Euro/dollar made quite a few attempts to recover, but had no success and eventually ended the week on the edge of the high cliff – a historic support line. Will it fall off? Forward looking purchasing managers’ indicators, and various surveys fill the agenda this week. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Spain drew attention: despite the Eurogroup approval of the bailout (with an extended deficit target) and the German approval of the option to directly recapitalize banks, the troubles in the region of Valencia and the skyrocketing yields eventually hurt the euro, that fell on its own. Also Greece returned to the limelight with an official ECB rejection of its bonds as collateral. Even with more weak US data, the dollar couldn’t beat the euro in the race to the bottom.

Updates: EUR/USD dropped to two-year lows on market concerns over the debt crises in Greece and Spain. There are fresh fears of a Grexit as Greece is already on track to miss a debt-to-GDP target, as part of the bailout package. Germany continues to warn that the bailout plan will not be implemented if Greece fails to comply with its obligations under the plan. In Spain, Treasury Minister Cristobal Montoro announced that the recession would last into 2012, and GDP would fall 0.5% in 2013, reversing the original estimate of a 0.2% increase. Meanwhile, Spanish 10-year bonds were trading on Monday at a record 7.37%, well above the 7% threshold which is widely considered unsustainable. The euro dropped below the 1.21 line, but recovered slightly, as EUR/USD was trading at 1.2119. Euro-zone Consumer Confidence will be released later on Monday. The market forecast stands at -20 points, which is identical to last month’s reading. Euro-zone Consumer Confidence came in at -22 points, its lowest level in almost three years. There were a string of PMI releases on Tuesday, and most were disappointing. French, German and Euro-zone Flash Manufacturing PMIs all fell below the market estimate. German and Euro-zone Flash Services PMIs were within market expectations, while the lone PMI which did well was the French Services PMI, which posted a five-month high. The yield on Spanish 10-year bonds continues to set new records, with a current yield of 7.59%. Moody’s reduced the outlooks on Germany, the Netherlands and Luxembourg, although it maintained the triple-A rating of all three coutries. The rating agency stated that countries such as Germany will have to carry the burden of weaker EZ members, such as Spain and Greece. The euro continues to test the 1.21 line, as EUR/USD was trading at 1.2095. There was more bad news out of Germany, as the German Ifo Business Climate fell to 103.3 points, a two-year low raising concerns about the health of the German economy. The yield on the German 30-year Bond Auction dropped, coming in at 2.17%. The euro strengthened on Wednesday, following comments from a senior member of the ECB. Ewald Nowotny, a member of the ECB Governing Council, spoke in favor of providing a banking license to the ESM, the Euro-zone’s bailout fund. Such a move would provide the ECB with more ammunition to fight the debt crisis. The euro pushed across the 1.21 line, as EUR/USD was trading at 1.2136. GfK German Consumer Climate came in at 5.9 points, matching expectations. German Import Prices disappointed the markets, dropping by 1.5%. M3 Money Supply posted a 3.2% gain, beating the estimate which stood at 2.9%. Italian Retail Sales dropped by 0.2%, slightly more than the forecast of a 0.1% loss. Eurozone Private Loans declined 0.2%, matching the market forecast. Italian Retail Sales dropped by 0.2%, slightly more than the forecast of a 0.1% loss. Eurozone Private Loans declined 0.2%, matching the market forecast. ECB head Mario Draghi will be joining BOE Governor Mervyn King at a conference in London on Thursday. The euro was up sharply following another weak US release. New Home Sales fell below the market forecast, raising hopes that the US Federal Reserve will step in and implement monetary measures to help the troubled US economy. EUR/USD was trading at 1.2260.

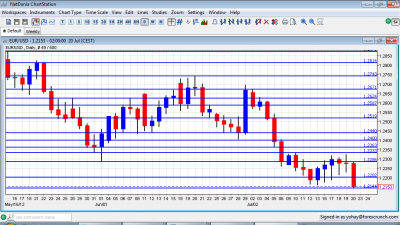

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Consumer Confidence: Monday, 14:00. This official data by Eurostat is stable at low ground, printing -20 last month. The negative number means that consumers are pessimistic. No change is expected now.

- Flash PMIs: Tuesday. France begins at 7:00, Germany continues at 7:30 and the figures for the whole euro-area are released at 8:00. There are separate releases for the manufacturing and services sectors. Purchasing managers’ indicesare forward looking indicators, and are of high importance. In June, all 6 indicators fell below the critical value of 50 points, indicating contraction everywhere. Manufacturing is clearly weaker, contracting at a faster pace with a score of around 45 points. The services sectors are doing a bit better, with Germany’s marginal contraction (49.9 points) holding the figure higher. All in all, the indicators are all expected to slide to lower ground. A return of the German services sector to growth would be somewhat encouraging.

- German Ifo Business Climate: Wednesday, 8:00. Germany’s No. 1 Think Tank releases its figure after the ZEW figure. After climbing slowly earlier in the year, IFO’s leading figure, business climate fell in the past two months, as the debt crisis worsened. At 105.3 points, it is at the lowest level since January 2010. Another drop is expected now, to 104.8 points.

- Belgium NBB Business Climate: Wednesday, 13:00. Also in the heart of the European Union, things aren’t that rosy: the survey of 6000 businesses dropped in the past 4 months and reached a level of -13.2 points, the worst since October 2009. Another slide is expected, deeper into negative territory, which represents worsening economic conditions.

- GfK German Consumer Climate: Thursday, 6:00. Contrary to other surveys, this one has been quite stable and even ticked up last month from 5.7 to 5.8 points. Another tick higher to 5.9 is expected.

- M3 Money Supply: Thursday, 8:00. One of the goals of the ECB’s LTROs was to increase money supply. After contracting at the turn of the year, money supply accelerated its expansion, standing on 2.9% last time. The same rate is likely now.

- German CPI: Friday, during the day. The level of German inflation is critical to the ECBs rate decisions. Prices dropped in the past two months (0.2% and 0.1%). A recovery with a rise of 0.4% is expected now. Note that this is the preliminary release, made of separate releases by the various German states.

- Spanish Unemployment Rate: Friday, 7:00. The euro-zone’s fourth largest economy is suffering from the highest unemployment rate in the Western world: 24.4% in Q1. The figure will likely be a bit higher, 24.7%,: the worsening financial situation will likely outweigh by a seasonal rise in tourism related jobs.

* All times are GMT

EUR/USD Technical Analysis

€/$ made more than one attempt to break higher, but it couldn’t breach the 1.2330 line (discussed last week). It eventually closed lower, just above critical support at 1.2150.

Technical lines from top to bottom:

1.2750 capped the pair after the Greek elections and also had a similar role in the past. It is now of higher importance. 1.2670 was a double bottom during January and was the high line of the recovery before the Greek elections in June. It also capped the pair at the beginning of July 2012.

1.2623 is the previous 2012 low and remains important despite recent battles over this line. Below, 1.2587 is a clear bottom on the weekly charts but is only a minor line now.

1.2520 had an important role in holding the pair during June, in more than one case, but it’s much weaker now. 1.2440 provided support for the pair at the same time. and worked as double bottom.

It is closely followed by 1.24 that provided some resistance in June 2010 and switched to resistance in July. 1.2360 was temporary support in July 2012 but quickly switched to resistance.

Further below, 1.2330 is another historical line after being the trough following the global financial meltdown in 2008. It’s stronger after working as strong support. The now previous 2012 low of 1.2288 is of higher importance now after being reached twice.

1.22 is now minor resistance, after serving as such in June 2010. 1.2144 is already a very strong line on the downside: it was a clear separator two years ago, when Greece received its first bailout.

Next we have the 1.20 line, which is a round psychological figure. The post crisis low of 1.1876 is the final frontier before lines last seen in the good years.

The launch price of 1.17 is the next line.

I am bearish on EUR/USD

Everything is working against the euro. When pro-euro Angela Merkel doubts the success of the European project, many eyebrows were raised, in addition to the already mounting pressure coming from Spain. Greece and Italy will likely get more attention, but the competition with Spain is tough.

Weak data in the US is still not enough – Bernanke didn’t provide the necessary QE3 hints, and not for the first time. 1.2144-1.2150 is critical. A loss of this area could trigger a downfall.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.