EUR/USD edged higher ahead of the second round of the French elections. Does it have more room to the upside? Apart from the elections, we have GDP and other events from the old continent. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The most recent polls look favorable for centrist Macron, with growing support above 60%. The widening gap helped the euro. Update: Macron elected president – exit polls show him at 65%. Economic data also provided a boost: GDP grew by 0.5% in Q1, showing accelerated growth. PMIs were OK, pointing to further growth and retail sales beat expectations with 0.3%. In the US, the Fed left rates unchanged and did not seem worried about the recent slowdown. The Fed helped the dollar, but not against the euro.

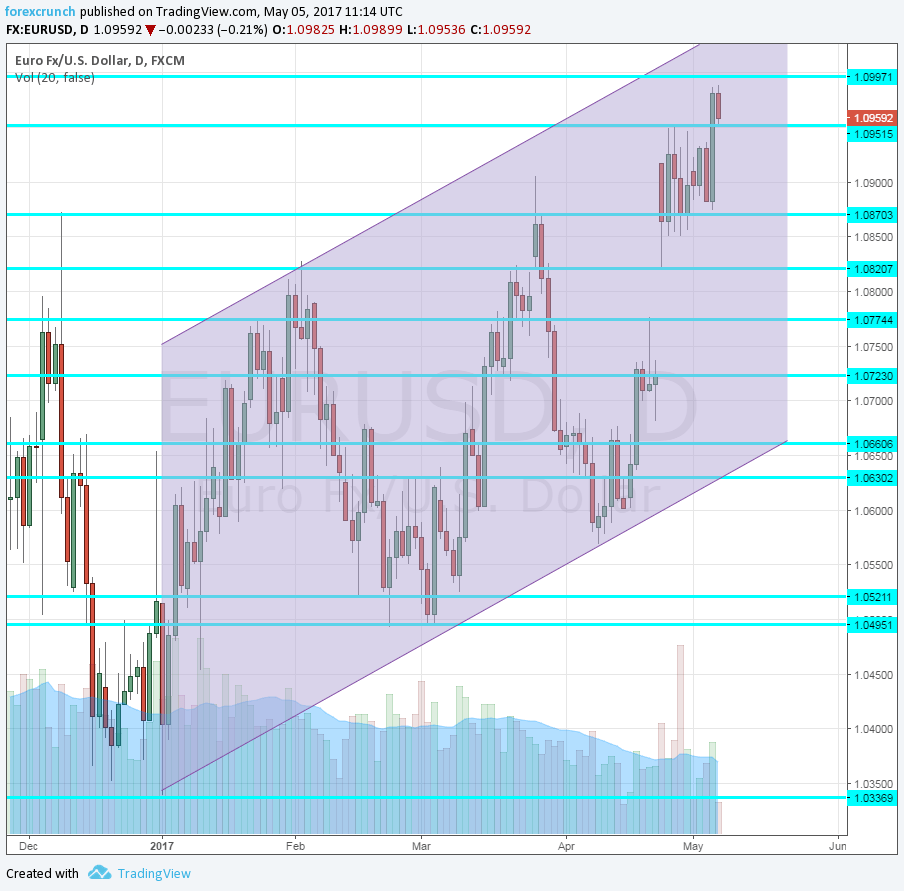

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- French elections round 2: Sunday, exit polls are at 18:00 GMT and real results will trickle around the market open. In the televised debate, Macron remained calm and Le Pen was quite unpresidential according to observers. The result in the opinion polls was favorable to the centrist, diminishing the talk of an erosion in his popularity. If the polls are as correct as they were in the first round, Macron is set for a landslide victory with 62%. This will encourage markets about the upcoming parliamentary elections, giving Macron a potential majority that will enable reforms. A victory with less than 60% could cause worry, but still prevent the biggest danger of a Le Pen presidency. If she shocks the world and emerges as a winner against all odds, the euro is set to collapse below parity with the dollar. Le Pen wants France to leave the euro-zone and there is no euro without France. Follow French elections – all the updates in one place.

- German Factory Orders: Monday, 6:00. Germany is the industrial “locomotive” of the continent. Factory orders advanced by 3.4% back in February.

- Sentix Investor Confidence: Monday, 8:30. This business survey has advanced nicely in recent months, reaching 23.9 in April, beating expectations for the fourth consecutive month.

- German Industrial Production: Tuesday, 6:00. Similar to factory orders, also industrial output has been upbeat in Germany in February, rising 2.2%.

- German Trade Balance: Tuesday, 6:00. Germany’s wide trade surplus keeps the euro bid. After two months below the 20 billion euro mark, the surplus widened again to 21 billion in February.

- French CPI (final): Tuesday, 6:45. According to the initial read for April, prices rose by only 0.1% m/m, against the all-European trend. The number will likely be confirmed now.

- French Industrial Production: Tuesday, 6:45. Industrial output in the continent’s second-largest economy dropped by 1.6% in February. We could see a bounce now.

- French Trade Balance: Wednesday, 6:45. Contrary to Germany, France has a deficit in its balance of trade. This deficit has widened to 6.6 billion in February

- ECB Economic Bulletin: Thursday, 8:00. Two weeks after Draghi was optimistic about growth but unsure about inflation, we will get more data from the central bank, the data they used for making their assessments.

- EU Economic Forecasts: Thursday, 9:00. Three times a year, the European Commission releases its economic forecasts for growth and other measures. Given the recent firming of the economies, we can expect an upgrade of the forecasts this time.

- German GDP: Friday, 6:00. This is the first release of the German GDP for Q1 2017. We already had the all-European number, but any surprise from Germany can shift that figure easily, as Germany is the biggest economy. In Q4, Germany grew by 0.4%, marginally below expectations.

- German CPI (final): Friday, 6:00. Prices remained flat in April according to the flash data. This will likely be confirmed. The final German figures feed into the all-European numbers.

- French Non-Farm Payrolls: Friday, 9:00. This is a quarterly measure of employment. In Q4, we had a growth rate of 0.4%, encouraging given the previous, slower quarters. We now get the initial number for Q1 2017.

- Industrial production: Friday, 9:00. Industrial output disappointed in February with a drop of 0.3% across the euro-zone. Despite being released after the big countries will already have published their numbers, the publication still moves markets.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week trading above support at 1.0870 (mentioned last week). The pair then made a move to the upside, reaching new highs for the year.

Technical lines from top to bottom:

We start from higher ground this time. 1.13 is the top line seen in November before the collapse. 1.1120 was a support line beforehand.

The round number of 1.10 is a key psychological level. 1.0950 is close by, and the most recent 2017 high.

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0820 was the post French elections low.

1.0775 capped the pair in January and remains of importance. 1.0720 was also a high in January.

The pair was unable to crack 1.0660 in February and it remains the high end of the range. 1.0630 is the next level, holding back the pair in February and March.

Uptrend channel stays intact

EUR/USD has had three significant and rising lows in 2017: 1.0340 in the wake of the year, 1.0490 in March and 1.0565 in April. Also on the topside, we can see higher highs. If this is the case, there is more room to the upside than to the downside.

I remain bullish on EUR/USD

A projected victory for Macron will not only provide a bit of upside (the event is mostly priced in) but will also clear the scene for the fundamentals that are now more favorable for the euro: stronger growth and rising inlfation, in clear contrast to the US.

Our latest podcast is titled US economic unease and slippery oil

Follow us on Sticher or iTunes

Safe trading!