EUR/USD continued its deep dive and hit new lows as the dollar rally continued and euro-zone data was mixed. Another public appearance from Draghi and fresh PMIs stand out now. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

German GDP missed expectations but thanks to a beat in Italy, the 0.3% growth rate was confirmed for Q3. On the other hand, German business confidence looks good. Trump’s Triumph continued supporting the dollar, sending EUR/USD to support at first and after a pause, to new lows, leaving only two support lines left. The pair was not helped by Draghi, which remained dovish.

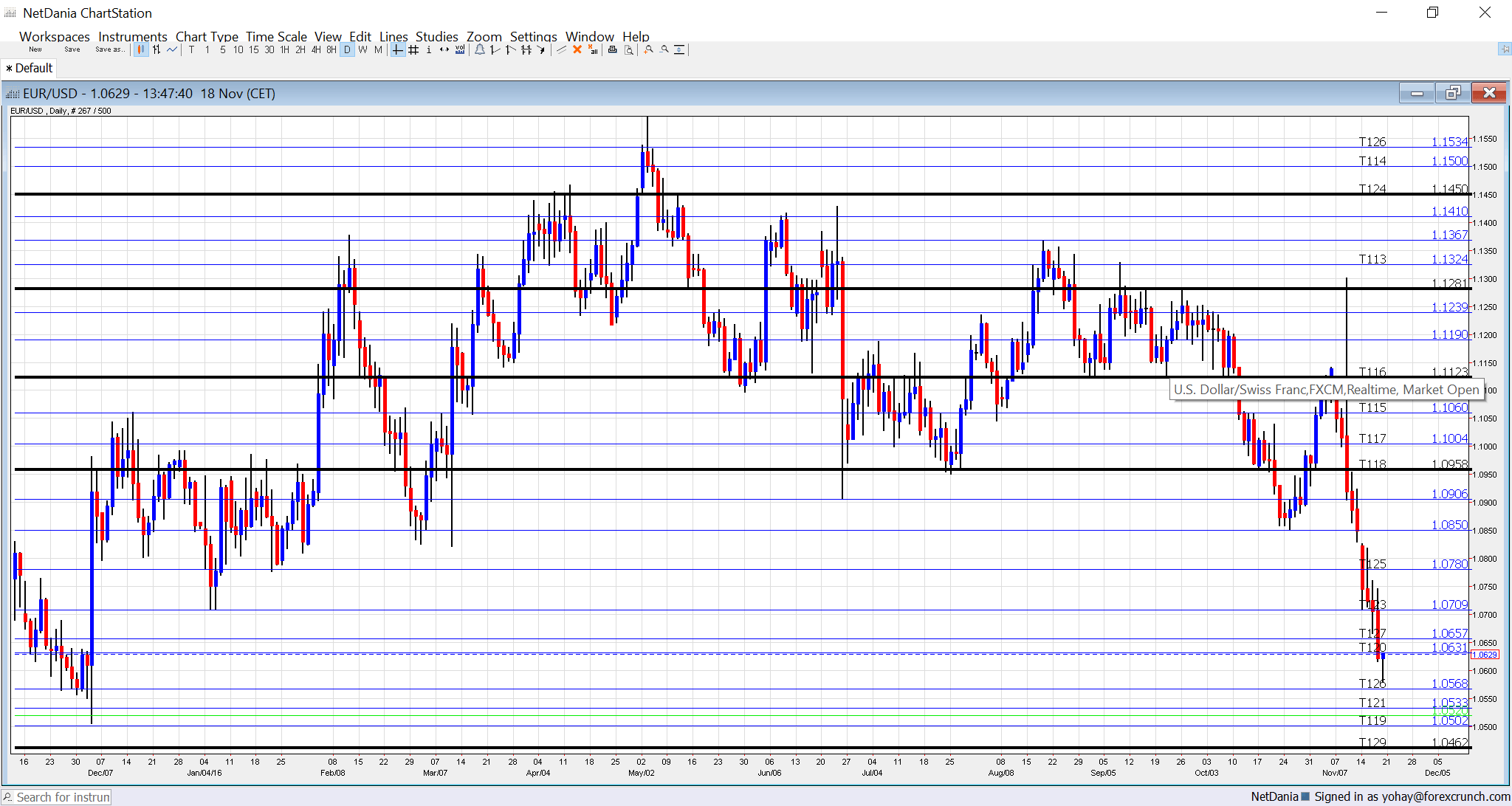

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Draghi talks: Monday, 16:00. After making dovish sounds, the President of the ECB makes another public appearance, this time at an official testimony in the European Parliament. He may hint about the highly anticipated December meeting of the Bank.

- Consumer Confidence: Tuesday, 15:00. This official figure from Eurostat remained unchanged at -8 points in October. The figure for November will probably remain in negative territory, at the same level, reflecting pessimism.

- Flash PMIs: Wednesday: 8:00 for France, 8:30 for Germany and 9:00 for the euro-zone. Markit releases its preliminary purchasing managers’ indices for November. In October, France had a score of 51.8 points in the manufacturing sector, above the 50 point threshold separating expansion from contraction. A small slide to 51.5 is on the cards now. The services sector stood at 51.4 points and 52.1 is projected for November. In Germany, the manufacturing PMI was at a solid 55 points and 54.8 is predicted now. The services PMI was 54.2 points a very similar 54.1 is predicted. For the whole euro-zone, manufacturing was ahead at 53.5 and services at 52.8 points, with 53.2 and 53.1 expected now.

- ECB Financial Stability Review: Wednesday, 9:00. Twice a year, the European Central Bank assesses the stability of the financial sector. During 2016, various Italian and German banks have been under the spotlight. It will be interesting to see if the ECB singles out these issues or sends a signal of stability.

- Final German GDP: Thursday, 7:00. According to the initial release, the German economy grew by only 0.2%, a significant drop from 0.4% seen in Q2. The final read for Q3 will likely confirm the data.

- German Ifo Business Climate: Thursday, 9:00. Germany’s No. 1 Think-tank has released an upbeat report for October: a score of 110.5 points that beat expectations. Will the US elections curb the bullishness? Probably not: a score of 110.6 is forecast.

- German GfK Consumer Climate: Thursday, 12:00. This measure of consumer surprised with a big drop in October, to 9.7 from 10 points. Will it recover now? A small rise to 9.7 is on the cards.

- Belgian NBB Business Climate: Thursday, 14:00. This small country produces a wide survey that is eyed by markets. After two months in positive ground, the indicator fell back to negativity and has been there in the past three months. The score was -1.8 in October. A small improvement to -1.5 is expected.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar dropped to 1.0710 (mentioned last week) and bounced from there. But this did not last for a long time and the pair continued to low ground, fighting over 1.06.

Technical lines from top to bottom:

1.1125 cushioned the pair in early September. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which supported the pair in early 2016 worked as resistance in October. 1.0850, which worked as support during the same month, serves as support.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

Further below, the 2016 low of 1.0520 and the 2015 low of 1.0460 provide further support – it is the last line in the sand.

I turn from bearish to neutral on EUR/USD

After the ongoing ascent of the dollar, it could take a breather in the week of Thanksgiving, allowing a pause also for EUR/USD. The pair could resume the downtrend afterward, as monetary policy divergence still favors even lower ground, with some talking about EUR/USD parity.

Our latest podcast is titled Not all financial assets are Trump-ed equally

Follow us on Sticher or iTunes

Safe trading!