EUR/USD had an exciting week, taking a dive only to close the week higher. German retail sales, French consumer spending and the Euro-area Unemployment Rate are the main market movers this week. Here is an outlook for these events among others, and an updated technical analysis for EUR/USD.

Rumors about an imminent negative deposit rate of 0.1% hurt the euro, and the clear denial helped it recover quickly. Last week, Markit’s Eurozone Services Purchasing Managers’ Index was released, showing the Euro-zone private sector recovery unexpectedly weakened in November as French figures pulled them down. Germany still shows positive signs, with a strong business confidence from IFO joining the solid PMIs. In the US, the relatively hawkish meeting minutes boosted the dollar only shortly. What is the next move?

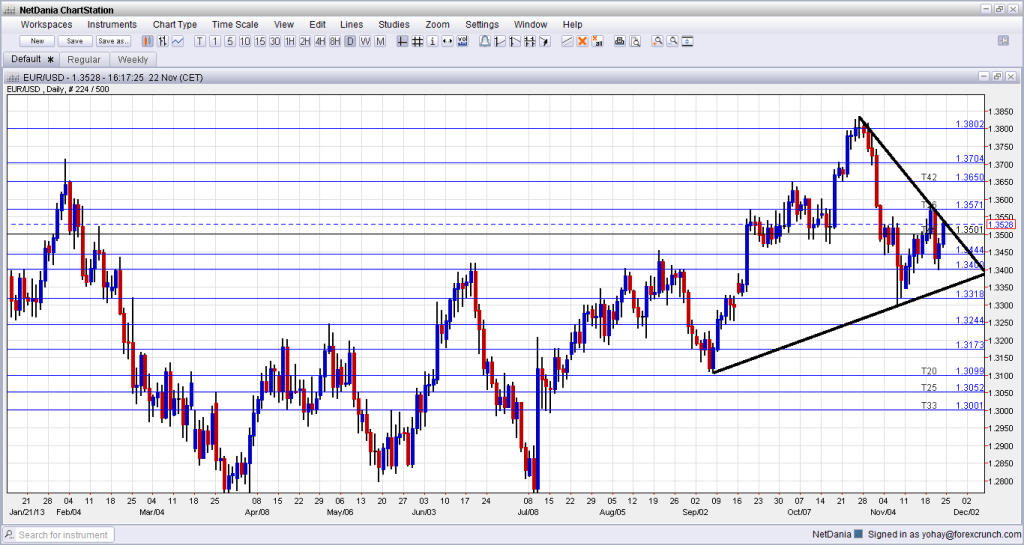

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- GfK German Consumer Climate: Wednesday, 9:00. German consumer sentiment declined in November to 7.0 points from 7.1 in October, below market consensus of 7.3 points reading. However, the index stayed close to its highest level in six years, indicating private consumption is the main locomotive in the German economy. Consumers were more concerned regarding future market conditions, but overall, remained optimistic. Robust employment market leads to an increase in private consumption, which is essential for economic growth. A rise to 7.1 is forecasted now.

- German CPI: Thursday. Consumer prices were weaker in September falling 0.2% reducing the annual inflation rate by also 0.2% to 1.2%, its slowest pace since April. However, the main drops occurred in falling energy costs. The readings suggest that inflation in Germany remains low despite the pick-up in the real economy and may lead the ECB to additional easing. Consumer prices are expected to rise 0.1%.

- German Unemployment Change: Thursday, 8:55. German unemployment increased for a third month in October, adding 2,000 unemployed, following a 24,000 increase in the previous month, a possible sign of a slowdown in Europe’s largest economy. Economists expected a small gain of 1,000. The German economy, expanded at a slower pace in the third quarter, and business sentiment fell, for the first time in six months, in October amid uncertainty over the rate of the recovery in the Euro-zone. No change is expected now.

- M3 Money Supply: Thursday, 9:00. Eurozone money supply grew at a slower pace in September, advancing 2.1% following a 2.3% climb in August. The decline occurred due to fewer loans provided to the private sector. However, credit to general government increased 0.7% in September, but lower than the 2.1% growth posted in August. An increase of 1.8% is expected.

- German Retail Sales: Friday, 8:00. Retail sales in the Eurozone’s largest economy unexpectedly fell 0.4% in September following an upwardly revised 0.5% gain in August. The main reason behind this decline was weakening consumer confidence. Economists expected a 0.5% gain in September. On a yearly base, growth fell to 0.2% from the prior revised growth of 0.4%. Analysts had forecast a 1.0% rise. Retail sales are expected to gain 0.5%.

- French Consumer Spending: Friday, 7:45. French consumer spending declined unexpectedly in September amid lower spending on energy. Households spending fell 0.1% in September after a revised 0.3% drop in the previous month, lowering GDP growth in the third quarter. Consumer spending is not expected to lead the French economy in the coming months due to high unemployment and tax increases aimed to lower the government’s budget deficit. A rise of 0.3% is anticipated.

- CPI Flash Estimate: Friday, 10:00 Annual inflation rate in the Eurozone fell to 0.7% in October posting the third consecutive decline. This is what triggered the rate cut. In September, inflation rate reached to 1.1%. Food, alcohol and tobacco prices reached an annual inflation rate of 1.9%, down from 2.6% in September while energy prices shrank at an annual rate of 1.7%, a bigger decline than the 0.9% rate posted in September. Meanwhile, core CPI, excluding food and energy items, edged up 0.8%. An increase of 0.8% is forecasted.

- Unemployment Rate: Friday, 10:00. The number of unemployed in the 17-nation Eurozone reached another record in September as the number Jobless citizens increased by 60,000, 12.2% rise to a record 19.45 million indicating the bloc’s recovery failed to generate jobs. Analysts believe growth will remain slow and unemployment high until the Eurozone banking sector will restore confidence and help boost lending. Unemployment Rate is expected to remain at 12.2%.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week with a gradual climb and met resistance at the 1.3570 line (mentioned last week). It then turned lower and bounced on support at 1.34. From there the roller coaster went upwards again, and the pair closed the week not far from 1.3570.

Technical lines from top to bottom:

1.3870 capped the pair during the fall of 2011 and served as the “shoulders” in a H&S pattern. 1.38 is a round number and also worked as a temporary cap during that period of time and also in October 2013.

1.3710 was the previous 2013 peak, and served as a clear separator. The pair needed a big trigger to break above this line, and when it lost it again, the fall was painful.

1.3650 temporarily capped the pair during that period of time and is stronger after capping the pair in October 2013. It returns to serve as resistance. 1.3570 is the swing high of September 2013 and also proved itself as resistance quite a few times afterwards. It temporarily stopped the avalanche.

1.35 is a nice round number and was a pivotal line or “magnet” within the previous range. 1.3440 worked as a clear separator in early November 2013 and is a key line to the upside.

The round number of 1.34 worked as resistance several times in 2013, and is strengthening now. 1.3320 worked as a double top in early September and it was crossed only with a Sunday gap. It remains a clear separator of ranges.

It is followed by 1.3240, which capped the pair in April and also had a role in August. It worked as support in September. 1.3175 capped the pair during July 2013.

1.3100 is worked as temporary resistance in December 2012 and is becoming more important once again, after capping a recovery attempt in June and then in July and providing support in September. It is followed by 1.3050, which proved be strong support in May 2013, defending the round number in more than one occasion, but it is less significant now.

The very round 1.30 line was a tough line of resistance. In addition to being a round number, it also served as strong support and recently worked as a pivot line. 1.2940 is the next line of support. It worked as such during April and May 2013.

Triangle forming

We can note (thick black lines on the chart) a moderate uptrend support line starting from September and a steeper downtrend resistance line dating from October. The pair is very close to downtrend resistance.

I am neutral on EUR/USD

In the last week of the month and before big events afterwards, the pair could remain in range and continue its impressing technical behavior. There are risks to the downside from the CPI numbers which triggered the rate cut this month. On the other side of the Atlantic, the Fed could still taper in December, but no big hints are likely this week.

More:

If you are interested a different way of trading currencies, check out the weekly binary options setups, including EUR/USD and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.