Euro/dollar closed the month with a bang, rising from the abyss to high levels as hope from the EU Summit took over any doubts. Are we set for more gains? Or will the rally fade out as in past summits. The rate decision is the main event of this week. Will the ECB finally cut rates?Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Germany finally made concessions and agreed to direct buying of bonds and injecting capital into banks. This comes with quite a few conditions, and some details are still lacking. Despite some obvious holes, this rally was stronger and lasted more time than the post Spanish bailout and post Greek elections rallies. The ball now moves to Draghi’s court: he can contribute to the rally, or pour cold water on it. We will also get to see how bond markets react to Spain’s improved bailout conditions.

Updates: Italian Manufacturing PMI came in at 44.6 points, matching the market forecast. Euro-zone Final Manufacturing PMI posted a reading of 45.1, slightly above the estimate of 44.8 points. Italian Monthly Unemployment Rate dropped down a notch to 10.1%, beating the forecast of 10.4%. The Euro-zone unemployment rate hit a record in May, climbing to 11.1%. It was the highest level since the euro was introduced in 1999. Spain’s weak housing sector received more bad news, as house prices declined by 2.8% in Q2. Euro-zone PPI fell by 0.5%, well below the market forecast of a 0.2% decline. There is talk of the ECB announcing a rate cut to help stimulate the struggling euro-zone economies. The markets are predicting that the central bank will lower the present rate of 1.0% to 0.75%. EUR/USD is testing the 1.26 line, as the pair was trading at 1.2590. Italian Services PMI came in at 43.1 points, slightly above the market forecast of 42.6 points. The index has been below the 50 point level for over a year, indicating sustained contraction in the Italian service sector. Euro-zone Final Services PMI also posted a reading slightly better than the market forecast. The index posted a reading of 47.1 points, just above the estimate of 46.8 points. Euro-zone Retail Sales had a strong performance, posting a 0.6% increase. This was well above the market forecast of 0.2%. Euro-zone Final GDP, a quarterly release, came in at a flat 0.0%, matching the market prediction. The US markets are closed for the Fourth of July holiday. The markets are anxiously awaiting the ECB interest rate announcement on Thursday. Most analysts are predicting a 0.25% cut, but some analysts are saying that the ECB could slash rates by 0.50%. EUR/USD has edged downwards on the market uncertainty, as the pair was trading at 1.2570. For those looking for some market movement, Thursday certainly did not disappoint. The ECB did indeed cut the benchmark interest rate, from 1.0% to 0.75%. The deposit rate of 0.25% was eliminated, as it was lowered to 0.0% . This represents a historic new low for the ECB interest rate level. The rate announcement will be followed by a press conference with ECB head Mario Dragahi. The euro has slumped on the news, and was trading at 1.2432. The Spanish government auction of 10 year bonds raised EUR 3 billion, but the average yield climbed to 6.43%. This was higher than last’s month yield of 6.04%. The French treasury’s auction of 10 year bonds fetched an average yield of 2.53%. German Factory Orders posted a 0.6% gain, easily exceeding the market forecast of 0.1%. This was particularly good news after a recent host of weak data out of Germany.

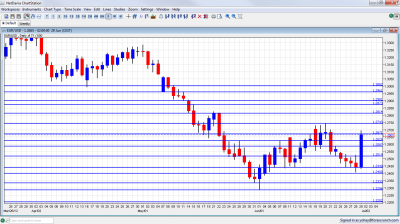

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Italian Manufacturing PMI: Monday, 7:45. The euro-zone’s third largest country should be closely watched, as it might be the next candidate for a bailout. The manufacturing sector is contracting (under 50 points) for 10 consecutive months, but at least it has risen from the bottom and climbed to 44.8 points. A similar score is expected now: 44.6 points.

- Final Manufacturing PMI: Monday, 8:00. The score for the whole euro-zone fell to 44.8 points according to the initial assessment, a bit lower than the previous month and deep in contraction territory. This will probably be confirmed now.

- Unemployment Rate: Monday, 9:00. The unemployment rate has risen to 11% last month. This number doesn’t tell the whole story: Germany and some other countries enjoy a low unemployment rate, Italy is around the average and Ireland, Greece and Spain are way above the average, with the latter seeing nearly 25%. Another tick up is expected now, to 11.1%.

- PPI: Tuesday, 9:00. Producer prices stalled after three consecutive rises. The figure for May will likely show a drop in prices, as commodities dropped during that period: -0.2%.

- Final Services PMI:Wednesday, 8:00. The services sector is doing a bit better than the manufacturing one, but not that great – “only” five months of contraction. The small rise to 46.8 will probably be confirmed in the final print.

- Retail Sales: Wednesday, 9:00. The volume of sales bitterly disappointed in April with a drop of 1%. May probably saw a small recovery, not in the same scale of the fall. Arise of 0.2% is expected, but given the German disappointment, it will not be a big surprise if the final number will be lower.

- Final GDP: Wednesday, 9:00. Thanks to German growth (+0.5%), the euro-area avoided an official recession and GDP remained unchanged in Q1 2012. This figure will probably be confirmed now, after Germany confirmed its growth.

- Spanish bond auction: Thursday. Just before the rate decision, Spain will test the markets’ mood with a bond auction. In recent bond auctions, Spain managed to fully cover the desired amount of money, but paid higher prices each time. Spanish banks received downgrades, but they get so much backing, so they seem quite safe.

- German Factory Orders: Thursday, 10:00. The euro-zone’s locomotive saw a big fall of 1.9% in April. It’s important to note that this is a volatile indicator. However, the rise in the month of May isn’t expected to fully compensate for the drop. A rise of 0.2% is predicted.

- Rate decision: Thursday 11:45, press conference at 12:30. Draghi left the rates unchanged last time, and practically offered nothing at all. There is a good chance that the ECB will finally move and cut the rates. Falling inflation in Germany will likely remove the Bundesbank’s objection. A rate cut was already on the cards last time and some members have hinted that this will the outcome. The struggling economies of the euro-zone certainly need a rate cut in the current conditions. If Draghi indeed announces a rate cut, this will probably be cheered by the markets and boost the euro. Another non-action by the ECB will hurt the common currency

- German Industrial Production: Friday, 10:00. The second industrial figure from Germany also disappointed last time with a big fall of 2.2%. And also here, a small rise of 0.3% is predicted.

* All times are GMT

EUR/USD Technical Analysis

€/$ quickly lost the 1.2520 line (mentioned last week) and dropped further down, unable to reconquer this line. After grinding lower, the picture dramatically changed on Friday with a huge leap. The pair eventually closed at 1.2665.

Technical lines from top to bottom:

The round number of 1.30 was a tough line as support, and pro-bailout victory in Greece could challenge this line. 1.2960 is close by, after providing some support before the bigger fall.

1.29 provide support in May and is weak resistance now. 1.2873 was a historic line remains strong . 1.2814 is now stronger after being a clear line separating ranges in May 2012.

1.2750 capped the pair after the Greek elections and also had a similar role in the past. It is now of higher importance. 1.2670 was a double bottom during January and was the high line of the recovery before the Greek elections in June. This will be a pivotal line at the beginning of the week.

1.2623 is the previous 2012 low and remains important despite recent battles over this line. Below, 1.2587 is a clear bottom on the weekly charts but is only a minor line now.

1.2520 had an important role in holding the pair during June, in more than one case, and it is key support now. 1.2440 provided support for the pair at the same time. and worked as double bottom.

It is closely followed by 1.24. It provided some resistance in June 2010 and is now minor support. 1.2286 is a new minor line of support after being the swing low in June 2012.

Further below, 1.2330 is another historical line after being the trough following the global financial meltdown in 2008. The new 2012 low of 1.2288 is minor support now.

1.22 is minor support below, after serving as such in June 2010. 1.2144 is already a very strong line on the downside: it was a clear separator two years ago, when Greece received its first bailout.

I am neutral on EUR/USD

The relatively surprising outcome of the EU Summit is a good step forward and seems to have a stronger effect. Mario Draghi has a chance to contribute to stabilization with the rate cut and perhaps more steps, after he got action from the governments. However, the decision is full of flaws and the implementations is till to be seen. Markets might begin doubting the results and seeing through the holes before things really stabilize. All in all, the bears and bulls might be balanced at these levels. A break above 1.2750 will be bullish.

In the US, the housing sector continues to shine while all the rest are dragging along. The Non-Farm Payrolls could boost the dollar on Friday, as it will probably not be bad enough for QE3, and not good enough to boost risk appetite.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.