Euro/dollar reached out to new highs after the Greek elections but couldn’t hold on to them, eventually ending lower. The EU summit is the main event of a busy week, and hopes are high. Will we see another disappointment that will send the pair lower? Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Spanish yields made new records and they stabilized thanks to refreshing German flexibility: the EFSF bailout fund will be able to buy bonds directly. The exact manner of how this will work is still to be seen. Spanish stability is also critical for Italy. Greece managed step back from the headlines after pro-bailout parties won the elections and formed a new government. However, Greece is far from meeting the targets, and a renegotiation of the terms may lead to a third bailout, if not the dreaded Grexit. Europe is not alone in its troubles: also the US economy is struggling and no magic QE3 is in sight.

Updates: The euro dropped as the markets are in a gloomy mood to start the trading week. Spain has formally submitted a request for aid, and the data out of Germany and Italy has been weak. Both countries will release data on Tuesday. An EU Summit will take place at the end of the week, but expectations are very low for any breakthroughs. EUR/USD continues to sag, and was trading at 1.2484. German Consumer Climate posted a reading of +5.8 points, slightly above the market forecast. This was welcome news, as it brought to an end a string of weak German releases in recent weeks. Italian Retail Sales declined by 1.6%, well below the market forecast of -0.6%. There were government bond auctions in Spain and Italy on Tuesday. In Spain, the government sold about EUR 3 billion worth of three and six-month debt instruments. The yields for both were well above the May figures. Following the auction, the yield on Spanish 10-year bonds climbed to 6.71%. In Italy, the government auctioned off about EUR 3 billion worth of two-year bonds. The yield of 4.71% was the highest since December. The Spanish banking sector continues to concern the markets. In the latest development, the Moody’s ratings agency has downgraded 28 Spanish banks. The euro continues to struggle, and has again dropped below the 1.25 line. The pair was trading at 1.2479. German data again disappointed, as Import Prices contracted 0.7%, a bit lower than the market estimate of a 0.6% drop. The markets will be hoping for better news from the German Prelim CPI, which will be released later on Wednesday. The euro continued to trade in a narrow range, as the markets await for the EU Summit, which begins Thursday in Brussels. There is skepticism that the meeting will deliver any concrete results. In Spain, the yield on 10-year bonds were again on the rise, pushing up to 6.87%. Meanwhile, the government has passed a new law limiting cash transactions, which is unlikely to enhance the embattled government’s popularity. EUR/USD has edged downwards, and was trading at 1.2488. The EU Economic Summit takes place on Thursday and Friday, but the markets are not expecting any tangible progress. The euro was down sharply as a result. German data continued to disappoint the markets, as employment figures were released on Thursday. The number of unemployed people rose by seven thousand, exceeding the estimate of five thousand. The unemployment rate came in at 6.8%, above the 6.7% forecast. German Prelim CPI contracted by 0.1%, while the markets had predicted no change in this month’s reading. Euro-zone Retail PMI came in at 48.3 points, indicating continued contraction in the retail industry. Italian Preliminary CPI rose 0.2%, matching the market forecast. Also in Italy, a 10-y bond auction took place, with an average yield of 6.19%.

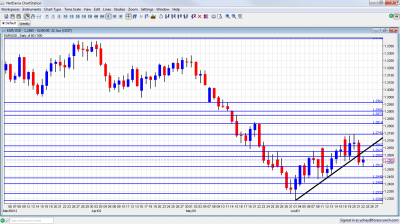

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- GfK German Consumer Climate: Tuesday, 6:00. This survey of 2000 consumers was relatively stable, and showed only a small dip from the peak of 6 points. The score of 5.7 is expected to remain unchanged.

- German CPI: Wednesday. German inflation is a major consideration in the rate decisions of the ECB. The initial read of inflation is released by the various German states during the day. After a slide of 0.2% in May, no change is expected now. Another drop could push rates lower.

- German Import Prices: Wednesday, 6:00. Given the importance of German inflation, also this second tier figure is of importance. Prices fell by 0.5% last month, and a similar fall is predicted now.

- EU Economic Summit: Thursday and Friday. This summit has even greater expectations now, after the G-20 practically told Europe to solve its own problems. The mini summit in Rome between leaders of Germany, France, Italy and Spain yielded some interesting promises: a growth pact worth 130 billion euros. It is still to be seen if this positive declaration will have some content at the wider meetings. Also closer European integration will be discussed. Greece might return to the limelight as well: the debt struck country wants to renegotiate the bailout terms. It’s important to note that a June 30th deadline still looms. Greece has to pass 77 new measures.

- German Unemployment Change: Thursday, 7:55. Europe’s locomotive saw two consecutive disappointing months in the unemployment front. The figures for May are already expected to be more worrying: a rise of 4K in the number of unemployed people. Recent German surveys have turned negative as well.

- Retail PMI: Thursday, 8:10. This purchasing managers’ index follows the retail industry – feeling the pulse of consumers. The last time that this figure was positive was back in November. May saw a small improvement: a rise from 41.3 to 43.3 points. This is still deep in contraction territory (under 50 points). With all the market turbulence, a drop can be expected now.

- Italian 10 year bond auction: Friday. The euro-zone’s third largest economy is in trouble after a strong contraction in Q1 and lower market confidence as Mario Monti loses grip. This critical market test comes after the new peak in Spanish yields. Italy paid a dear price of over 6% in yield last time. Only a significantly lower yield will calm the markets. Another 6%+ result will put the spotlight on Italy.

- German Retail Sales: Friday, 6:00. Germany enjoyed two months of rises in sales volume. The figures for May can reflect deteriorating conditions, although a rise of 0.1% is predicted.

- French Consumer Spending: Friday, 6:45. Europe’s second largest economy saw consumer spending rise by 0.6% after a big downfall of 2.9% beforehand. No change is expected now. French bond markets are stable for now, but could come under pressure if the market decides to dislike the reforms of the new president.

- M3 Money Supply: Friday, 8:00. Mario Draghi’s LTRO certainly helped keep the money flowing in the old continent after it contracted on a monthly basis early in the year. However, the effect of the LTRO is diminishing – the pace of money expansion fell to 2.5% in April. Another squeeze, to an annual pace of 2.4% is expected now. A fall under 2% could push the ECB to act.

- CPI Flash Estimate: Friday, 9:00. After Germany releases its initial CPI estimate, the initial assessment for the whole continent is released. Inflation dropped gradually and reached 2.4% last month – the lowest in over a year. The same annual pace is predicted now, although the deteriorating economic situation and the drop in commodity prices could be reflected here.

* All times are GMT

EUR/USD Technical Analysis

€/$ kicked off the week with a nice weekend gap and hit a new level of 1.2748. This later became a stubborn line of resistance. After the Greek euphoria passed, the pair fell under 1.26 and made another attempt to break higher. After this failed, it found support at 1.2520 before closing at 1.2565.

Technical lines from top to bottom:

Note that some lines have changed since last week. The round number of 1.30 was a tough line as support, and pro-bailout victory in Greece could challenge this line. 1.2960 is close by, after providing some support before the bigger fall.

1.29 provide support in May and is weak resistance now. 1.2873 was a historic line remains strong . 1.2814 is now stronger after being a clear line separating ranges in May 2012.

1.2750 capped the pair after the Greek elections and also had a similar role in the past. 1.2670 was a double bottom during January and was the high line of the recovery before the Greek elections in June.

1.2623 is the previous 2012 low and remains important despite recent battles over this line. Below, 1.2587 is a clear bottom on the weekly charts but is only a minor line now.

1.2520 had an important role in holding the pair during June, in more than one case, and it is key support now. 1.2440 provided support for the pair at the same time.

It is closely followed by 1.24. It provided some resistance in June 2010 and is now minor support. 1.2286 is a new minor line of support after being the swing low in June 2012.

Further below, 1.2330 is another historical line after being the trough following the global financial meltdown in 2008. The new 2012 low of 1.2288 is minor support now.

1.22 is minor support below, after serving as such in June 2010. 1.2144 is already a very strong line on the downside: it was a clear separator two years ago, when Greece received its first bailout.

The round number of 1.20 is of course highly important in the psychological level. Below, the 2010 trough of 1.1876 is apparent, before the launch value of the euro at 1.17 to the dollar in 1999.

Broken Uptrend Support

As the graph shows, the pair traded alongside an uptrend channel. This has been broken now. It should be noticed in addition to the regular lines.

I remain bearish on EUR/USD

High hopes towards the EU summit may underpin the pair at first. Given the past, there is a high chance of disappointment. Nothing has been solved in Spain – the assessment about the funding needs of banks are probably short of mark and will be revised higher. Italy’s pro-reform government is unstable of late and will find it hard to make new decisions. Greece finally has an elected government, but the trouble is far from over. Even Germany, which certainly enjoys the safe haven status within the zone, is already feeling the economic contagion.

The dynamics in the US have changed as well: as only a catastrophe might move the Fed to QE3, the worsening conditions over there just boost the dollar as a safe haven. All in all, European weakness and US weakness help the dollar. Positive news on both sides of the Atlantic is needed for the pair to rise, and this is hard to find.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.