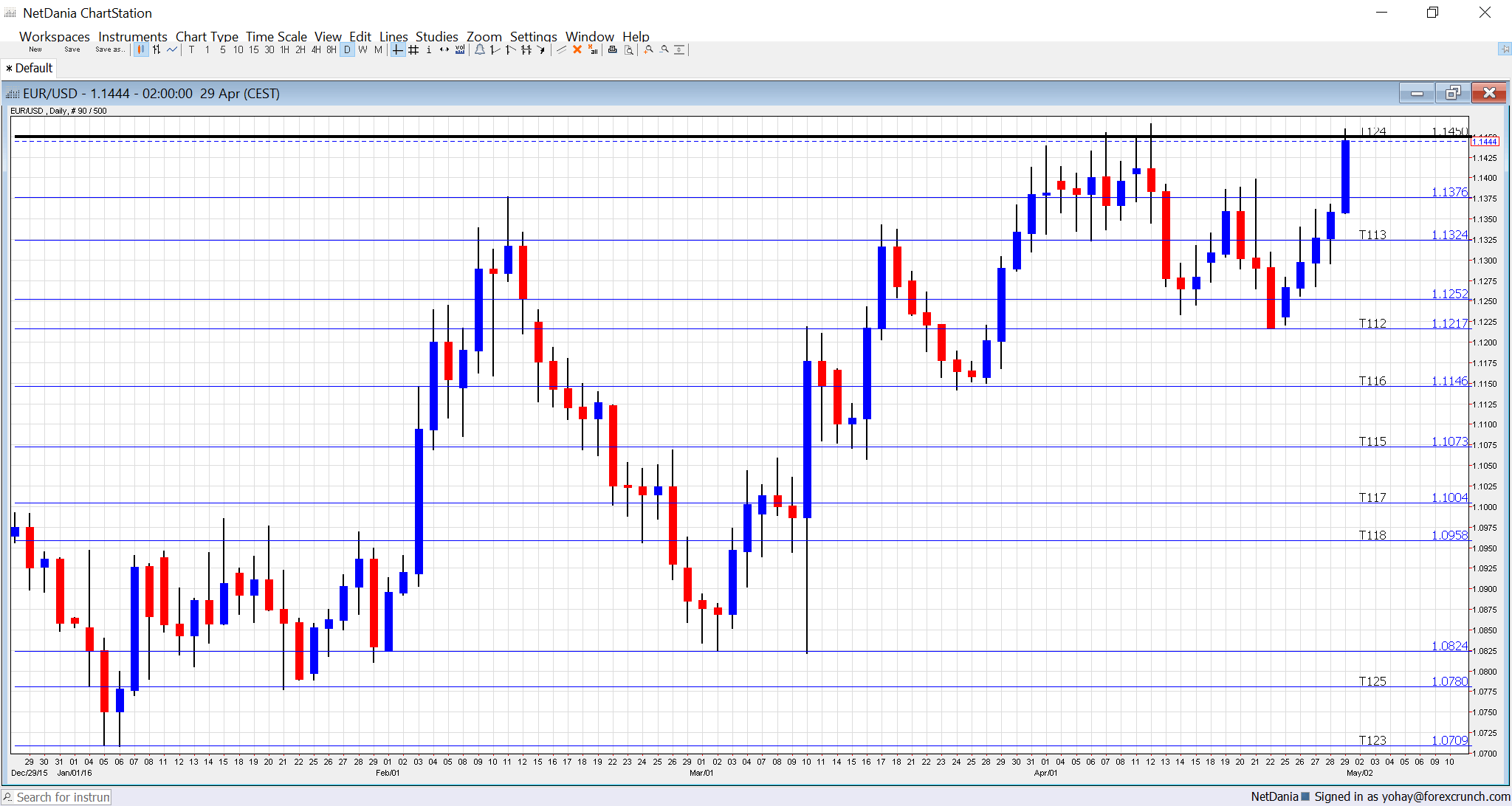

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday: Spain at 7:15, Italy at 7:45, final French figure at 7:50, final German at 7:55 and final euro-zone number at 8:00. According to Markit, Spain’s manufacturing sector continue enjoying growth in March with a score of 53.4 points, above the 50 point barrier separating growth from contraction. A score of 53 is on the cards now. Italy had 53.5 and 54.1 is now expected. The preliminary read for France in April was 48.3, in contraction territory. For Germany it 51.9 and the whole euro-zone had 51.5. The final data is expected to confirm the initial reads, but revisions are quite common.

- Jens Weidmann talks: Monday, 9:30. The president of the German central bank (the Bundesbank) is a critic of the ECB’s extremely loose policy but did go out to defend its actions. How does he see the situation now?

- Mario Draghi talks: Monday, 14:00 and Thursday, 10:15. The president of the ECB has come under fire for recent policy but markets want him to do even more. In his speech in Frankfurt, he has the chance of providing more information about the situation and if more monetary easing is needed. The recent rise of the exchange rate is certainly not favorable for his efforts to battle deflation.

- PPI: Tuesday, 9:00. Producer prices are also low and this eventually feeds into consumer prices. After a drop of 0.7%, a small bounce of 0.1% is on the cards, but we had many misses in this indicator.

- French Trade Balance: Wednesday, 6:45. Contrary to Germany, France has an ongoing trade deficit. A relatively wide one of 5.2 billion was seen last time and -4.2 billion is on the cards now.

- Spanish Unemployment Change: Wednesday, 7:00. This monthly gauge of the euro-area’s fourth largest economy is closely watched. The number of unemployed surprisingly dropped by 58.2K in March and another drop of 86.6K is on the cards now, as more tourists flood the country, raising the need for more jobs in this sector.

- Services PMIs: Wednesday. Spain at 7:15, Italy at 7:45, final French figure at 7:50, final German at 7:55 and final euro-zone number at 8:00. Spain’s services sector saw nice growth of 55.3 points in this sector in March. A small slide to 55.1 is expected. Italy had 51.2 and 51.3 is expected now in the euro-zone’s third largest economy. The preliminary read for France was 50.8, for Germany it stood on 54.6 and for the whole euro-zone on 53.2 points. The last 3 numbers are expected to be confirmed now.

- Retail sales: Wednesday, 9:00. The volume of sales advanced by 0.2% in March. A smaller rise of 0.1% is predicted. Note that the German and French numbers are already out.

- ECB Economic Bulletin: Thursday, 8:00. Two weeks after the ECB’s decision we get the data they had in front of their eyes for making their calls. This is somewhat overshadowed by the release of the meeting minutes that were introduced not that long ago.

- Retail PMI: Friday, 8:10. Markit’s survey of purchasing managers in the retail sector showed a slide back to contraction in March with 49.2 points. A similar number could be seen now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar made its way up but was once again unable to break above the 1.1460 level (mentioned last week) and eventually closed lower.

Technical lines from top to bottom:

1.1712 was the high point in August 2015 and remains high in the sky. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1410 is weak resistance on the way up after working as such in the Spring of 2016.

1.1335 separated ranges in April 2016 and now works as resistance. It is followed by the swing low of 1.1220 in September which is minor resistance now.

1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which worked in the past as resistance, provided a cushion for the pair in February. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

I am neutral on EUR/USD

While the ECB is clearly disappointed with the rise of the euro against the dollar and consequently against the Chinese yuan, there is little they can do

In our latest podcast we ask: is China out of the woods?