EUR/USD is struggling around the fresh two year lows it plunged to on Friday. After Draghi cut the rates and acknowledged economic weakness, the release of the US Non-Farm Paryolls set a new wave of falls. Draghi will have another chance to impact the euro in an official testimony, as euro-zone finance ministers meet and will try to make progress on the EU Summit decisions. Their chances aren’t too high, as bickering continues. Funding costs continue rising.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

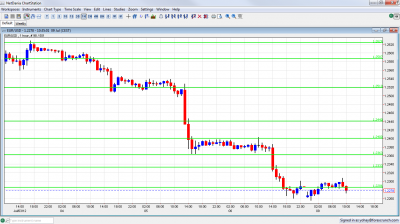

EUR/USD Technicals

- Asian session: Euro/dollar consolidated Friday’s losses and remained around 1.2288.

- Current range: 1.22 to 1.2288.

- Further levels in both directions:

- Below: 1.22, 1.2150, 1.20 and 1.1876.

- Above: 1.2288, 1.2330, 1.2360, 1.24, 1.2440, 1.2520 and 1.2624.

- 1.2330 is the next serious resistance.

- 1.22 is only a minor line before the clear historic separator of 1.2150.

Euro/Dollar around two-year lows after rate cut, NFP – click on the graph to enlarge.

EUR/USD Fundamentals

- During the day: Eurogroup meeting

- 6:00 German Trade Balance. Exp. +15.7 billion. Actual: 15 billion.

- 8:30 Euro-zone Sentix Investor Confidence. Exp. -26.3 points. Actual: -29.6 points.

- 12:30 ECB president Mario Draghi talks.

- 15:55 US FOMC member John Williams talks.

- 19:00 US Consumer Credit. Exp. 8.7 billion.

For more events and lines, see the Euro to dollar forecast

EUR/USD Sentiment

- European bickering continues: After Finland hinted about leaving the euro-zone (and denied later on), Italy’s PM Mario Monti blamed northern countries for causing tensions and raising funding costs. In Germany, support for bailouts is falling and Germany’s president demanded to receive the secret agreements in Brussels.

- Trying to implement the summit agreements: Markets have already faded the EU Summit rally, but now it’s time to implement: July 9th was mentioned as the date which the Eurogroup will implement the decisions. But. the holes in the EU Summit statement are surfacing. A banking union could take a year to put in place, the Netherlands and Finland oppose direct bond buying, and also Greece wants to renegotiate.

- ECB cuts benchmark and deposit rate: The European Central Bank cut the benchmark lending rate to a new historic low of 0.75% and also eliminated the deposit rate from the previous 0.25%. The move came after more QE from the UK and a rate cut from China and the impact on the euro was quite negative: a drop of over 100 pips in a short time. Draghi added fuel to the fire by saying that downside risks have materialized. Draghi will speak again and could clarify his words about the European fragmentation.

- Mediocre US jobs report: The US gained 80K jobs, a bit under expectations. The unemployment rate remained unchanged at 8.2%. The US economy is growing slow enough to maintain the global gloom, but not slow enough to trigger QE3 – a favorable situation for the US dollar.

- Spain’s troubles continue: Spanish yields are on the rise once again and are cross 7%, after yet another bad bond auction. The 8 holes in the package are causing quite a lot of trouble. The Spanish government is feeling the heat, and recently passed a new law limiting cash transactions. Meanwhile, Spain’s weak housing sector received more bad news, as house prices declined by 2.8% in Q2. The government wants to cut another 30 billion euros in order to satisfy markets, but this isn’t applauded, to say the least.

- Italian weakness: Italian PM Mario Monti has asked for help from Germany and the ECB as the situation worsens. The Euro-zone’s third largest economy is also suffering from a problematic banking system. This may explode later on. Here is more about a potential Italian bailout.