Markets are in a sharp reversal after yesterday’s risk-on rally. We can see some USD recovery this morning but for now that’s only on the intra-day basis. The larger picture is still down for the buck, so technically nothing changes.

The only difference may be in a shift between strong commodity currencies to a temporary bearish picture. But an important part here is »temporary «. Before we go to some wave counts, lets take a look on correlations first.

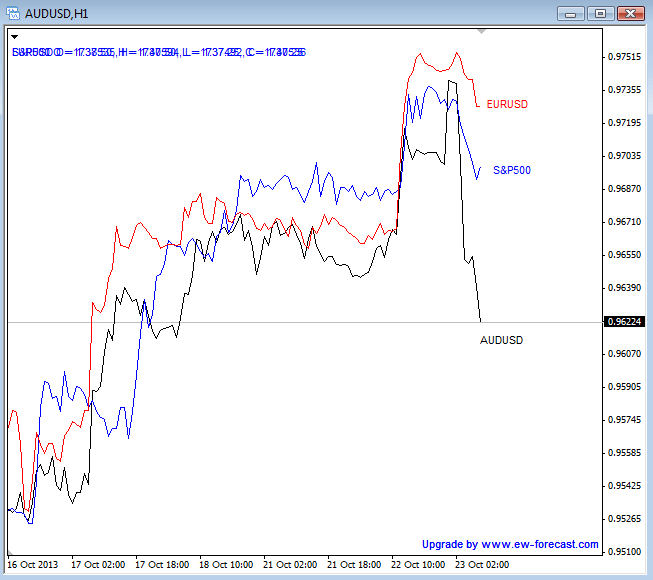

On the chart below we can see a comparison between the S&P, EURUSD and AUDUSD. We can see that AUDUSD is the weakest and EURUSD the strongest so based on this relationship its better to put money into the EUR rather than in to AUD if of course you assume that the S&P will stay in bullish mode.