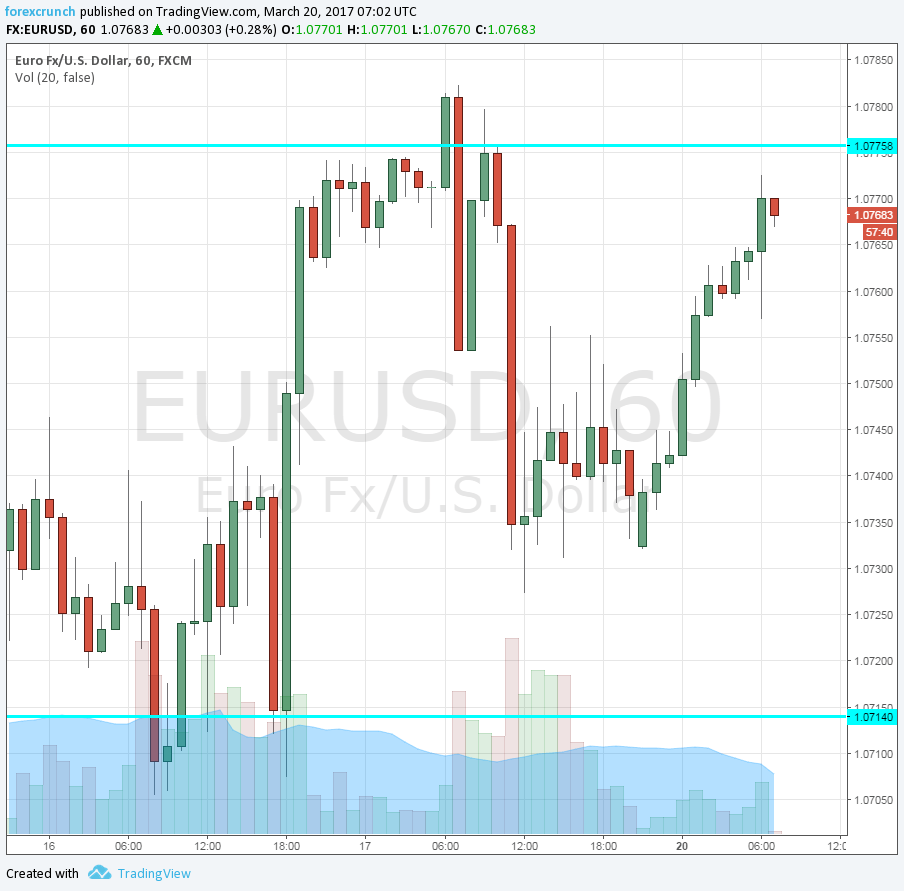

EUR/USD starts the trading week on a positive note. After consolidating the gains towards the end of the week, we are now seeing an upwards move in the range. The world’s most popular currency pair trades around 1.0770, just under resistance at 1.0775. Further resistance awaits at 1.0830.

What is behind the fresh move? This is mostly a fresh bout of USD selling. Last week, the Federal Reserve raised interest rates as expected, yet without altering its outlook. The decision triggered a big downfall in the dollar (see the 5 dollar downers). In the euro-zone, the favorable outcome of the Dutch elections gave a boost to the euro.

Apart from the Dutch elections, the common currency also received a boost from the European Central Bank. Various members deliberated raising the negative deposit rate from the lows of -0.40% even before the bond-buying program reaches its end, currently at the end of this year.

Visco, the Italian member, talked about “Shortening the break between the end of QE and the rate hike”. This is a softer comment in comparison to Nowotny, but also more hawkish than the previous stance of the ECB.

Over the weekend, the G-20 Summit of finance ministers resulted in a weak communique that reflected differences. The new US Administration insisted on dropping the reference to protectionism. Trump wishes to get better deals for the country. Germany and Japan seem keen to forward free trade without the US.

Euro-zone data is not necessarily euro-positive. Producer prices in Germany rose by 0.2%, lower than 0.4% that was expected and 0.7% seen in the previous month. On Friday, the euro-zone’s trade balance missed expectations with 15.7 billion euros against 22.3 predicted.

More: EUR/USD: Forming A Base For A Move Higher; Where To Target? – Danske

Later today, the German Bundesbank will release its monthly report and this will be followed by a speech by President Jens Weidmann. A central banker will also speak in the US: Charles Evans of the Chicago Fed.

Here is how it looks on the euro/dollar chart.