EUR/USD had an excellent week, breaking decisively to levels last seen in November 2011. Is 1.40 the next target? Or will the common currency take a break now? German retail sales, inflation and employment data, , consumer sentiment in France and Germany and GDP in Spain. Check out these events, on our weekly outlook. Here is an outlook for these events among others, and an updated technical analysis for EUR/USD.

Weak Non-Farm Payrolls in the US provided the trigger needed for the big breakout. If this is what the US can do without a crisis, things will likely look worse in the following months. However, in the old continent not all is well. PMIs couldn’t maintain their recovery and dropped. German business confidence is also weaker and so is inflation. Will the ECB step up its rhetoric and try to weaken the euro?

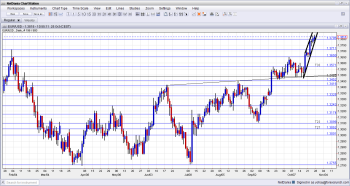

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- GfK German Consumer Climate: Tuesday, 7:00. German consumer confidence advanced to its highest level in six years reaching 7.1 in October, from 7.0 in the prior month, in line with market forecast. Strong consumer spending lifted growth in 2013, increasing confidence among consumers for the next 6 months ahead. Angela Merkel’s reelection will also boost confidence in the next reading. A rise to 7.3 is expected now.

- German CPI: Wednesday. German inflation was flat for the third consecutive month in September, supporting domestic consumption in Europe’s strongest economy. The yearly inflation rate reached 1.6%, in line with estimates. The low unemployment rate in Germany is also contributes to growth.

- Spanish Flash GDP: Wednesday, 8:00. The Spanish economy came closest to expansion in the second quarter, contracting only 0.1% from a 0.5% drop in the first quarter. This is a good sign for Spanish economic growth in the second part of 2013. The reading was in line with market forecast. However domestic demand and consumer spending are still sluggish, providing little hope for a speedy recovery. Spanish economy is expected to expand 0.1%.

- German Unemployment Change: Wednesday, 8:55. German unemployment edged up unexpectedly in September with an addition of 25,000 unemployed, after a 9,000 increase in August. However unemployment remains at the lowest level since reunification. This rise surprised analysts forecasting a 5,000 decline in the number of unemployed in September. However this rise could be a temporary slip, since domestic demand continues to strengthen boosting economic growth. A rise of 1,000 unemployed is expected now.

- Retail PMI: Wednesday, 9:10. Retail PMI in Eurozone declined to 48.6 in September, after reaching expansion in the previous month. However the average PMI reading for Q3 (49.5) was the best since Q2 2011. The main reason for this fall was anew contraction in France following two months of growth, and an ongoing decline in Italy. German retail sales edged up at the weakest rate in four months, indicating the Eurozone retail sales were fragile in August, largely due to a reverse in France.

- German Retail Sales: Thursday, 7:00. German retail sales climbed 0.5% in August, following a 0.2% decline in July, indicating that a recovery in Europe’s No. 1 economy is gathering pace. Economists expected a larger gain of 0.9%. Sales picked up 0.3% from a year earlier. Consumer climate is on a growth trend contributing to economic growth. Another rose of 0.5% is anticipated now.

- French Consumer Spending: Thursday, 7:45. French consumer spending dropped in August 0.4% following a 0.4% increase in July, led by food and energy declines. Consumer spending declined 0.1% on a yearly base in August. However, durable goods gained 0.1% and household goods climbed 0.4%. Textiles also jumped 1.3% on the month. A gain of 0.2% is anticipated.

- Italian Monthly Unemployment Rate: Thursday, 9:00. Italian Jobless Rate rose to an all-time high of 12.2% in August from a revised 12.1% in July. The reading missed predictions for a 12.0% rate. Companies are worried that the Italian economy will not exit recession and that the foreign investors may eliminate jobs to cut costs worsening the situation even further. The unemployment rate for people between the ages of 15 and 24 increased to a record high of 40.1% from 39.7% and Italian Industrial production also dropped in July, reducing hope that the two-year long recession will come to an end in the second half of 2013. A further rise to 12.4% jobless rate is expected this time.

- CPI Flash Estimate: Thursday, 10:00. The annual rate of inflation in the euro zone declined to the lowest level in three and a half years, rising 1.1% in September, from 1.3% in the previous month, indicating the European Central Bank will continue to pouring further stimulus into the region’s fragile economy if it deems it necessary. Economists expected inflation to remain 1.3%. The CPI rate is well below the ECB’s target level of just under 2%, indicating inflation will be no obstacle to further stimulus if bank officials decide the economy requires it. Annual inflation is expected to rise 1.1%.

- Unemployment Rate: Thursday, 10:00. The euro zone unemployment rate remained unchanged in August, better than the rise to 12.1% forecasted by analysts, suggesting the moderate economic recovery started to impact the labor market. The euro zone has progressed in the second quarter after its longest recession badly affecting job creation. Spain and Greece were the countries with the highest unemployment levels, above 25%, and economists do not forecast significant improvement in the near term. Meanwhile, unemployment in Europe’s largest economy, stood at 5.2%, the second lowest in the euro zone after Austria which had with 4.9%. Unemployment rate is expected to decline to 12.0%.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week trading above the 1.3650 line (mentioned last week). It then made a clear and impressive breakout above 1.3710, and was initially capped by the round number of 1.38. A further advance was already limited.

Technical lines from top to bottom:

We start from higher ground this time: 1.4250 was the peak in late 2011. It is followed by the round number of 1.41, which worked in both direction during that year.

1.4036 was a separator back in 2011, and awaits the pair if it breaks above 1.40. 1.3940 was a peak in September 2011, over two years ago, and is just before the round number of 1.40.

1.3870 capped the pair during the fall of 2011 and served as the “shoulders” in a H&S pattern. 1.38 is a round number and also worked as a temporary cap during that period of time and also in October 2013.

1.3710 was the 2013 peak, and served as a clear separator. The pair needed a big trigger to break above this line. 1.3650 temporarily capped the pair during that period of time and is stronger after capping the pair in October 2013. It now works as support.

1.3570 is the swing high of September 2013 and also proved itself as resistance afterwards. 1.35 is a nice round number and was a pivotal line or “magnet” within the previous range.

1.3460 worked as support in late September and should be watched for any downside moves. 1.3415 was the peak back in June and works as another line of support.

1.3325 worked as a double top in early September and it was crossed only with a Sunday gap. It remains a clear separator of ranges. It is followed by 1.3240, which capped the pair in April and also had a role in August. It worked as support in September.

EUR/USD trading in a steep uptrend channel

Towards the end of October, we can draw a steep, parallel channel in which the pair is trading. It will be hard to keep up with this channel (thick black lines).

Staying away from uptrend support: the line that enabled the big bounce is now far down (fine black line).

I turn bearish on EUR/USD

The weakness of the US economy and the incompetence of its politicians is already priced in, especially against the euro. Fresh US indicators could weaken the dollar, but against the euro the move could be overdue, and EUR/USD could be overbought.

The high exchange rate of the euro against the dollar and the pound is beginning to make policymakers at the ECB uneasy. Adding the tighter credit conditions in the old continent, falling inflation and a slide in German business confidence, we could see a nice correction now, with a helping hand of ECB comments.

More:

- EUR/USD Pulls Back Still Maintains Medium Term Upside Bias

- EURUSD Remains Bullish While The S&P Trades Higher – Elliott Wave Analysis

If you are interested a different way of trading currencies, check out the weekly binary options setups, including EUR/USD and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast