EUR/USD was looking for a new direction in a busy week. What’s next? The common currency faces yet another busy week with PMIs, trade balance and more. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Upbeat euro-zone growth continues and has reached 2.5% y/y in Q3 2017. The unemployment rate also looks good, dipping under 9%. Nevertheless, the level of inflation is dropping once again: 1.4% in the headline and 0.9% in core CPI. The ongoing Catalan crisis has reached new lows with the jailing of most of the ousted regional government, but the euro ignores it. In the US, Trump is in trouble over the Russia investigation. However, the economy is looking good and the Fed is set to raise rates in December, the last expected hike before Powell is due to enter his new job as Fed Chair. While the NFP report showed weak wage growth at 2.4%, the upbeat ISM Non-Manufacturing PMI kept the greenback bid late in the week.

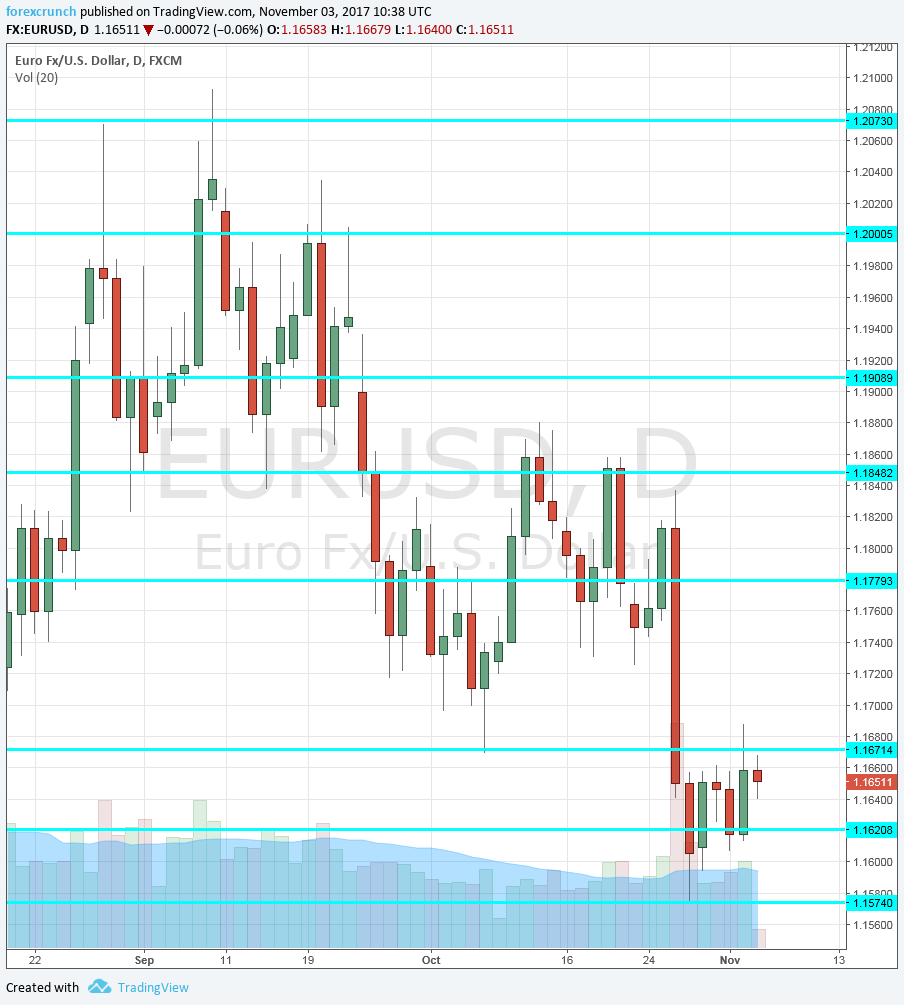

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Eurogroup Meetings: Monday. The finance ministers of the euro-zone convene in Brussels to discuss current matters. The crisis in Catalonia and its economic impact, rising growth and the changes in the ECB’s policy will all be on the table. Any statements regarding closer cooperation will be welcomed by the euro. The finance ministers of all the EU countries will convene on Tuesday, but the bigger decisions are taken between the euro area ministers.

- German Factory Orders: Monday, 7:00. The volume of factory orders in Europe’s locomotive is somewhat volatile but still, matters. A jump of 3.6% was recorded in August after a drop in July. We now get the figures for September where a drop of 1% is expected.

- Services PMIs: Monday: Spain at 8:15, Italy at 8:45, final French number at 8:50, final German figure at 8:55 and the final euro-zone number at 9:00. According to Markit, the Spanish services sector enjoyed decent growth in September, with a score of 56.7 points, significantly above the 50-point threshold separating expansion from contraction. A score of 55.7 is predicted now. Italy had a score of 53.2 points and a level of 53.1 is predicted now. In the initial read for October, France had 57.4, Germany 55.2 and the euro-zone 54.9. All the numbers are expected to be confirmed in the final read.

- Sentix Investor Confidence: Monday, 9:30. The wide survey of around 2800 analysts and investors surprised in October with yet another rise to 29.7, extending to another record, the highest since 2007. Another rise is projected now, to 31.2 points.

- PPI: Monday, 10:00. Producer prices eventually feed into consumer prices and the publication serves as another gauge of inflation. In September, PPI moved up by 0.3%, beating expectations. A rise of 0.4% is forecast.

- German Industrial Production: Tuesday, 7:00. Similar to the factory orders number, industrial output also advanced at a rapid clip in August, at 2.6%. Will we see a drop this time? A drop of 0.7% is estimated now.

- Retail PMI: Tuesday, 9:10. The purchasing managers’ index for the retail sector is on the rise and reached 52.3 points in September. This is sluggish growth, but stronger than beforehand.

- Retail Sales: Tuesday, 10:00. Even though major countries have already published their own reads of retail sales, the numbers for the euro-zone usually surprise markets. A disappointing drop of 0.5% was seen in August. It could rise this time. An increase of 0.6% is on the cards.

- French Trade Balance: Wednesday, 7:45. The second-largest economy in the euro-zone has a chronic trade balance deficit. This deficit narrowed to 4.5 billion back in August. A deficit of 4.7 billion is predicted.

- German Trade Balance: Thursday, 7:00. Contrary to France, Germany has a wide trade surplus, something that keeps the euro bid. In August, that surplus slightly widened to 21.6 billion. A similar figure is projected now. A surplus of 23.1 billion is forecast, larger than last time.

- ECB Economic Bulletin: Thursday, 9:00. Two weeks after the ECB decision, they publish the data that they had before them while making their decision. We may get a few more insights about the optimism that led to cutting back the bond-buying program to 30 billion per month and also the caution that led to leaving the door open to further bond-buys after September 2018.

- EU Economic Forecasts: Thursday, 10:00. The European Commission releases updated economic forecasts three times a year. Given the recent upbeat GDP figures, the EC may upgrade its forecasts. Forecasts for individual countries could focus on Spain, given the Catalan crisis.

- German CPI (final): Friday, 7:00. The initial read for Germany’s inflation showed no change in prices. This will probably be confirmed now.

- French Industrial Production: Friday, 7:45. Contrary to Germany, France saw a drop of 0.3% in its industrial production back in August. A rise is likely this time. France also releases its private payroll change for Q3 at the same time, but the industrial output is more important. A rise of 0.6% is projected.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week by making itself comfortable in the 1.1620 to 1.1670 levels mentioned last week. It hardly moved throughout the week.

Technical lines from top to bottom:

The cycle high of 1.2090 looms above. 1.20 is the obvious round level and also worked as resistance in September.

1.1910 held the pair down back in August. 1.1830 capped the pair in August and in October while working as support in September.

1.1670 was a swing low in October. and hasn’t worked too well. The 2016 high of 1.1620 slowed down the pair also in October.

1.1580 was a stepping stone for the pair on its way up. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. The next level of support is only 1.1370.

I remain bearish on EUR/USD

Lower inflation figures support a weaker euro, at least in the short term. While inflation is also absent in the US, the pair could drift lower amid the current dovishness of the ECB and the relative hawkishness of the Fed.

Our latest podcast is titled New normal NFP, reluctant rate rise

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!