EUR/USD jumped higher on the favorable results of the French elections. PMI and GDP data stand out in the first week of May, in the run-up to the second round of the French elections. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Centrist Emmanuel Macron topped the first round of the French elections and markets cheered. Macron is expected beat extremist Le Pen in the second round. His probable election is a sigh of relief for the European Union. ECB President Mario Draghi took the euro for a ride. He started off with optimism, talking about better growth and diminishing downside risks. Yet after sending the euro higher, he showed more caution on inflation and said there was no discussion on an exit strategy. This sent EUR/USD back down. The common currency got a boost from inflation data. Core CPI s up 1.2%, the highest since 2013. In the US, Trump completes his first 100 days in office with a mixed dollar. US GDP grew by 0.7% annualized in Q1 2017, worse than expected and the lowest in three years.

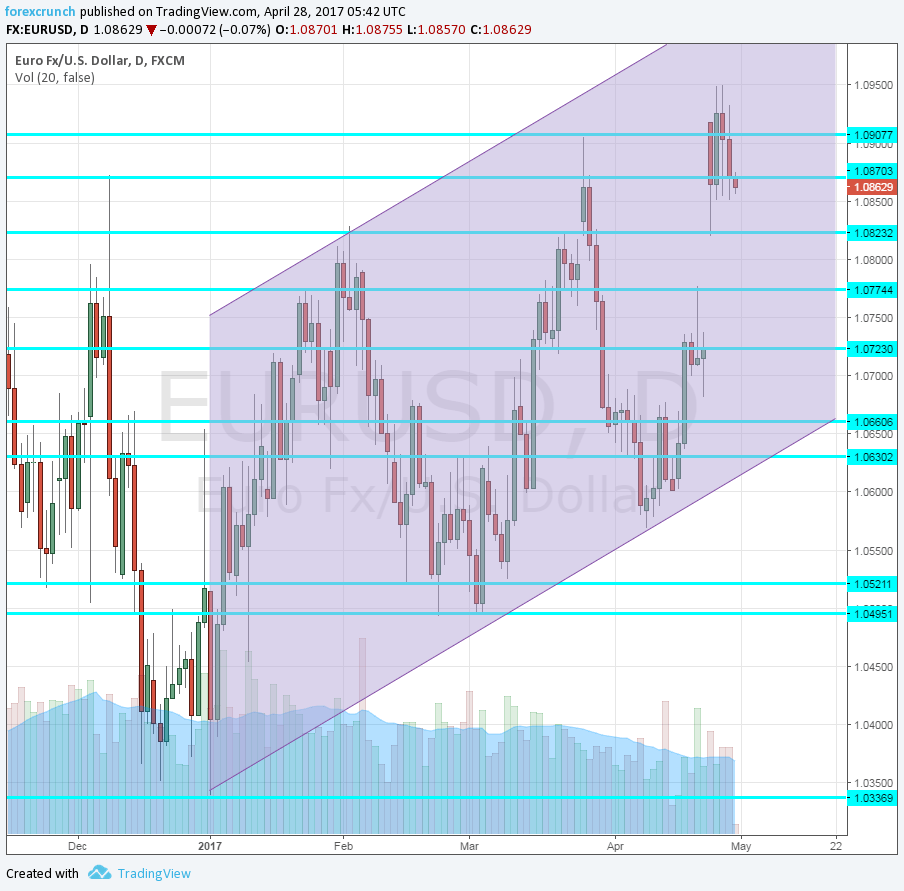

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Tuesday morning: 7:!5 in Spain, 7:45 in Italy, final French data at 7:50, final German figures at 7:55 and final euro-zone data at 8:00. Back in March, Markit’s purchasing managers’ index for the manufacturing sector showed a score of 53.9 points for Spain. A score of 54.3 is projected now. Italy had a higher score of 55.7 and 55.9 is on the cards now. According to the preliminary release for April, France had a score of 55.1 points. Germany was ahead with 58.2 points, reflecting robust growth. The all-European figure stood at 56.8 points. The last three figures will likely be confirmed.

- Unemployment Rate: Tuesday, 9:00. The jobless rate in the euro-zone continues dropping, albeit remaining high, at 9.5% back in February. A drop to 9.4% is forecast for March.

- Spanish Unemployment Change: Wednesday, 7:00. The fourth-largest economy reports fresh employment figures in the wake of the new month. A big drop of 48.6K was seen back in March. A rise of 21.3K is estimated now.

- German Unemployment Change: Wednesday, 7:55. Germany’s labor market is looking good, with consecutive drops in the number of the unemployed. Back in February, a drop of 30K was seen. A more modest drop is on the cards now: -10K.

- Flash GDP: Wednesday, 9:00. This is the first estimate of GDP for Q1 2017. Growth has slightly accelerated in Q4 2016, rising to 0.4%. The figure for the euro-zone is published after several major countries will have already published their data. Nonetheless, this release moves markets. A growth rate of 0.5% is expected now.

- PPI: Wednesday, 9:00. Producer prices fell short of expectations last time by stalling at 0%, ending a streak of positive surprises. A modest rise of 0.1% is projected.

- Services PMI: Thursday, morning: 7:!5 in Spain, 7:45 in Italy, final French data at 7:50, final German figures at 7:55 and final euro-zone data at 8:00. Spain’s services sector enjoyed laudable growth in March, with a score of 57.4 points and 57.5 is predicted now. Italy’s services sector was behind with 52.9 points, reflecting mediocre growth and 53.7 is on the cards now. According to the preliminary publication for March, France had solid growth at 57.7 points. Germany saw 54.7 points. The euro-zone had 56.2 points. The preliminary data is expected to be confirmed.

- Retail Sales: Thursday, 9:00. The euro-zone retail sales release lags the publications from major countries, but can still provide surprises. An increase of 0.7% was seen in February, better than had been expected. A small rise of 0.1% is expected.

- Retail PMI: Friday, 8:10. Markit’s PMI for the retail sector has been flirting with 50: the level that separates expansion and contraction. A score of 49.5 was recorded in March.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week with a weekend gap on the French elections and settled above the 1.0830 level (mentioned last week). The pair then continued to higher ground, tackling 1.0950.

Technical lines from top to bottom:

The round number of 1.10 is a key psychological level. 1.0950 is close by, and the most recent 2017 high.

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0820 was the post French elections low.

1.0775 capped the pair in January and remains of importance. 1.0720 was also a high in January.

The pair was unable to crack 1.0660 in February and it remains the high end of the range. 1.0630 is the next level, holding back the pair in February and March.

1.0520 is a relic of the past but still serves as a cap. The more recent low of 1.0490 follows very closely.

Uptrend channel

EUR/USD has had three significant and rising lows in 2017: 1.0340 in the wake of the year, 1.0490 in March and 1.0565 in April. Also on the topside, we can see higher highs. If this is the case, there is more room to the upside than to the downside.

I remain bullish on EUR/USD

The French elections resulted in a favorable outcome for the euro. While the second round still matters, the pair could continue rising on the opinion polls showing a solid lead for Macron. In addition, the euro-zone economies are looking good, contrary to the slowdown in the US.

Our latest podcast is titled French fate and British snaps

Follow us on Sticher or iTunes

Safe trading!