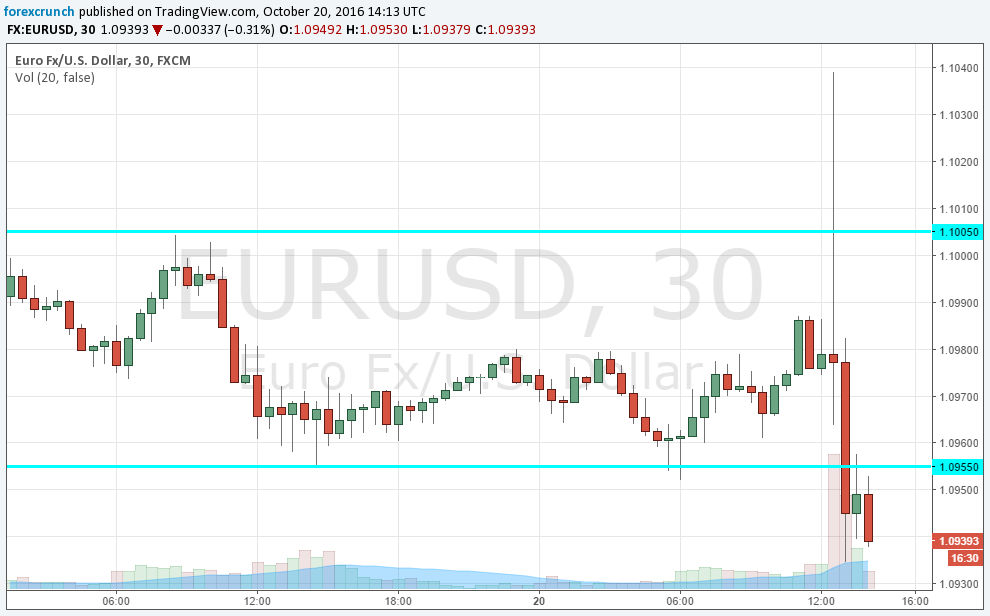

EUR/USD has been under pressure due to Draghi’s open door to more stimulus in December. At the beginning of his presser, Draghi said they had not discussed the extension of QE: without new bond buying, the euro jumped higher. However, he later clarified that the Governing Council also skipped topics such as tapering bond buys or basically any changes. Everything awaits December with the new forecasts, extending through 2019.

EUR/USD swiftly reversed coursed and returned to range under 1.10.

And now, the pressure continues from the other side of the Atlantic: US data came out better than expected: existing home sales surprised with a gain of 3.2%, much better than 0.4% expected. They reached an annualized level of 5.47 million, better than 5.35 expected and 5.3 last time.

EUR/USD has dropped to a new low of 1.0934, getting closer to the post-Brexit low of 1.0910 seen on June 24th. The world’s most popular currency pair moves slowly, but if we were to see a breakout, the next support line is 1.0820, followed by 1.0710.