The ECB decision is getting closer and the tension is rising. Will the ECB show its dovish side?

If so, will it hurt the euro or is it already priced in? The team at Danske weighs in:

Here is their view, courtesy of eFXnews:

We expect the ECB to keep its powder dry at the meeting on Thursday, but to retain a dovish tone and reiterate that it can adjust the size, duration and composition of the QE programme.

From a market perspective, the meeting should not provide further clarity but is likely to be seen as an ‘intermediate meeting’ ahead of the December meeting, when the ECB will release updated projections. Only one out of 43 analysts in a Bloomberg survey expects the ECB to step up its QE programme in October whereas 51% expect it in December.

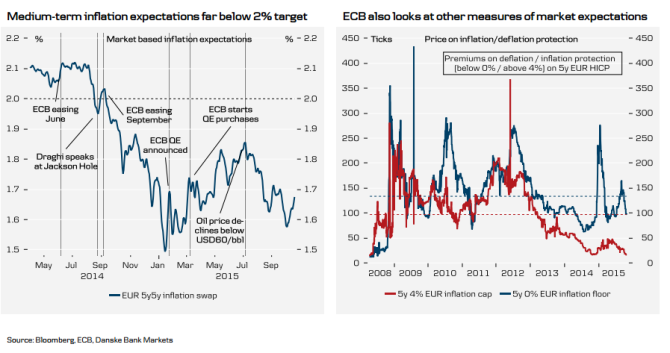

Very low market-based inflation expectations still put strong pressure on the ECB and we expect the door for more easing to be kept open, but we do not see Draghi signalling that further deposit rate cuts are on the table.

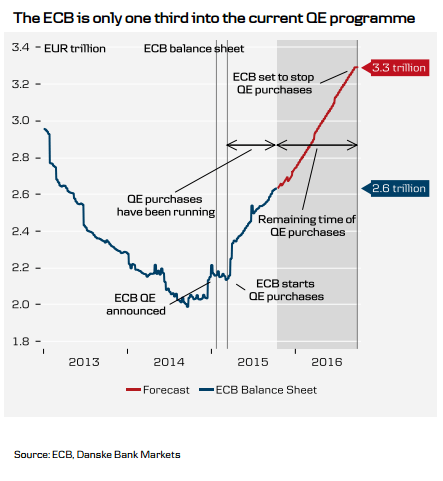

The ECB is only a third into its QE purchases and a number of ECB members have recently repeated the message from the September meeting that it is too early to decide whether more easing is needed.

The ECB is currently focusing on the lower cost of borrowing and better availability of credit from the monetary policy transmission. However, ECB members also see downside risk to inflation from the emerging market turmoil, the stronger euro and the lower oil price, but despite the latest weak German data, the impact is still judged to be uncertain.

Deflation print in September should not be enough for ECB to ease again. Draghi said in September that ‘we may see negative numbers of inflation in the coming months. The Governing Council tends to think that these are transitory effects, mostly due to oil price effects’. See Flash comment: Back into deflation, but Draghi will wait for more inflation prints, 30 September 2015.

We still expect the ECB to extend its QE purchases beyond September 2016, but do not think it will be announced before the December meeting. The ECB may stay on hold until Q1 16.

We see three potential triggers for more easing from the ECB: 1) the growth outlook deteriorates, 2) the ECB lowers its headline inflation projection, and/or 3) the ECB lowers its core inflation forecast.

FX markets: EUR/USD to be little changed.

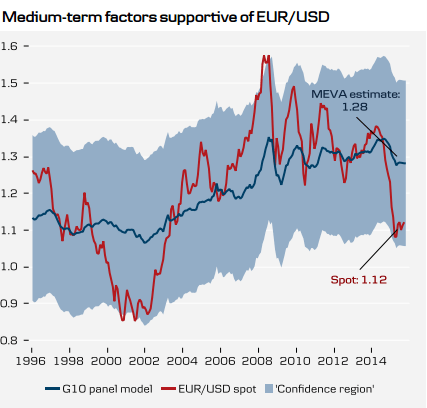

We expect EUR/USD to be little changed at the ECB meeting with risks tilted to the upside as the ECB fails to deliver fuel to expectations of ECB-Fed divergence for now.

A source of volatility in the cross is the possibility of a deposit-rate cut: while we think the ECB is a long way from going down this route, any hints that going lower on rates would be able to take EUR crosses substantially lower as this would induce a level shift in a money-market curve otherwise well-anchored by current policy.

More broadly, our not-so-aggressive call on ECB easing (a mere extension of QE, possibly not until Q1) limits the EUR downside from euro-area monetary policy, and we see EUR/USD range-bound between 1.10 and 1.16 in the coming months with a slight move lower with this range likely as markets buy into a first Fed hike in Q1 next year.

Crucially, as we see no sustained trend in relative monetary policy beyond Q1, we expect to eventually see a gradual move higher in EUR/USD towards the levels warranted by medium- to long-term fundamentals in 2016; we now see the pair at 1.20 in 12M .

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.