EUR/USD certainly felt the decision of the ECB in a week that unleashed some volatility and sent the euro tumbling down. The upcoming week features inflation and GDP data among other events. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The ECB announced that it will be halving the QE program to 30€ billion through September 2018 as widely expected, but left the door open to extending it beyond that date. The euro did not like it and plunged. Flash PMIs came out above expectations, reflecting optimism for the euro-zone economies. Attempts to resolve the crisis in Catalonia failed miserably. Catalonia eventually declared independence only to see the autonomy suspended by Spain. The US dollar jumped higher as the current Fed Chair Janet Yellen is reportedly out of the race for heading the central bank. The growing chances of John Taylor to head the Fed were also positive for the greenback and talk that Powell will be nominated cooled off the excitement. US GDP beat expectations with 3% annualized.

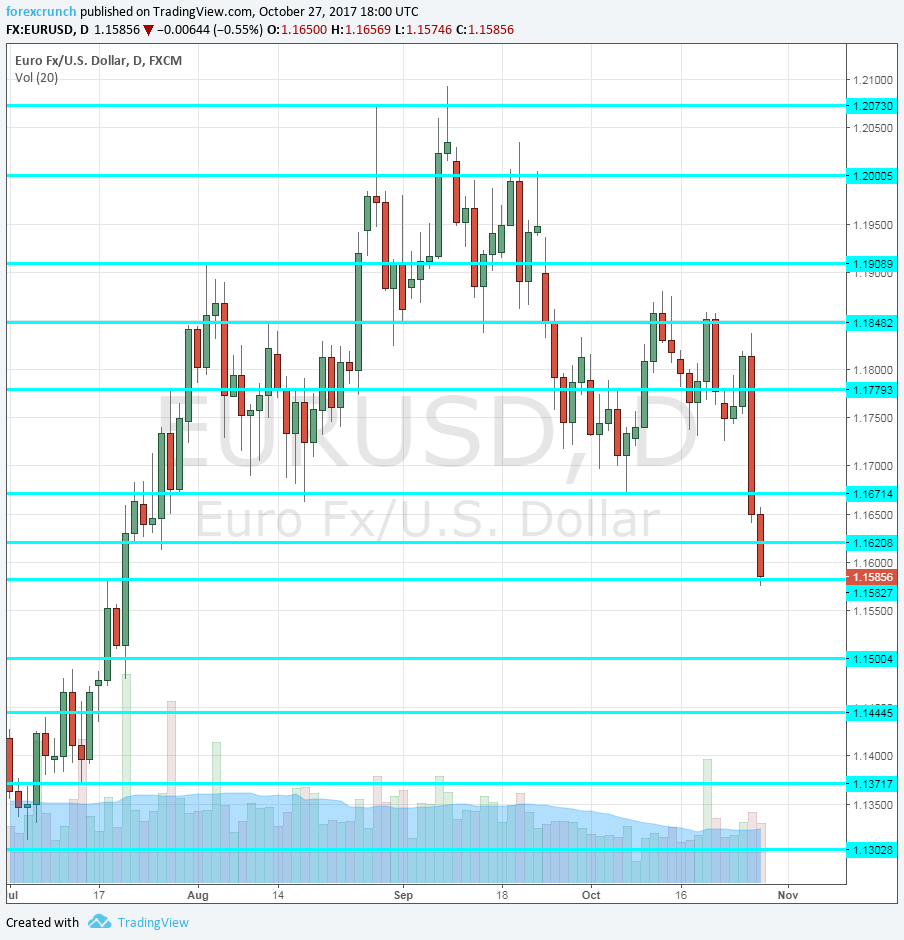

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German retail sales: Monday, 7:00. The largest economy in the euro-zone saw consumption sliding by 0.2% in August. For the month of September, a rise of 0.5% is expected. Germany’s economy leans more towards industrial exports than internal consumption.

- Spanish CPI: Monday, 8:00. The fourth-largest economy has seen inflation stabilizing in recent months after reaching 3% beforehand. In September, the annual level of inflation reached 1.8%. We now get the preliminary figures for October. A small slide to 1.7% y/y is on the cards.

- Spanish GDP: Monday, 8:00. Spain has been a success story in the past three years, growing above the euro-zone average. In Q2, the economy advanced by 0.9%. Q3 will likely see a similar rate, but uncertainty looms due to the ongoing Catalan crisis. A growth rate of 0.8% is projected.

- German CPI: Monday, during the morning for the various German states and the all-German figure, is published at 13:00. Prices rose by 0.1% m/m in September, exactly as expected. Germany is the largest economy in Europe and changes in its GDP impact the all-European number more than any other country. A similar figure is expected now.

- French GDP: Tuesday, 6:30. The second-largest economy in the euro-zone enjoyed an upbeat growth rate of 0.5%, albeit beneath the euro-zone average in Q2. The figure for Q3 will be the first full quarter with Macron in power. A gain of 0.5% is estimated now, a repeat of the previous quarter.

- French CPI: Tuesday, 7:45. Contrary to Germany, France saw a drop of 0.1% m/m in prices back in September. The publication from France provides a last-minute hint towards the all-European CPI. This time, a slide of 0.1% is forecast. The consumer spending measure is published at the same time but the CPI carries more weight.

- CPI: Tuesday, 10:00. While the ECB decision is already behind us, the fresh flash CPI estimate has a significant impact on future moves. Headline CPI stood at 1.5% in September, which is not satisfactory to meet the ECB’s “2% or a bit below” inflation target. Core CPI slipped to 1.1%, falling short of predictions. The exact same numbers are projected now.

- GDP: Tuesday, 10:00. After all the major countries published their estimates, we get the all-European measure. Current expectations may change according to the earlier publications. The euro-zone economies grew by 0.6% in Q2, continuing the streak of upbeat publications. A slightly more modest growth rate of 0.5% is expected.

- Unemployment Rate: Tuesday, 9:00. This busy time of the day also consists of the unemployment rate. After peaking above 12%, the jobless rate fell gradually and stands at 9.1% as of August. We now get the belated numbers for September. Another improvement is predicted: 9% this time.

- Manufacturing PMIs: Thursday morning: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German number at 8:55 and the final euro-zone release at 9:00. Markit’s manufacturing PMI for Spain stood at 54.3 points in September, above the 50 point threshold separating expansion from contraction. A small rise to 54.9 is forecast. Italy, the third-largest economy, had a score of 56.3 points. A small rise to 56.7 is projected. The initial read for France for October showed an upbeat level of 56.7. Germany’s reached 60.5 and the whole euro-zone was 58.6. The preliminary figures for October will likely be confirmed now.

- German Unemployment Change: Thursday, 8:55. Germany has seen unemployment dropping quite consistently in past years. The fall in July was quite impressive: 23,000. Another drop is likely for the month of August: 10K this time.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar was stuck in the well-known range early in the week and then collapsed to the 1.1620 level (was not mentioned last week).

Technical lines from top to bottom:

The cycle high of 1.2090 looms above. 1.20 is the obvious round level and also worked as resistance in September.

1.1910 held the pair down back in August. 1.1830 capped the pair in August and in October while working as support in September.

1.1670 was a swing low in October. and hasn’t worked too well. The 2016 high of 1.1620 slowed down the pair also in October.

1.1580 was a stepping stone for the pair on its way up. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. The next level of support is only 1.1370.

I am bearish on EUR/USD

The ECB’s open door to further cuts may already be fully priced in, but the ongoing crisis in Catalonia could continue weighing. In the US, the ousting of Yellen could continue to assist the US dollar, at least in the short term.

Our latest podcast is titled Draghi dread and the head of the Fed

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!