EUR/USD had a terrible week, falling around 300 pips. Is the pair oversold, or does the fall in inflation justify an extension of the fall? The euro is now in the hands of ECB President Mario Draghi and the rate decision becomes even more important that normally. In addition, manufacturing and services PMIs, employment and industrial data will also move the common currency. Here is an outlook for these events among others, and an updated technical analysis for EUR/USD, now on much lower ground.

European data disappointed on all fronts, including a rise in unemployment and a drop in German retail sales. The biggest shocker for the euro came from a big drop in inflation: 0.7% YoY, very far from the ECB’s 2% target. Together with the not-too-dovish US FOMC statement, the pair had a clear direction to go: down, and even dipped below long term uptrend support. Will Draghi cut the rates or announce a new LTRO?

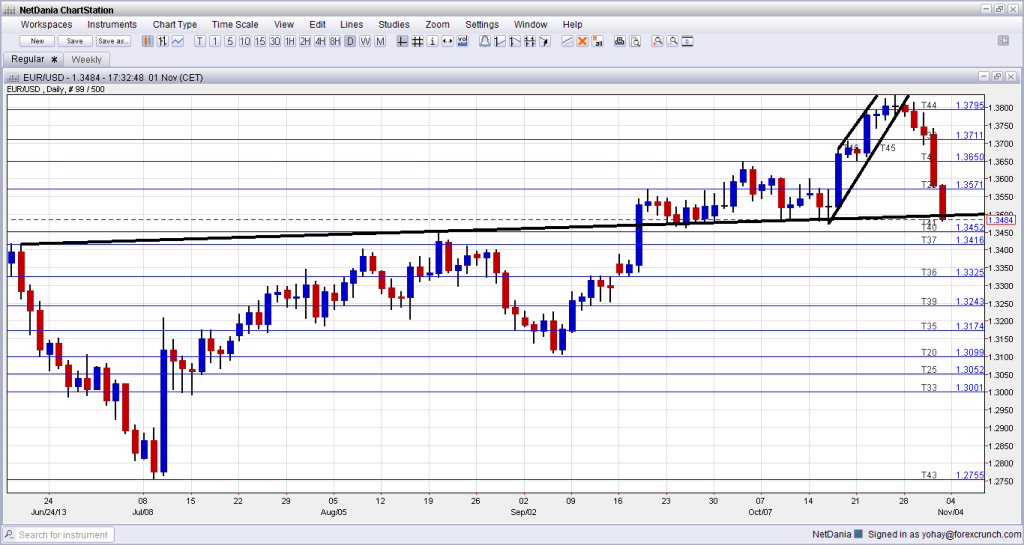

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday. Euro zone factories activity weakened in September, mainly due to sluggish growth in Spain and Italy, indicating recovery in the Eurozone block remains fragile. Italy disappointed, dropping to 50.8 from 51.3 in the previous month, struggling to emerge from its longest post-war recession. Spain declined to 50.7 from 51.1 in August still pointing to growth despite its high unemployment rate, regarded as one of the worst in the euro zone. The euro-zone manufacturing PMI, dipped to 51.1 in September from 51.4 in August, still indicating expansion. But the euro zone gradual improvement suggests it is not gaining much momentum. Spanish Manufacturing sector is expected to reach 51.0, Italy – 51.1, and the euro-zone – 51.3.

- Sentix Investor Confidence: Monday, 9:30. Eurozone investor sentiment remained positive in October reaching 6.1 from the sharp rise to 6.5 in September. Economists expected a further rise to 10.9. The main reason for the setback was a decline in the outlook component, while the assessment of the current conditions improved further. A rise to 6.6 is expected now.

- EU Economic Forecasts: Monday. The EU economic forecast report includes a two-year economic outlook for EU member states, upon which the European Commission bases its monetary decisions. The last report released in May noted positive growth expectations in the second half of 2013 and in 2014 with a more sluggish expansion in domestic demand.

- Spanish Unemployment Change: Tuesday, 8:00. Unemployment increased in Spain during September, rising by 25,572 to a total of 4.7 million unemployed. This release came after a positive summer season tourism trend. Nearly 52,000 lost their jobs in the service sector. However in the agricultural sector, 14,000 jobs were created, 7,000 in industrial sector and 16,793 in construction. Unemployment is expected to rise again in October as the holiday season draws to a definitive close and the remaining temporary contracts in the tourist sector come to an end. A rise of 31,300 unemployed is expected now.

- Services PMIs: Wednesday. The services sector in the Eurozone continued to expand in September, unlike the setback in the manufacturing sector, rising to a 27-month high of 52.2 from 51.5 in August, beating market forecast for a 52.1 reading. Demand improved both domestically and abroad. Spain was the weakest EU member, dropping to 49 from 50.4 in August offsetting the modest growth in manufacturing production. Italy increased to 52.7, from48.8 in August showing expansion. The outlook for the Eurozone service sector remained positive on the whole, with new business growth at a 27-month record and business confidence rising to its highest level since March 2012. Services sectors in Spain is expected to reach 48.1, Italy – 51.6, and the Eurozone – 50.9.

- Retail Sales: Wednesday, 10:00. Retail sales in the euro zone edged up more than expected in August, rising 0.7% following a revised 0.5% gain in the previous month. The main contributors were increased demand for fuel, food, clothes and computers indicating recovery in domestic demand. Economists expected a 0.3% rise in August. In Spain, despite high unemployment rates, retail sales accelerated by 3.8% in August against July, the strongest rise in a year. A drop of 0.3 is expected now.

- German Factory Orders: Wednesday, 11:00. German factory orders dropped unexpectedly in August, down 0.3% following a 1.9% decline in the previous month, backing views that the economic recovery in the euro area is fragile. Economists anticipated a rise of 1.2% in August. Orders edged up 3.1% from a year ago, and consumer climate, growth slowed unexpectedly in the third quarter, indicating recovery is a slow. German factory orders are expected to gain 0.6% this time.

- German Industrial Production: Thursday, 11:00. German industrial production rebounded in August, gaining 1.4% from a 1.1% decline in July. Analysts expected a smaller increase of 1.1%. However, recovery is uneven, with factory orders dropping for the second month. Nevertheless, German industry is expected to remain positive in the coming months. A small rise of 0.2% is expected now.

- Rate decision: Thursday, 12:45, press conference at 13:30. The ECB is likely to keep policy unchanged, but convey a message that it is ready to act in order to ease monetary conditions, perhaps in December. The euro area is still not out of the woods, and credit conditions are still tight. Inflation has been falling and it is now far from the 2% target. In addition, the exchange rate is not only weighing on inflation but also making euro-zone less competitive. Draghi already mentioned the exchange rate in October, and is likely to be more vocal about it this time. The euro could suffer from a worried appearance by Draghi in the press conference. A rate cut will hurt the euro, and a negative deposit rate will send it plunging. Opinion: Draghi could change expectations on rates and LTRO.

- German Trade Balance: Friday, 7:00. Germany’s trade surplus increased in August to a seasonally-adjusted t15.6 billion euros, from 15.0 billion euros in July. Exports rose 1.0% while imports gained 0.4%. The positive reading supports the underlying growth in the third quarter. Surplus is expected to rise to 17.2 billion.

- French Industrial Production: Friday, 7:45. Industrial production in France rebounded in August, rising 0.2%, following two months of declines. The gain was attributed to a big turnaround in the auto industry. However the gain was less than the 0.7% rise anticipated by analysts. France exited recession in the second quarter of the year with economic growth of 0.5 percent. A rise of 0.4% is forecasted now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week holding on to the 1.38 line (mentioned last week). This didn’t last too long and the pair began falling. The move accelerated once the pair lost the 1.3710 line and couldn’t recovered. A temporary pause was seen above 1.3570 but the pair continued lower, eventually dipping below the long term uptrend support line. The break still needs to be confirmed, as we’ve seen false ones in the past.

Technical lines from top to bottom:

We start from lower ground this time. 1.3940 was a peak in September 2011, over two years ago, and is just before the round number of 1.40. 1.3870 capped the pair during the fall of 2011 and served as the “shoulders” in a H&S pattern.

1.38 is a round number and also worked as a temporary cap during that period of time and also in October 2013. 1.3710 was the 2013 peak, and served as a clear separator. The pair needed a big trigger to break above this line, and when it lost it again, the fall was painful.

1.3650 temporarily capped the pair during that period of time and is stronger after capping the pair in October 2013. It returns to serve as resistance. 1.3570 is the swing high of September 2013 and also proved itself as resistance afterwards. It temporarily stopped the avalanche.

1.35 is a nice round number and was a pivotal line or “magnet” within the previous range and is key resistance to the upside. 1.3460 worked as support in late September and should be watched for any downside moves.

1.3415 was the peak back in June and works as another line of support. 1.3325 worked as a double top in early September and it was crossed only with a Sunday gap. It remains a clear separator of ranges.

It is followed by 1.3240, which capped the pair in April and also had a role in August. It worked as support in September. 1.3175 capped the pair during July 2013.

1.3100 is worked as temporary resistance in December 2012 and is becoming more important once again, after capping a recovery attempt in June and then in July and providing support in September. It is followed by 1.3050, which proved be strong support in May 2013, defending the round number in more than one occasion, but it is less significant now.

The very round 1.30 line was a tough line of resistance. In addition to being a round number, it also served as strong support and recently worked as a pivot line.

EUR/USD dips below long term uptrend support

Towards the end of October, we can draw a steep, parallel channel in which the pair is trading. After moving out of the channel, the big fall began.

The avalanche also brought long term uptrend support into the picture and the pair dipped below this line, accompanying the pair since June. We have already seen a false break in October, so caution is warranted.

I remain bearish on EUR/USD

Last week, the pair seemed overbought, and it could seem oversold now. A correction could be seen, but the fundamentals are certainly pointing lower. The euro-zone isn’t out of the woods: it isn’t only the danger of deflation but also rising unemployment and a danger of a credit crunch. Draghi will be forced to send a strong message and meet fundamentals and expectations. He will probably refrain from using the “nuclear option” of a negative deposit rate, but a path for an LTRO and /or a rate cut could be enough for the next leg lower.

In the US, the NFP will certainly rock markets and could even turn negative due to the government shutdown. But, this will probably be taken with a grain of salt due to distorted data. The Fed seems more fearful of bubbles and more determined to taper than earlier thought. At the moment, the damages of the government shutdown will probably be subsided. While another excellent week isn’t likely for the greenback, a big downwards correction is unlikely either. All in all, the pair has more potential to finish another week lower.

More:

- Has the long awaited recovery in the US dollar started?

- EUR beginning to fall into some pretty strong support

If you are interested a different way of trading currencies, check out the weekly binary options setups, including EUR/USD and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.