EUR/USD had a bad week, falling to a 7 month low amid the ECB meeting. Will it continue lower? A mix of PMIs, inflation data and yet another speech from Draghi stand out Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Draghi left us speculating about the next move of the ECB, but that will come in December. The euro initially ran higher when he said that extending QE was not discussed, but fell sharply once we learned they did not discuss anything. The combination of low inflation (confirmed this week), downside risks and unconvincing growth dampens the picture and the euro reached 7 month lows. In the US, the dollar took a breather after the previous gains, but resumed the upwards trend also enjoying the better-than-expected existing home sales.

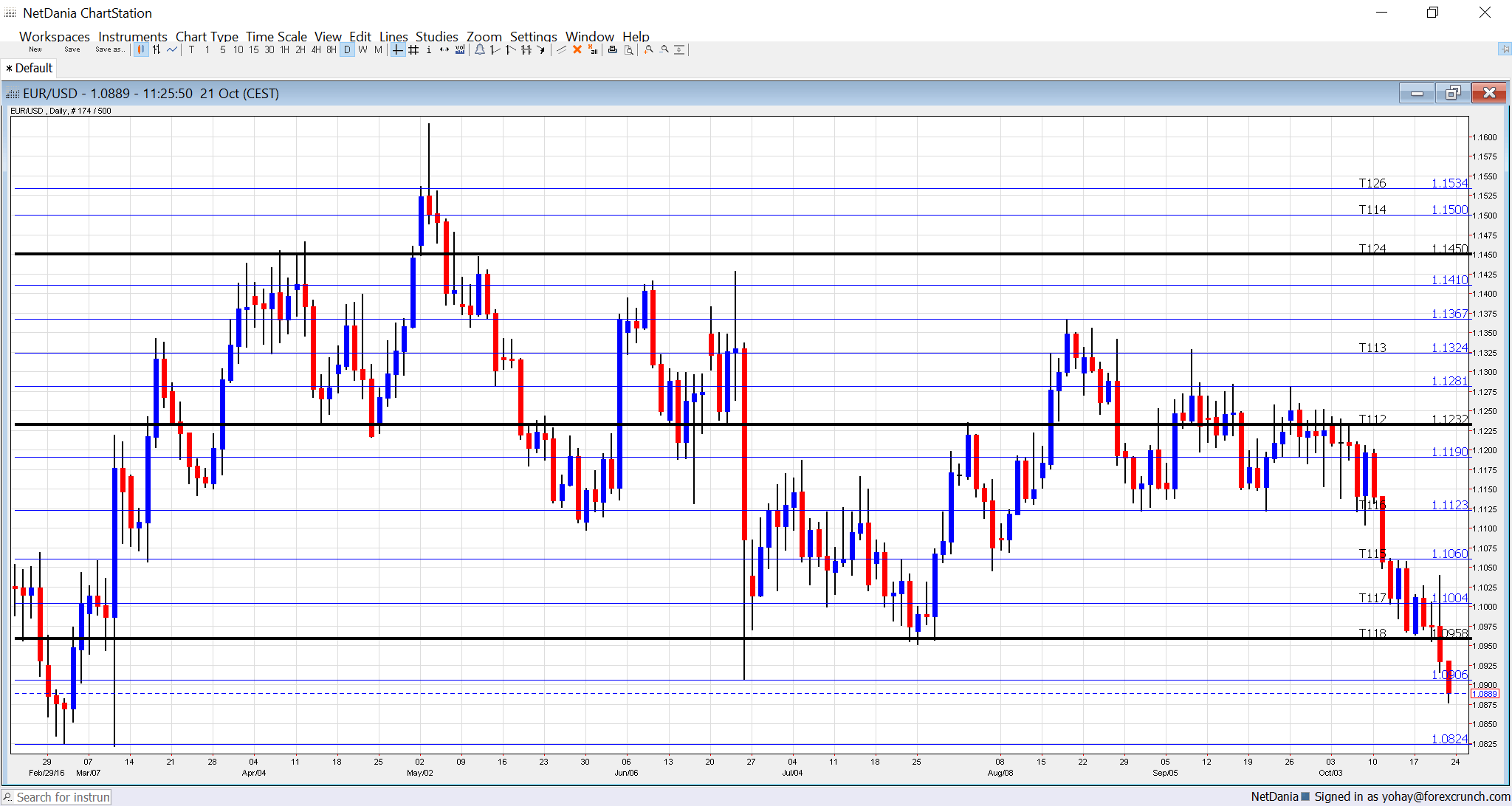

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Flash PMIs: Monday morning: 7:00 for France, 7:30 for Germany and 8:00 for the euro-zone. Markit’s preliminary purchasing managers’ indices for October are generally expected to show a small improvement in comparison to September. France’s manufacturing PMI stood on 49.7 in the final read for September, just under the 50 point threshold separating expansion and contraction. It is now expected to rise to 50.2 points. The services sector is expected to advance from 53.3 to 54.1 points. Germany’s manufacturing PMI, the most closely-watched number, carries expectations for remaining unchanged at 54.3 points. The services PMI is expected to rise from 50.9 to 51.9 points. The all-European manufacturing PMI is expected to rise from 52.6 to 52.7. The services one is projected to move from 52.2 to 52.4.

- German Ifo Business Climate: Tuesday, 8:00. IFO is Germany’s No. 1 Think-tank. Despite releasing its data after competitors ZEW, it has a big impact. In September, the indicator surprised with a jump to 109.5 points. A minimal move higher to 109.6 is on the cards now.

- Draghi talks: Tuesday, 15:30 The president of the ECB has another chance to rock markets after he caused commotion in the euro at the rate decision. Speaking in Berlin, monetary policy is one of the topics. He will likely call governments to do more but markets will focus on any hints about the future of the Bank’s QE program.

- German GfK Consumer Climate: Wednesday, 6:00. This 2000 strong consumer survey was rising for quite a few months before sliding back to 10 points in September. A rise to 10.1 is estimated now.

- German Import Prices: Wednesday, 7:00. Prices of imported goods feed into consumer prices. For European countries, oil prices make a large portion of imported good. After a drop of 0.2% in August, a small rise of 0.1% is on the cards.

- Spanish Unemployment Rate: Thursday, 7:00. Spain is the euro-zone’s fourth-largest economy and it suffers from a very high unemployment rate of 20%, and that’s after seeing much higher levels in previous years. A drop to 19.3% is predicted now.

- Monetary data: Thursday, 8:00. The ECB’s stimulus has led to accelerated money creation as well as more loans. M3 Money Supply is expected to remain at the same pace of 5.1% in September. Private loans are predicted to accelerate from 1.8% to 1.9% y/y.

- German CPI: Friday, during the morning from the various German states with the all-German number at 12:00. Prices advanced by 0.1% in September, not going anywhere fast. The same pace is expected for October, in the preliminary release.

- French GDP: Friday, 5:30. According to the final figure for Q2 2016, the French economy suffered from contraction of 0.1%. A return to growth is expected with +0.3% this time. France is the euro area’s second-largest economy.

- French CPI: Friday, 6:45. Consumer prices slid by 0.2% in September and are expected to bounce back by the same scale in October. Note that at the same time France releases its consumer spending, which carries expectations for a rise of 0.3%. However, CPI has a priority as it impacts the ECB more directly.

- Spanish CPI: Friday, 7:00. Spain suffered from deflation for a long time, but saw a rise in prices back in September: 0.2% y/y according to the final figure. An acceleration to 0.3% is on the cards now.

- Spanish GDP: Friday, 7:00. Equally important as the CPI number, GDP growth is predicted to remain strong in Spain: a pace of 0.7% q/q in Q3 2016, that is expected is slower than 0.8% seen in Q2, but nonetheless solid.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar had a hard time climbing above 1.10. It later fell, temporarily holding onto the 1.0905 level (mentioned last week).

Technical lines from top to bottom:

1.1335 worked as the bottom bound of a higher range and then capped recovery attempts in May. 1.1230 capped the pair after the fall in May and worked as resistance.

1.1190 is the post-Brexit high seen in July. 1.1125 cushioned the pair in early September. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0905 is the swing low seen in June and serves as a weak support. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

Further below, the 2016 low of 1.0520 and the 2015 low of 1.0460 provide further support.

I remain bearish on EUR/USD

Monetary policy divergence is in play and will likely continue. EUR/USD traded in a narrow range for too long. When it finally chose a direction, to the downside, this trend could last. Draghi could use his public apperance to hit the euro when it’s down.

Our latest podcast is titled Bold BOJ vs. Fearful Fed