EUR/USD had a second negative week, losing over 100 pips. Can it stabilize at these levels or continue falling? GDP, employment and inflation data are the main market movers for this week. Here is an outlook for these events among others, and an updated technical analysis for EUR/USD.

The ECB cut the interest rate to 0.25% in its monthly meeting, catching markets by surprise. The weak performance of the euro states, excluding Germany and the overvalued Euro compelled the ECB to cut rates, in an attempt to spur the euro-zone economies. ECB president Mario Draghi also made it clear that he has more “artillery”. EUR/USD fell also on news from the other side of the Atlantic: both GDP and the Non-Farm Payrolls exceeded expectations. We’ll now see how bad the euro-zone situation is.

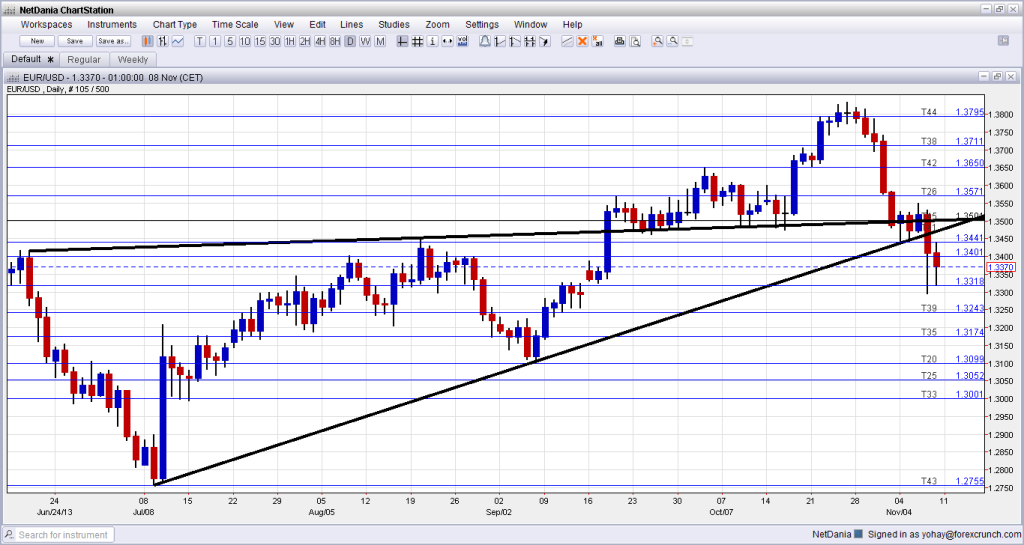

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Italian Industrial Production: Monday, 9:00 Italian industrial output dropped unexpectedly for the second consecutive month in August, down 0.3%, following a 1.0% fall in the previous month. Economists expected Italian production to gain 0.6% in August. These poor readings suggest that Eurozone’s third-biggest economy is still struggling to exit recession. A rise of 0.2% is expected this time.

- Jens Weidmann speaks: Monday, 17:00. The President of the Deutsche Bundesbank Jens Weidmann will speak in Basel, where he may talk about the Eurozone’s recovery and prospects.

- German Final CPI: Tuesday, 7:00. German final CPI for September remained unchanged from its flash estimate reaching an annual inflation rate of 1.4%, the slowest since April. Household energy prices increased 0.6%, core CPI excluding energy costs posted a 0.1% monthly drop, reaching 1.7% annual rate. The readings were in line with market predictions. A decline of 0.2% is forecast. The fall in German inflation was one of the triggers for the rate cut.

- Industrial Production: Wednesday, 10:00. Euro-area industrial output increased more than forecasted in August, rising 1.0% following a 1.0% dip in July, exceeding analysts’ expectations of a 0.8% expansion. Positive indicators verified that the Eurozone is on a recovery path. ECB President Mario Draghi said that the central bank will maintain interest rates at low levels for an extended period, to boost recovery. The Eurozone industrial output is expected to drop 0.2%.

- Preliminary GDP in France, Germany, Italy and the Eurozone: Thursday. The Eurozone exited the recession in the second quarter, with the leading economies Germany and France, indicating a solid recovery for the 17 state-bloc. The Eurozone posted a 0.3% growth rate in the second quarter following 7 quarters of contraction. Germany reported strong growth of 0.7% and France showed a 0.5% expansion in the second quarter. Italy reported a 0.2% contraction following 0.5% fall in the first quarter. All in all, the euro zone’s performance in the second quarter was better than the 0.2% growth rate expected. French GDP is expected to gain 0.1%, Germany – a gain of 0.3%, and Italy a contraction of 0.2%.

- French Non-Farm Payrolls: Thursday, 7:45. French non-farm payrolls dropped by 0.2% after a decline of 0.1% in it’s the first quarter. Service sector employment declined 0.1%, while construction employment remained 0.5% as in the first quarter. A smaller decline of 0.1% is forecast. France suffered a rating downgrade from S&P.

- ECB Monthly Bulletin: Thursday, 9:00. The recent ECB bulletin released in October showed why the ECB decided to leave interest rate on hold. The bank expects economic growth to remain fragile and inflation subdued close to 2% over the medium term. Draghi stated that interest rates will remain low for an extended period and downside risks are expected to be resolved this year and in 2014 bringing stability to the Eurozone. We will get to see some of the insights that led to the rate cut.

- Eurogroup Meetings: Thursday. Eurogroup meetings attended by the Eurogroup President, Finance Ministers from euro area member states, the Commissioner for economic and monetary affairs, and the President of the European Central Bank.

- Inflation data: Friday, 10:00. Euro zone inflation dropped in line with expectations in September, falling to 1.1% year-on-year, after posting 1.3% inflation in August. This 3.5 year low inflation reflects the weak economic recovery and modest domestic demand. Meantime, Core CPI excluding food and energy products fell 0.1% to 1.0% in September. ECB Executive Board member Peter Praet said inflation pressures in the euro zone are expected to remain subdued until the end of 2015. CPI is expected to increase 0.7% while core CPI is predicted to increase by 0.8%.

- ECOFIN Meetings: Friday. ECOFIN meetings attended by Finance Ministers from EU member states will meet in Vilnius and discuss the EU’s economic outlook, development of the Banking Union and other steps to ensure the financial stability of Europe, policy on improving access to finance for small and medium-sized enterprises, a global standard on the automatic exchange of tax information, and other issues.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week with a drop to 1.3440, a new line that didn’t appear on the chart last week. It then managed to bounce back up and settle above 1.35. From there, the pair plunged and even temporarily dipped below 1.33. A recovery saw challenges of the 1.3440 line, before another slide and a close at 1.3370.

Technical lines from top to bottom:

We start from lower ground once again. 1.3870 capped the pair during the fall of 2011 and served as the “shoulders” in a H&S pattern. 1.38 is a round number and also worked as a temporary cap during that period of time and also in October 2013.

1.3710 was the previous 2013 peak, and served as a clear separator. The pair needed a big trigger to break above this line, and when it lost it again, the fall was painful.

1.3650 temporarily capped the pair during that period of time and is stronger after capping the pair in October 2013. It returns to serve as resistance. 1.3570 is the swing high of September 2013 and also proved itself as resistance afterwards. It temporarily stopped the avalanche.

1.35 is a nice round number and was a pivotal line or “magnet” within the previous range. 1.3440 worked as a clear separator in early November 2013 and is a key line to the upside.

The round number of 1.34 worked as resistance several times in 2013, but is only minor resistance. 1.3320 worked as a double top in early September and it was crossed only with a Sunday gap. It remains a clear separator of ranges.

It is followed by 1.3240, which capped the pair in April and also had a role in August. It worked as support in September. 1.3175 capped the pair during July 2013.

1.3100 is worked as temporary resistance in December 2012 and is becoming more important once again, after capping a recovery attempt in June and then in July and providing support in September. It is followed by 1.3050, which proved be strong support in May 2013, defending the round number in more than one occasion, but it is less significant now.

The very round 1.30 line was a tough line of resistance. In addition to being a round number, it also served as strong support and recently worked as a pivot line. 1.2940 is the next line of support. It worked as such during April and May 2013.

Lower, 1.2890 worked in both directions during 2012 and was the beginning of the uptrend support line. It is becoming more important, as a clear separator of ranges. 1.2840 worked as a cushion for the pair during May 2013.

EUR/USD broke below two uptrend support lines

The steeper uptrend support line accompanied the pair since early July and was clearly broken now. Also the more moderate line that worked in both directions since June, was now clearly taken.

I remain bearish on EUR/USD

Not only did Draghi cut the rates, but firmly kept the “nuclear option” of a negative deposit rate on the table. He means business. Contrary to the previous period of low inflation in the euro-zone, energy prices are now more stable and the euro-zone is experiencing growth. Or perhaps it isn’t experiencing growth? Disappointing GDP numbers could push the euro lower.

In the US, the distortions in the NFP report and the doubts about the details of the GDP report cannot remove the notion that there are better chances of QE tapering in December. With a “Dectaper” in the air, it will be for EUR/USD to stage a recovery.

More:

- Has the long awaited recovery in the US dollar started?

- EUR beginning to fall into some pretty strong support

If you are interested a different way of trading currencies, check out the weekly binary options setups, including EUR/USD and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.