EUR/USD struggled to recover, but it also did not extend its falls. A mix of PMIs, inflation figures and also GDP stand out at the turn of the month. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The economic recovery is set to continue according to forward-looking PMIs and also Germany’s IFO business survey. However, there still is a divide between Germany and France, where the latter struggles to grow. In the US, durable goods orders have been mixed. Headline GDP came out above expectations at 2.9%, but the internals were mixed.

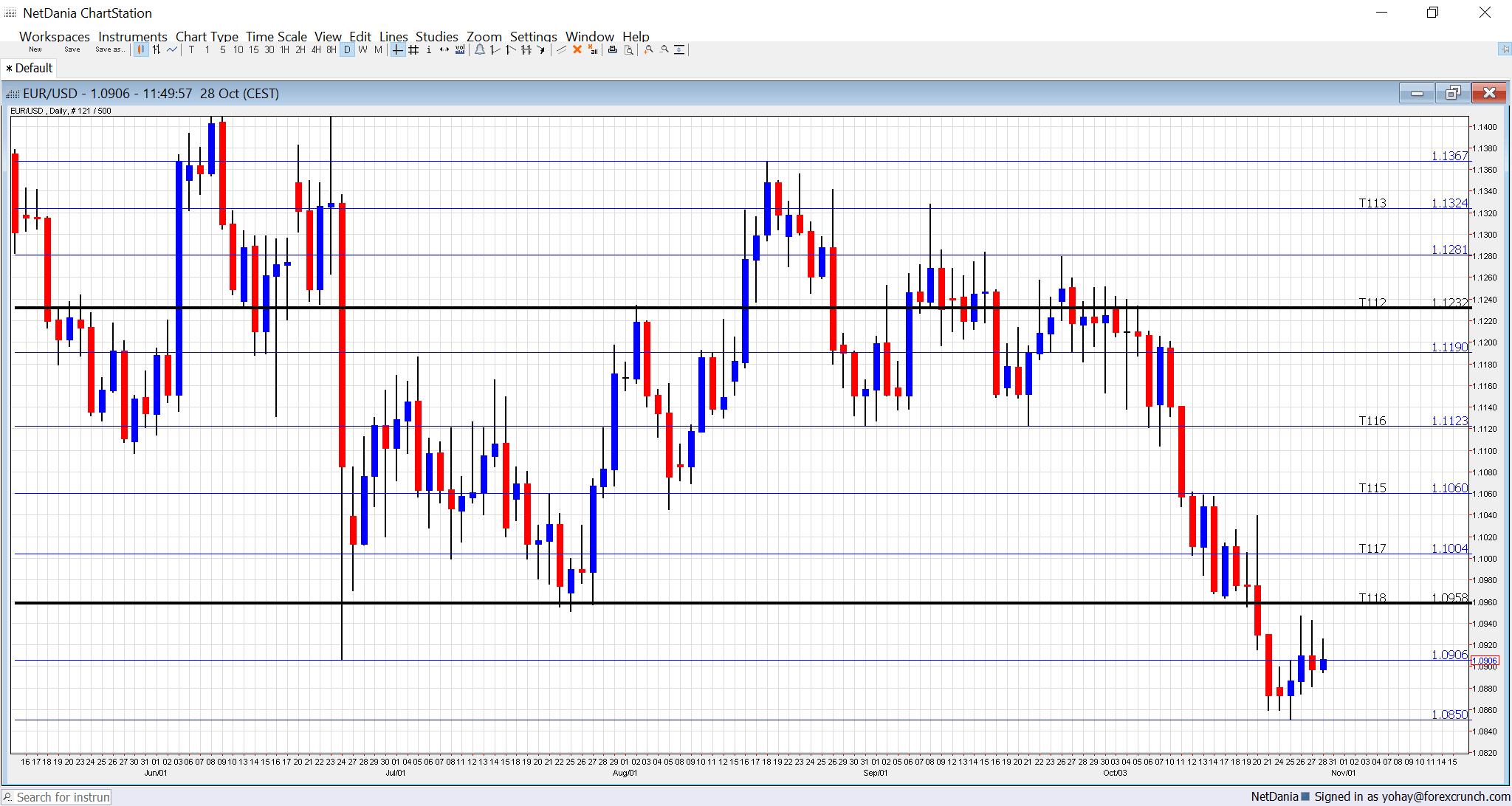

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German Retail Sales: Monday, 7:00. German consumers slowed down in August, with the volume of sales dropping by 0.4%. A rebound is on the cards this time with a projected rise of 0.2%.

- CPI: Monday, 10:00. Headline inflation has picked up thanks to the diminishing base effect of falling oil prices last year reaching 0.4% in September. However, core inflation has been stuck at 0.8% for quite some time. We now get the initial estimates for October. Initial releases from various countries have been mixed. Once again, headline inflation is predicted to advance to 0.5% y/y while core inflation is forecast to remain at 0.8%.

- GDP: Monday, 10:00. The 19-country eurozone has grown by 0.3% q/q in Q2 2016, and further growth is on the cards also in Q3. Spain’s growth remains encouraging, but France lags behind. A repeat of 0.3% is expected for Q3.

- Spanish Unemployment Change: Wednesday, 8:00. Spain has recently reported a significant drop in the unemployment rate: 18.9% in Q3. We now get the monthly estimate for October, on the number of unemployed. In September, they rose by 22.8K.

- Manufacturing PMIs: Wednesday morning: 8:15 for Spain, 8:45 for Italy, 8:50 the final number for France, 8:55 final figure for Germany and 9:00 final figure for the euro-zone. In September, Spain saw modest growth in September with a score of 52.3 points, above the 50 point threshold separating growth and contraction. A rise to 52.7 is expected. Italy, the third-largest country had a score of only 51. In the preliminary publication for October and 51.5 is on the cards now. France had 51.3 points in its manufacturing PMI. Germany enjoyed a much stronger 55.1, and the whole euro-zone had 53.3. The last three numbers will probably be confirmed now.

- German Unemployment Change: Wednesday, 8:55. The German job market remains robust, usually seeing drops in the number of unemployed. Last time, it saw a disappointing rise of 1K, but bumps have been seen in the past, not moving the downtrend. No change is expected now.

- ECB Economic Bulletin: Thursday, 9:00. Two weeks after the European Central Bank left its policies unchanged, the Frankfurt-based institution releases the data that its members saw before making the decision. We will get a better insight into the trends, with inflation standing out – the Bank’s central mandate.

- Unemployment Rate: Thursday, 10:00. The level of unemployment in the euro area has been stable at 10.1% in the past four months. This stall comes after long months of improvements.

- Services PMIs: Friday morning: 8:15 for Spain, 8:45 for Italy, 8:50 the final number for France, 8:55 final figure for Germany and 9:00 final figure for the euro-zone. In September, the services sector in Spain has been stable at 54.7 points. Italy had a minor growth rate with 50.7, just above the 50 point threshold. According to the initial read for France in October, growth stood on 52.1. In Germany, the number was 54.1 and in the wider euro-zone it held on 53.5. The latter three figures will likely be confirmed now.

- PPI: Friday, 10:00. Producer prices eventually reach the final consumer. Prices dropped by 0.2% back in August. We now get the figures for September.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar was trading in range, with the 1.0910 (mentioned last week) and never went too far.

Technical lines from top to bottom:

1.1335 worked as the lower bound of a higher range and then capped recovery attempts in May. 1.1230 capped the pair after the fall in May and worked as resistance.

1.1190 is the post-Brexit high seen in July. 1.1125 cushioned the pair in early September. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which supported the pair in early 2016 worked as resistance in October. 1.0850, which worked as support during the same month, serves as support.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

Further below, the 2016 low of 1.0520 and the 2015 low of 1.0460 provide further support.

I am neutral on EUR/USD

While the larger trend remains to the downside, good European data could stabilize the pair. Also, the growing tension towards the US elections could keep the pair in range before the action in the following week.

Our latest podcast is titled Bold in oil and talking up the currency

Follow us on Sticher or iTunes

Safe trading!